FTT price skyrockets as new FTX CEO John Ray III suggests restarting the crypto exchange

- FTX Chief Executive Officer stated that reviving the bankrupt exchange would make recovering customer funds easier than liquidating assets.

- John Ray III also commented on former CEO Sam Bankman-Fried, saying that the company did not need him at all.

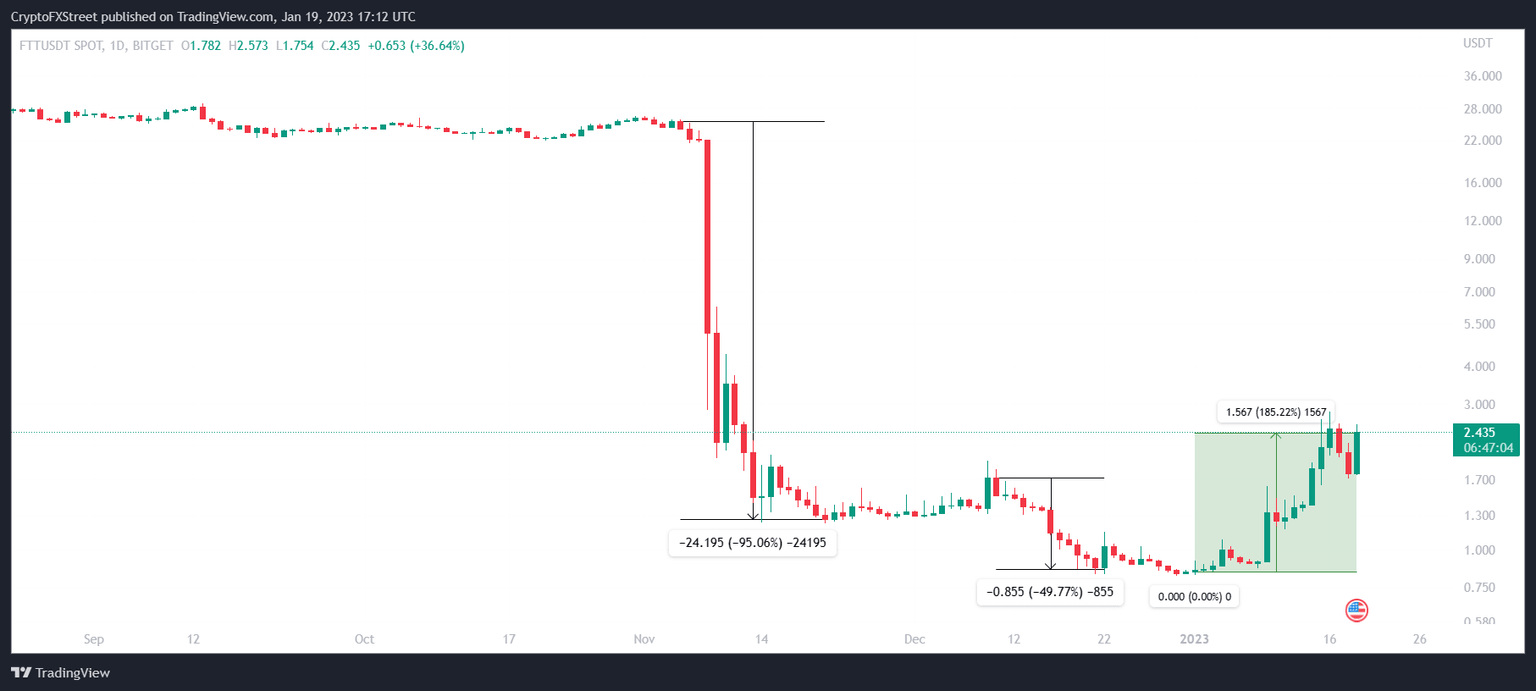

- FTT price shot up by more than 44% at one point before declining to trade at $2.43 on the back of this news.

FTX bankruptcy proceedings have been making positive developments over the last couple of days, which is also being reflected in the price of its native token, FTT. Thursday’s announcement further reinvigorated customers’ interest as the new FTX CEO discussed rebooting the exchange.

FTX to get a new lease on life

FTX saga continued to make headlines on January 19 as the customers and creditors of the crypto exchange were seemingly given hope by its new management. According to a report from the Wall Street Journal, the current CEO of FTX, John Ray III, is looking to restart the bankrupt exchange.

In the interview, John stated that in order to do so, a task force has been set up, which will look into the prospect. He added,

“Everything is on the table. If there is a path forward on that, then we will not only explore that, we’ll do it.”

This is the second major development this week, as on Tuesday, FTX managed to identify $5.5 billion worth of liquid assets. In a “Herculean effort”, FTX had identified $1.7 billion in cash, $3.5 billion in the form of crypto assets and another $300 million as securities.

John Ray further stated that the decision to restart the cryptocurrency exchange also stems from the intention of making the recovery easier. Ray stated that reviving FTX would actually recover more assets than simply liquidating their assets or selling the exchange would.

He also discussed the need for Sam Bankman-Fried and the legal proceedings around him. Criticizing Sam Bankman-Fried’s comments about the bankruptcy team, Ray said,

“We don’t need to be dialoguing with him. He hasn’t told us anything that I don’t already know.”

FTT price shoots up

FTT price, following the news of the possible revival of FTX, noted a sharp increase in value as the cryptocurrency jumped to trade at $2.43. At its highest, the altcoin was up by nearly 45%, rising to $2.57 before sliding back down to register a 36% increase.

FTT/USDT 1-day chart

FTT price has mostly been moving shoulder to shoulder with the rest of the crypto market as the crypto asset noted a 185% increase over the last three weeks. While most of the other cryptocurrencies recovered their November 2022 losses, the same will be impossible as the altcoin would need to rise by more than 1000% and climb back to $25.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.