- Friend.tech founders to take a breather after the tokenized social media platform recorded a massive boom, becoming latest internet sensation.

- The app is built atop Coinbase incubation, Base, to buy and sell keys or shares on social media platform X.

- With celebrities signing up and the project outpacing several decentralized players, speculation of the possible scam has sprouted.

Friend.tech has become the latest internet sensation, after Worldcoin (WLD) and Pepe coin (PEPE) before it. The protocol has attracted celebrities like NBA star Grayson Allen and the common folk, raising up to $2.88 million in fees despite being live for barely 14 days. The turnout has shocked projects heads, who told Decrypt:

We want to catch a breath.

Also Read: Will Fed’s Jerome Powell steal friend.tech’s spotlight this week?

Friend.tech surprises bosses, but users cite possible Ponzi

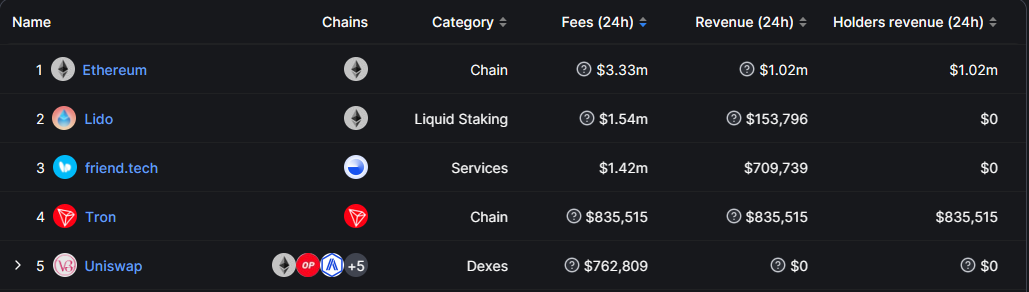

Tokenized social media platform, Friend.tech, has excited the market after an impressive two-week run, the project now boasts a record $2.88 million in protocol fees. Based on DefiLlama data, this rise places it next to Ethereum (ETH) and Lido DAO (LDO) in the list of on-chain protocols.

Friend.tech ranking by fees and revenue

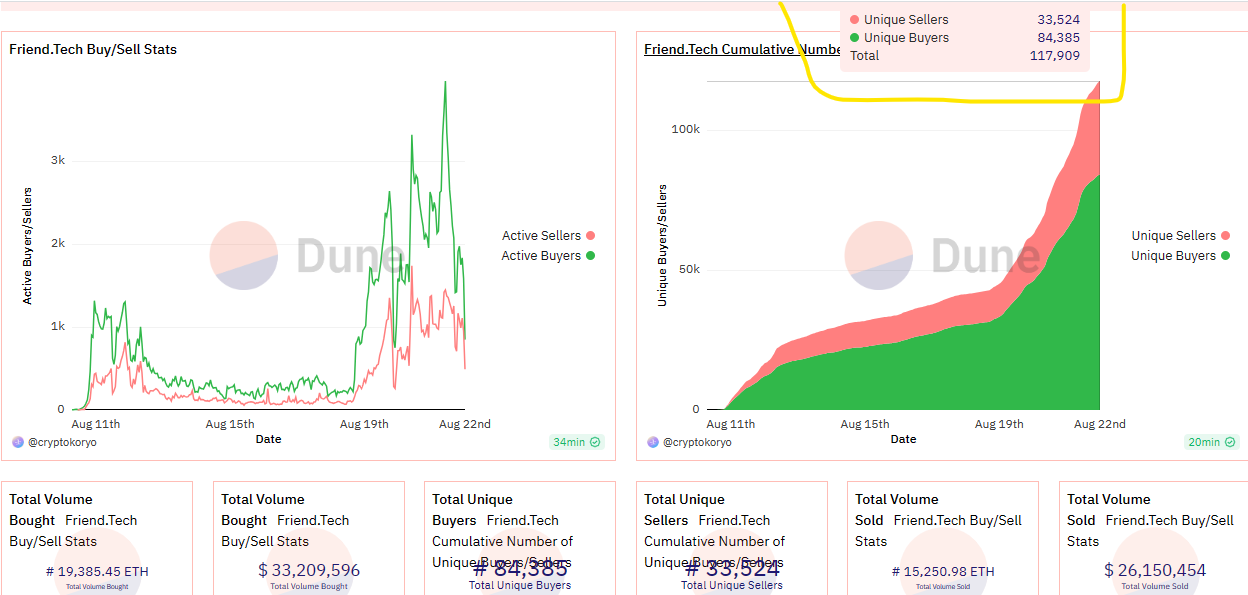

Citing one of the project's pseudonymous co-founders, who has expressed complete surprise, "We initially shared the app to start load testing and didn't expect it to go viral." The site boasts almost 118,000 users, which is no mean feat considering it is still nascent.

Friend.tech users

Nevertheless, as project executives contemplate how to advance the project, some social media platform users think it is a scam.

If someone can please fill me in, how is #friendTech not a clear as day Ponzi? You buy and if more people buy that group it goes up. The only way to appreciate is more people coming in, with the inevitability of a load of bag holders. What am I missing? pic.twitter.com/NyXvpo1pyT

— TheChartGuys (@ChartGuys) August 21, 2023

Another user says, "Every couple years in crypto, somebody reintroduces an elaborate Ponzi with a bonding curve," acknowledging the role of influencers in driving the project, saying, "And there's always some group of influencers that rave about it being "the new paradigm," before speculating the use of bots that, "No pun intended. You're already getting front run by bots making it -ev. This ends in mass carnage."

If the project is fraudulent, investors should brace for a massive sell-off that would come once the hype cycle fades and dies down. Investors could sell their shares in huge loads, triggering panic and causing a sell-off. The speed of the crash could be just as fast as the speed of the climb. One of the reasons cited for the possible slump is that it lacks incentive to keep users interested.

Friendtech (FT) isn't the next OF. It's another ponzi shitcoin and you're the exit liquidity into whoever is shilling their bag. People shilling it are grifting, and will walk away clean while you end up poorer and reading a dead chat.

— Alex Wice (@AWice) August 21, 2023

The most important reason it fails in the…

However, crypto lawyers have challenged this assertion, saying that the Friend.tech shares have some utility. According to legal experts, there is also the possibility of capital appreciation, which could put the project on the radar of the US Securities and Exchange Commission (SEC). Citing Mark Hiraide, a partner at Mitchell Silberberg & Knupp:

It is a question of whether the shares are traded on a platform other than Friend.tech, as that would make it harder to distinguish the asset from traditional securities.

The project transformed the name "shares" to "keys" to avoid securities-related risks. Key holders can use them to unlock their friends' chat rooms.

Notwithstanding, it is imperative to consider the speed at which users have enlisted to the project, which points to significant demand for a "social token" platform. More importantly, investors must always perform their research and due diligence to avoid falling victim to fraudulent projects.

Cryptocurrency prices FAQs

How do new token launches or listings affect cryptocurrency prices?

Token launches like Arbitrum’s ARB airdrop and Optimism OP influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

How do hacks affect cryptocurrency prices?

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

How do macroeconomic releases and events affect cryptocurrency prices?

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence risk assets like Bitcoin, mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

How do major crypto upgrades like halvings, hard forks affect cryptocurrency prices?

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs. This has been observed in Bitcoin and Litecoin.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.