FTX and Alameda wallets deposit over $24 million in Ether to Coinbase, ETH price at risk of decline

- FTX and Alameda wallets moved 6,500 Ether tokens to centralized exchange Coinbase on Friday.

- ETH price corrected, crumbling under the rising selling pressure in previous instances of FTX and Alameda’s Ether dump.

- Ethereum price wiped out recent gains, declined to a low of $3,570 on Friday.

Bankrupt crypto exchange FTX and trading firm Alameda have deposited 6,500 Ether tokens to Coinbase early on Friday. Similar large-volume deposits from Samuel Bankman-Fried’s firms has previously ushered a correction in ETH.

ETH price is down 5% on the daily timeframe, $3,697, at the time of writing.

Also read: Ethereum risks correction to $3,600 as $1 billion worth of ETH floods exchanges

FTX and Alameda could trigger another ETH price decline

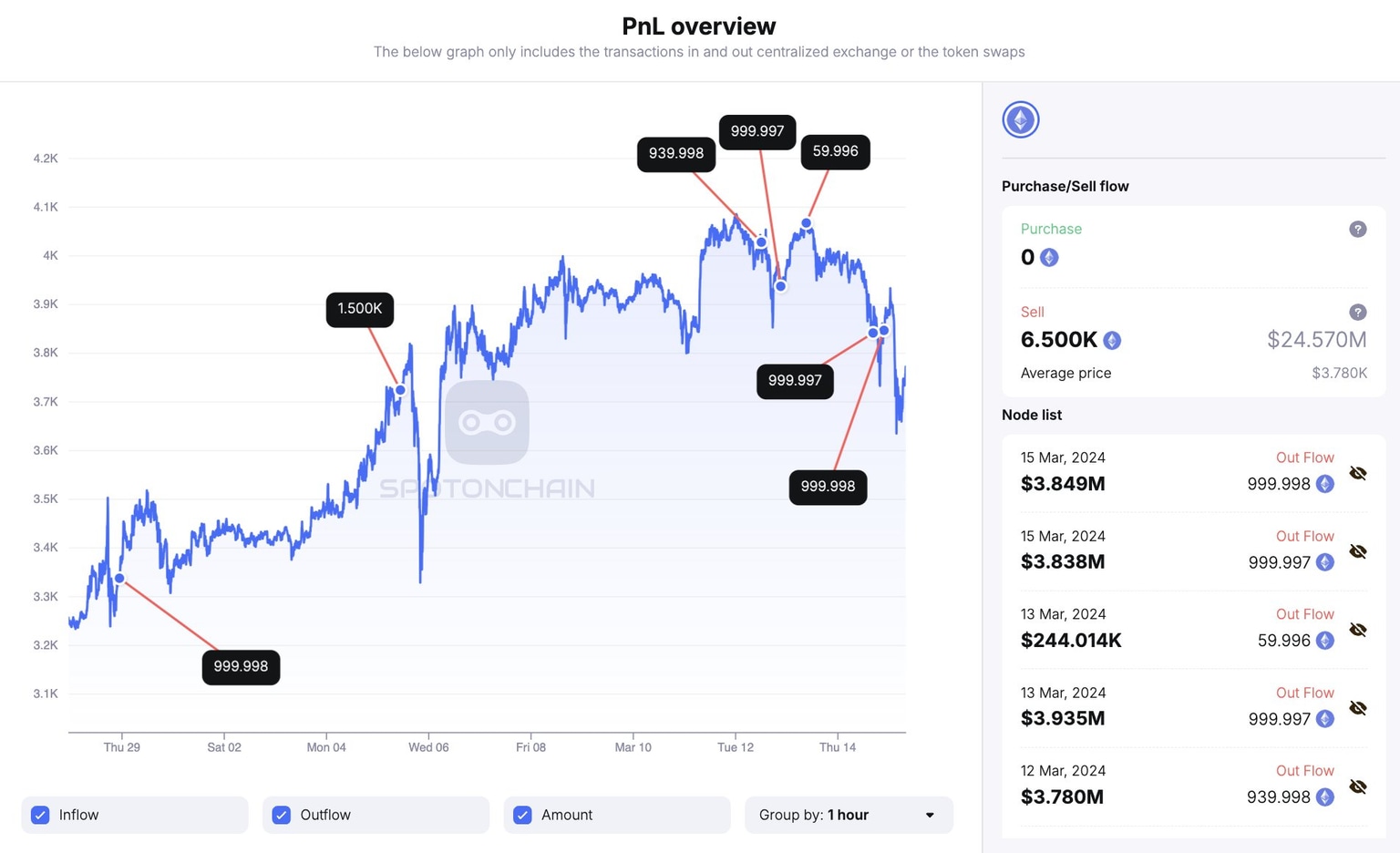

Samuel Bankman-Fried’s bankrupt sister firms, FTX exchange and Alameda, have moved 6,500 Ether to a centralized exchange, Coinbase, according to Spotonchain’s data. The wallets have frequently moved their Ether holdings and the altcoin’s price has corrected, in five out of seven instances, mapped by Spotonchain below.

In the past fifteen days, the two firms deposited 6,500 Ether worth $24.57 million to the exchange at an average price of $3,780. The recent move is significant since it could usher further correction in Ethereum, the altcoin is consolidating below the $3,800 level.

Ethereum price and FTX/Alameda deposits. Source: Spotonchain

Bitcoin price is in a state of decline. With the tight correlation of 0.98 between the two largest assets by market capitalization, Bitcoin and Ethereum, ETH price is likely to slide lower. The two catalysts, FTX and Alameda’s Ether deposits and Bitcoin’s correction, could catalyze a drop in Ethereum price.

Ethereum price is $3,697, down from Tuesday’s peak and year-to-date high of $4,093.92.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.