GameStop short squeeze highlights the power of decentralization

What do the traders on r/WallStreetBets have in common with cryptocurrency traders? Both are using technological breakthroughs to skirt processes inherent in traditional financial systems.

The success of the GameStop short squeeze in pumping the price above $370— and the reaction from centralized authorities and markets to it — has highlighted the need for decentralized finance, according to some in the crypto industry.

The stock, which was trading at less than $20 per share earlier this month, was deemed by members of the r/WallStreetBets subreddit to be under attack by a hedge fund which had disclosed a large short position in the stock.

As a result of the pump coordinated on Reddit and executed by individual traders using platforms like TD Ameritrade and Robinhood, hedge fund Melvin Capital Management lost a total of $3.75 billion by having to close their massive, losing short position on GME.

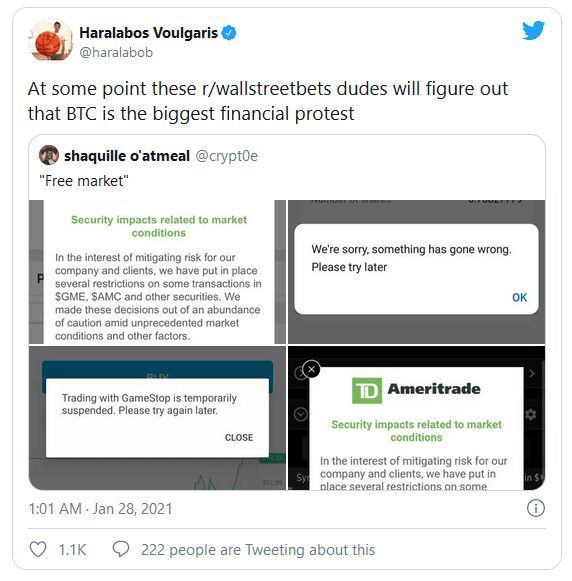

Various centralized trading platforms have now put limits on trading the stock and the president of NASDAQ — the exchange on which GME is listed — suggested that trading could be temporarily halted on stocks deliberately targeted by internet users, in order to give investors a chance to “recalibrate.”

Eyebrows were also raised when the subreddit behind the short squeeze, WallStreetBets, was taken offline temporarily and its Discord channel suspended, apparently over content moderation issues.

The crypto community has watched on with fascination as traditional markets start to resemble crypto markets, only worse.

Mike Novogratz, CEO of digital assets management company Galaxy Digital, likened what happened with GME to “a giant endorsement of DeFi” on Twitter, calling it “a revolution that started with people not trusting central authority.” He also drew comparisons between the Reddit-based movement and the current social climate of inequality that has gripped the U.S., as well as many other countries, in recent years.

Anthony Scaramucci of SkyBridge Capital — which owns about $385 million in BTC — also believes recent events surrounding GME were positive for the future of Bitcoin, telling Bloomberg that they are “more proof of concept that Bitcoin is going to work.”

But not everybody was impressed, including CNBC’s Jim Cramer, who downplayed the event’s significance on a recent episode of Mad Money.

“As entertaining as these moves are, this stuff is only a sideshow,” said Cramer. At the end of the day I don’t think a Reddit forum can bring the house down.”

“They’re picking undervalued stocks, opening big short positions and running with them. That can cause crazy moves in a handful of stocks, but it’s not enough to move the entire market. C’mon.”

The jaw dropping rise in GameStop saw derivatives and futures specialists at FTX list a tokenized version of GME futures for trading against cryptocurrency-based collateral last night. FTX’s inclusion of GME comes at a time when platforms such as TD Ameritrade and Robinhood are putting restrictions on its trade.

Driven higher by afterhours and futures trading on smaller, non-traditional platforms, the price of GME opened at $354.83 on Wednesday, representing a 140% gain overnight.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.