Friday pullback? Biggest Bitcoin mining pool sends 800 BTC to Binance

CryptoQuant warns that a sell-off from Poolin may accentuate downward Bitcoin price pressure in the short term.

Bitcoin (BTC) may have recovered to $11,700 but miners could soon spark a price plunge, data warns.

In an update on Aug. 14, on-chain monitoring resource CryptoQuant identified a spike in mining pool outflows.

BTC price: CryptoQuant expects a “little pullback”

Aftering remaining stable this month, mining pool outflows have begun to grow, with 802 BTC in aggregated flows recorded by CryptoQuant on Friday.

Describing the event as “unusual” in an automated alert, CryptoQuant noted that if the Bitcoin leaving pools were being sent to an exchange, selling pressure could quickly mount, pushing down price.

Alternatively, an over-the-counter transaction popular in China, a country home to many major mining pools, would avoid negative price repercussions.

In the event, 800 BTC from Poolin — responsible for the lion’s share of newly-mined BTC over the past several days — ended up at Binance.

“I expect a little pullback,” CryptoQuant CEO Ki Young Ju commented on Twitter.

In comments to Cointelegraph, Ki equated the shipment of BTC to roughly one week’s activity for Poolin.

“They mined 147 blocks this week, and the average BTC for block reward is 6.25. So It’s like what they mined per week,” he summarized.

Poolin mining pool outflows one-week chart. Source: CryptoQuant/ Twitter

Miner revenue cancel out halving impact

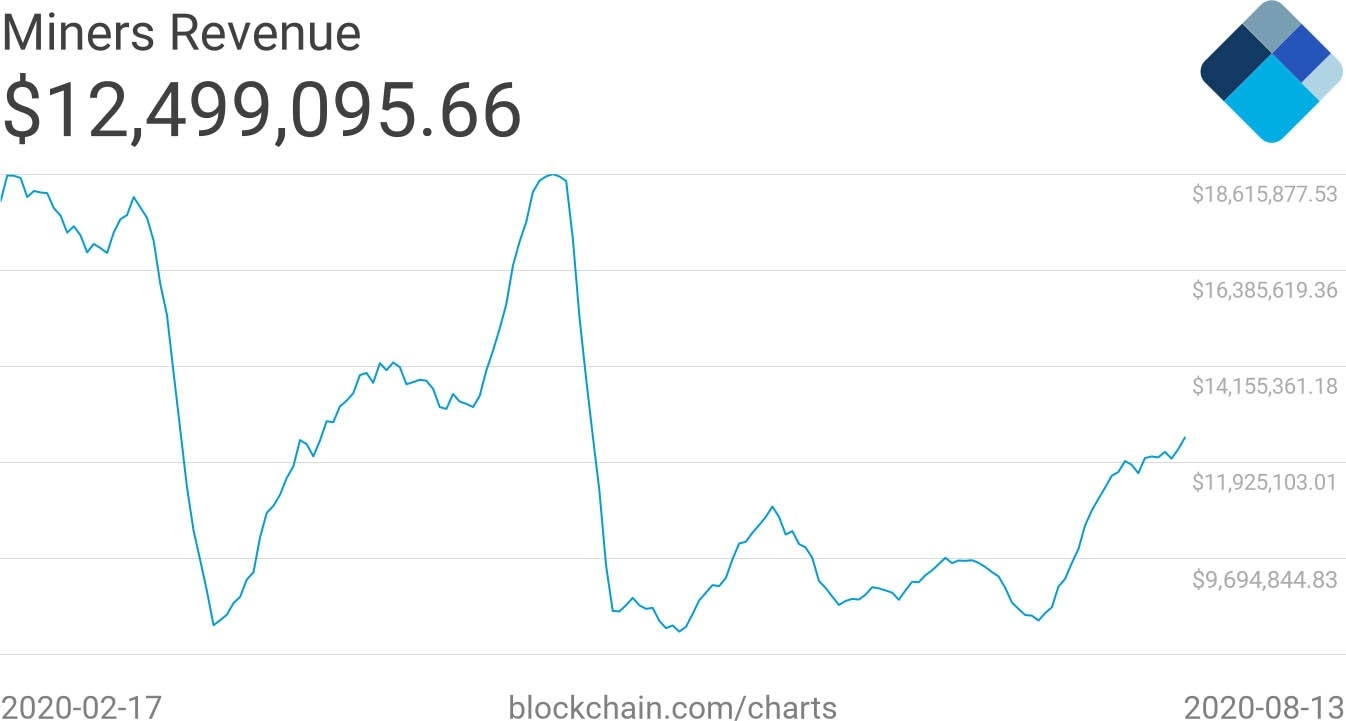

Miners’ financial health has staged a comeback in recent weeks, with revenue returning to pre-halving levels in April.

The halving itself cut supply dramatically, fueling anticipation of major institutional buy-ins boosting price performance further this month.

Bitcoin 7-day average miner revenues six-month chart. Source: Blockchain

Previously, a basket of factors had persuaded Cointelegraph Markets analysts to double down on bullish sentiment.

On Thursday, Filbfilb highlighted technical and macro signals pointing upwards, including a rebound for “highly correlated” gold and silver.

“We are still in an uptrend so I should lean on the side of bullish,” he told Telegram subscribers.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.