- FTX exchange has sued former employees of Salameda, a Hong Kong based entity affiliated with the trading platform.

- The court filing shows that the bankrupt exchange seeks to recover $157.3 million from Salameda employees.

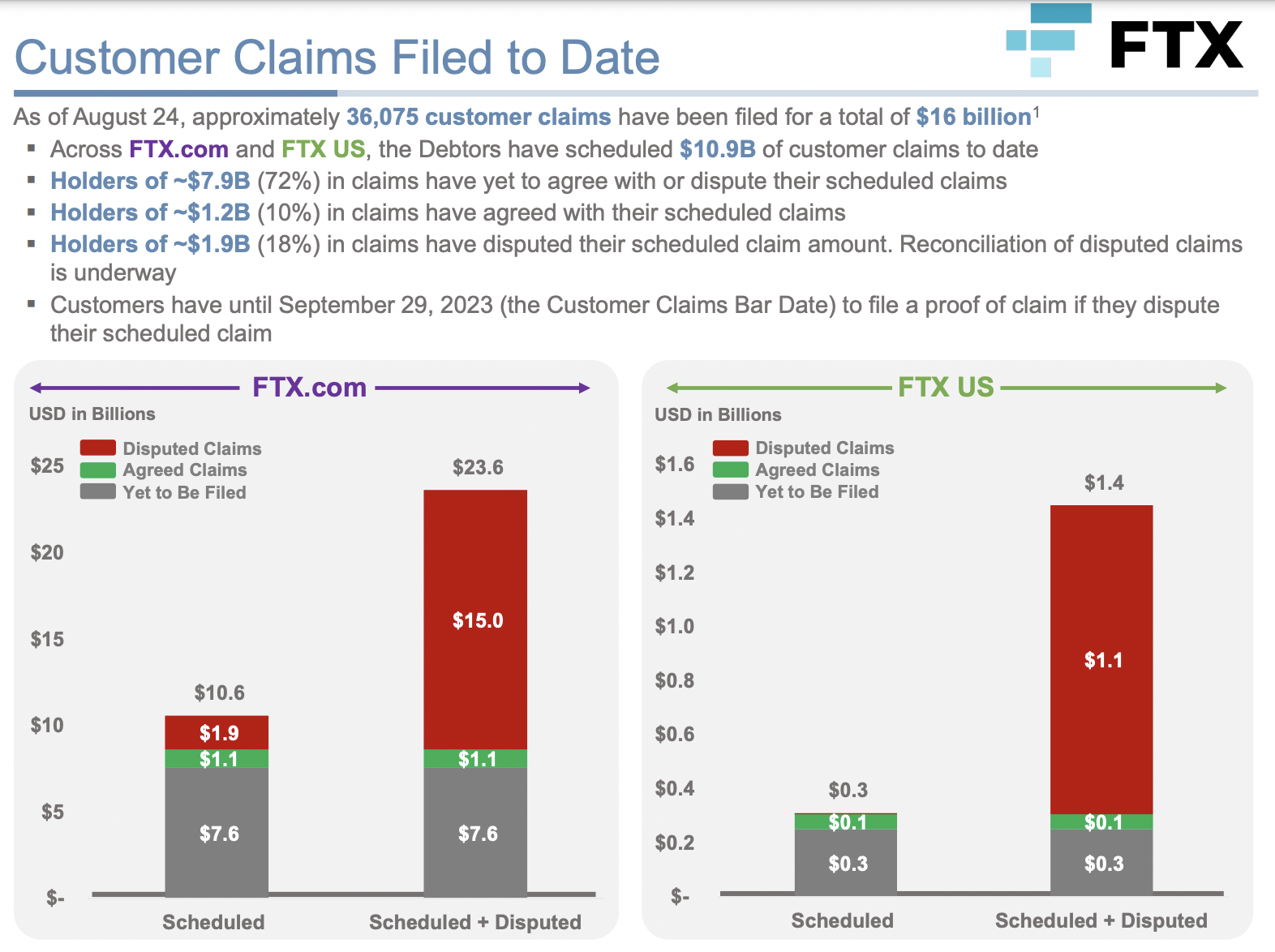

- FTX creditors struggle to agree with or dispute their scheduled claims worth $7.9 billion, a week away from the deadline.

FTX exchange initiated legal proceedings against former employees of Salameda, a Hong Kong incorporated entity that is affiliated with the platform. Administrators of the bankrupt exchange, which are handling its liquidation, seeks to recover $157.3 million from the firm claiming it was controlled by Samuel Bankman-Fried, the former CEO of FTX.

These developments come at a time when creditors of the exchange are reporting technical problems and are yet to agree or dispute claims worth $7.9 billion, a week away from the September 29 deadline.

Also read: First Ethereum futures ETF expecting approval by October 2

FTX sues Salameda employees

In the past few weeks, bankrupt FTX exchange has approached sports influencers, athletes, Formula 1 teams or universities that received donations from the exchange and its founder, in an attempt to recover funds for paying back its creditors.

In another move aligned with this objective, FTX exchange sued employees Michael Burgess, Matthew Burgess, their mother Lesley Burgess, Kevin Nguyen, Darren Wong and two companies that had accounts registered at FTX.com and FTX US for fraudulently withdrawing assets in the days leading up to the bankruptcy.

According to the court filing, defendants attempted to quickly withdraw their assets in the preference period, or the 90-day period before the bankruptcy filing. This was an attempt to ensure that their withdrawals go through on priority.

FTX therefore seeks $157.3 million, the collective pricing of the assets as of August 31, from the aforementioned individuals and entities. The recovery of these funds is key as they would add to the assets that the exchange can use to pay back its creditors and make them whole, nearly a year past the bankruptcy filing.

FTX creditors struggle to agree to claims

September 29 is the deadline for filing a proof of claim in case creditors want to dispute their scheduled claim with FTX.com or FTX US, according to a bankruptcy court filing from September 11. On combining the “yet to be filed” claims represented in gray in the bar charts below, the total value of claims “yet to be agreed with or disputed” stands at $7.9 billion.

This means that 72% of the overall claims filed to date are yet to be agreed or disputed. The number is relatively high when considering that the deadline to file a proof of claim is a week away. According to posts on social media platforms like X, many users are reporting technical problems in submitting their claims and passing Know Your Customer (KYC). This is one of the reasons for a large percentage of claims waiting to be filed.

FTX Customer claims details

The exchange’s former CEO, Sam Bankman-Fried, is set to go on trial on October 3.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 gainers Supra, Cosmos Hub, EOS: Supra leads recovery after Trump’s tariffs announcement

Supra’s 25% surge on Friday calls attention to lesser-known cryptocurrencies as Bitcoin, Ethereum and XRP struggle. Cosmos Hub remains range-bound while bulls focus on a potential inverse head-and-shoulders pattern breakout.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin price remains under selling pressure around $82,000 on Friday after failing to close above key resistance earlier this week. Donald Trump’s tariff announcement on Wednesday swept $200 billion from total crypto market capitalization and triggered a wave of liquidations.

Can Maker break $1,450 hurdle as whales launch buying spree?

Maker is back above $1,300 on Friday after extending its lower leg to $1,231 the previous day. MKR’s rebound has erased the drawdown that followed United States President Donald Trump’s ‘Liberaton Day’ tariffs on Wednesday, which targeted 100 countries.

Gold shines in Q1 while Bitcoin stumbles

Gold gains nearly 20%, reaching a peak of $3,167, while Bitcoin nosedives nearly 12%, reaching a low of $76,606, in Q1 2025. In Q1, the World Gold ETF's net inflows totalled 155 tonnes, while the Bitcoin spot ETF showed a net inflow of near $1 billion.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.