FTM whales pull back as Fantom price crashes by 10% in 24 hours

- Fantom price has defied recovery, falling by nearly 23% over the last month.

- Fantom whales' activity declined towards the end of April and continues to remain alarmingly low.

- Retail investors have been spooked, too, as participation has slipped to a two-year low.

Fantom price is observing new lows as Bitcoin, too, fell on May 24. The crypto market turned bearish once again over the last few hours, with many other altcoins following a similar fate. However, in the case of Fantom, the trouble is a little more extensive since it is also losing the support of its investors.

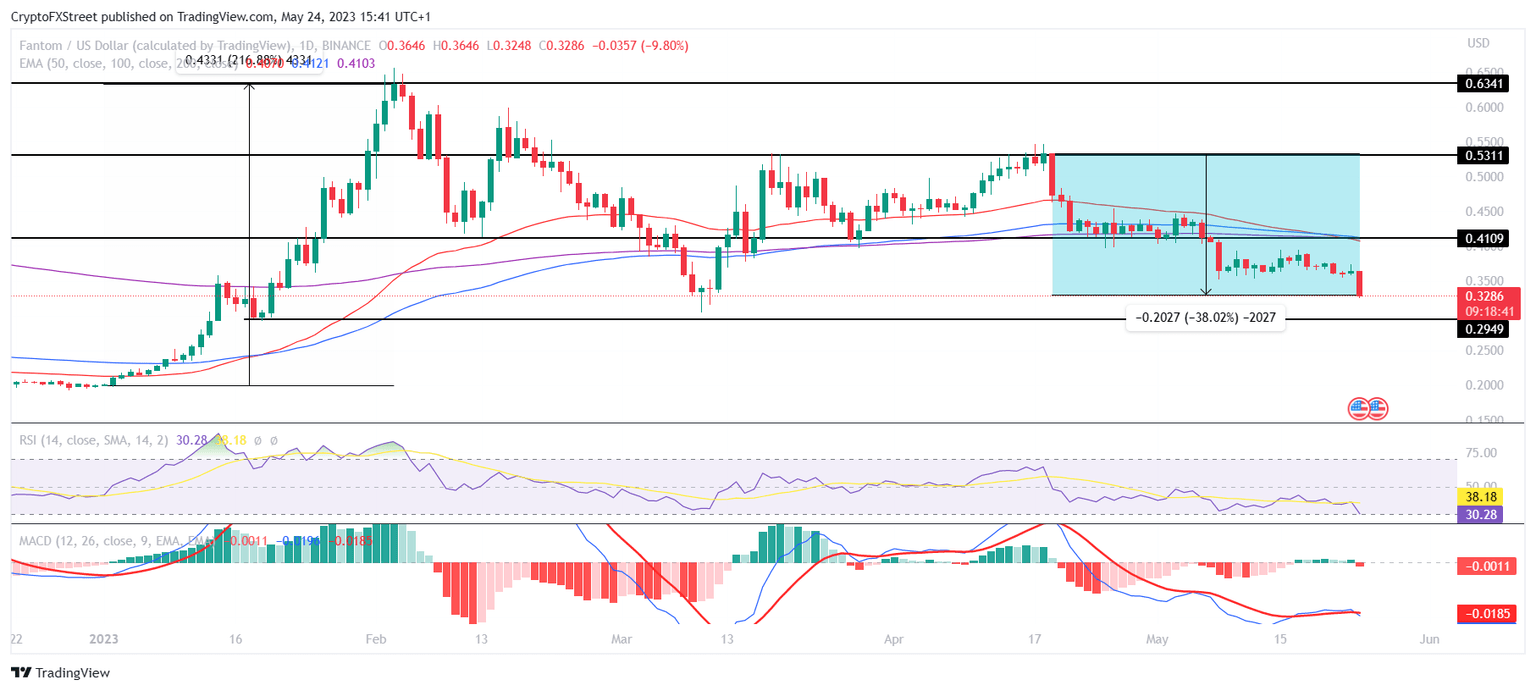

Fantom price hits four-month low

Fantom price slipped by nearly 10% to trade at $0.328 in the last 24 hours, following Bitcoin's lead which is currently trading below the $27,000 mark. The market-wide corrections are in anticipation of the upcoming release of the Federal Open Market Committee's (FOMC) recent meeting minutes.

The minutes are expected to shed light on what the FOMC discussed before hiking the interest rates by 25 basis points to the target range of 5% to 5.25%, at their last meeting, the highest since 2007.

FTM/USD 1-day chart

While broader market bullish cues might serve as a potential trigger for recovery, Fantom price might find some resistance since the altcoin is noting no backup from its investors. FTM holders' participation has declined to a two-year low as active addresses declined to 200 on average.

This means only 0.21% of all FTM holders are conducting transactions on the network, but even among these 200 investors, there are very few whale addresses.

Fantom active addresses

The cohorts conducting transactions worth $100,000 and more usually tend to have a significant impact on the asset's price action. During bearish moments, these investors' activity serves as a cue for recovery, but since the end of April, their presence has diminished considerably.

The average volume of large transactions from whales and larger wallet holders has declined from $9 million to $1 million and below in the span of a month.

Fantom large transaction volume

The reason why the activity of Fantom whales matters more to the FTM price action is that whales command most of the circulating supply. About 76.82% (1.64 billion) of all FTM sit in whale wallets, making their actions crucial to the price action.

Fantom whale concentration

Thus as long as this cohort stays out of participating on the network, FTM price will find it tough to mark a steep recovery. But at the same time, if this drawdown continues, Fantom price might not take long before falling to the support level at $0.294.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.