- FTT price increase also breached the 14-month-long downtrend, bringing the asset closer to the next important resistance.

- More than 17% of the addresses that were underwater recovered with this rally, witnessing profits after two months.

- FTT is noticing bullishness following its exclusive partnership with GameStop, announced a month ago.

FTT price, following the broader market signal, observed a significant increase over the last ten days. However, beyond the bullish cues, the development noted by the FTX exchange itself also contributed to this price rise. The rally also turned things around for many FTT investors, resulting in much-awaited profits.

FTT price climbs new highs

FTT price might not have established a new all-time high, but the recent rally certainly pushed it beyond a crucial resistance level. The downtrend line established following the decline from FTT's all-time high of $79 was breached this week. The 16% increase in FTT's market value made it happen for the first time in 14 months.

FTT/USD 1-day chart

FTT/USD 1-day chart

The rise in price also helped the cryptocurrency reclaim the 50-day (red) Simple Moving Average (SMA) and the 100-day variant.

Both these levels are crucial in sustaining this growth as FTT nears $32.5. Acting as the next critical resistance, this price level has been tested as resistance multiple times in the past, and flipping it into support is crucial for FTT.

FTT/USD 1-day chart

FTT/USD 1-day chart

This would be possible since, historically, every time the altcoin bounced off the critical support line ($21.67), it rallied to test the resistance, even breaching it in July 2021. It shouldbe able to achieve the same this time as well since the Relative Strength Index (RSI) is still highlighting buying pressure for the asset. (ref. FTT/USD 1-day chart)

Profits on the way

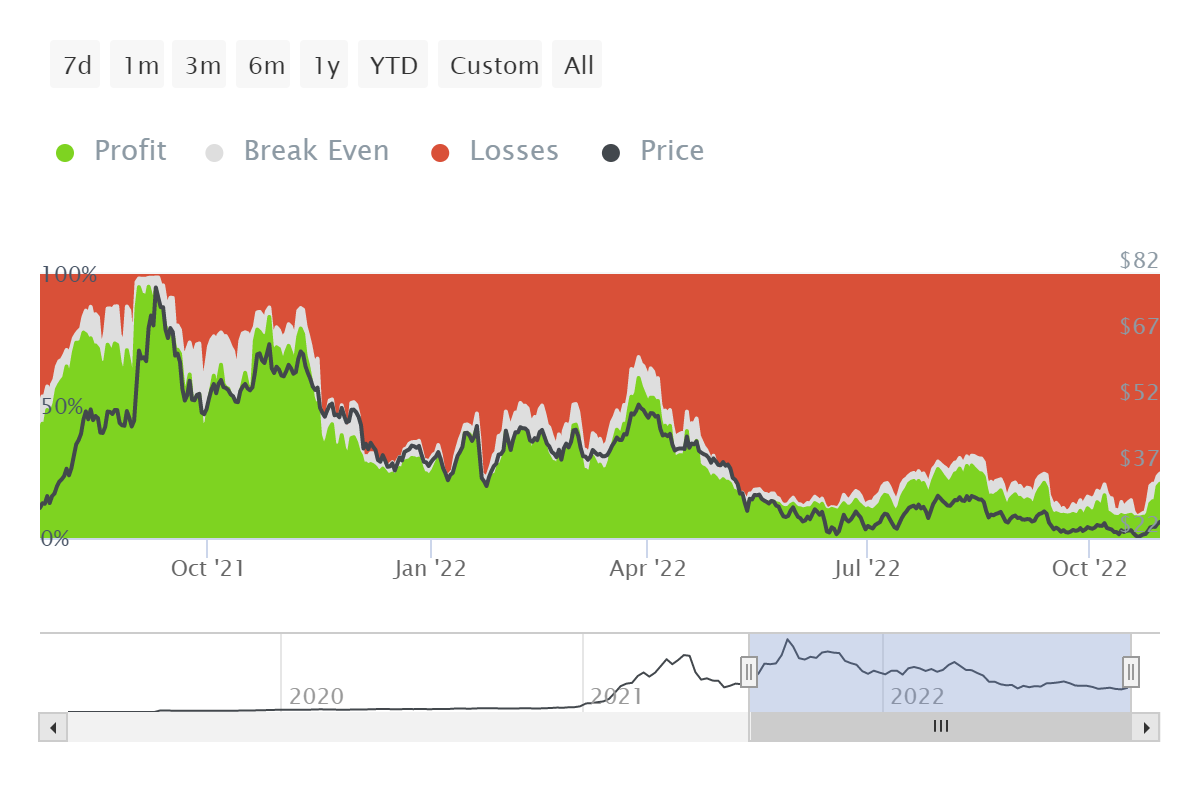

The price increase was also the first instance since September 13 that investors noted some profits. Break Even price calculates the addresses either in profit or loss depending on the price at which they purchased their asset. According to it, the percentage of loss-bearing addresses reduced from 92% to 75% over the week.

FTT addresses facing losses

This will further reduce if FTT's rise continues, which is possible since FTX is gearing up for its deal with GameStop. Through this partnership, FTX will become GameStop's exclusive crypto exchange partner in the U.S.

Pushing forward on the same, FTX made its first announcement teasing the arrival of something soon. Thus, FTT would be an important asset to look out for.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.