France issues first crypto license under MiCA rules to third largest bank Societe Generale

- Societe Generale was designated a digital asset service provider (DASP) by the AMF on Tuesday.

- The license enables the country's third-largest bank's crypto unit, Forge, to act as a custodian as well as enable the purchase, sale and trading of digital assets.

- Institutional inflows from Europe have not been great year-to-date, with France making very little contribution despite having 3.8 million users.

Europe marked a milestone earlier this year after successfully approving the Markets in Crypto Assets (MiCA) bill, becoming the first major instance of crypto adoption in the world. In line with this, France this week issued its first crypto license, furthering the embrace of crypto and digital assets by financial institutions.

Societe Generale receives France's first crypto license

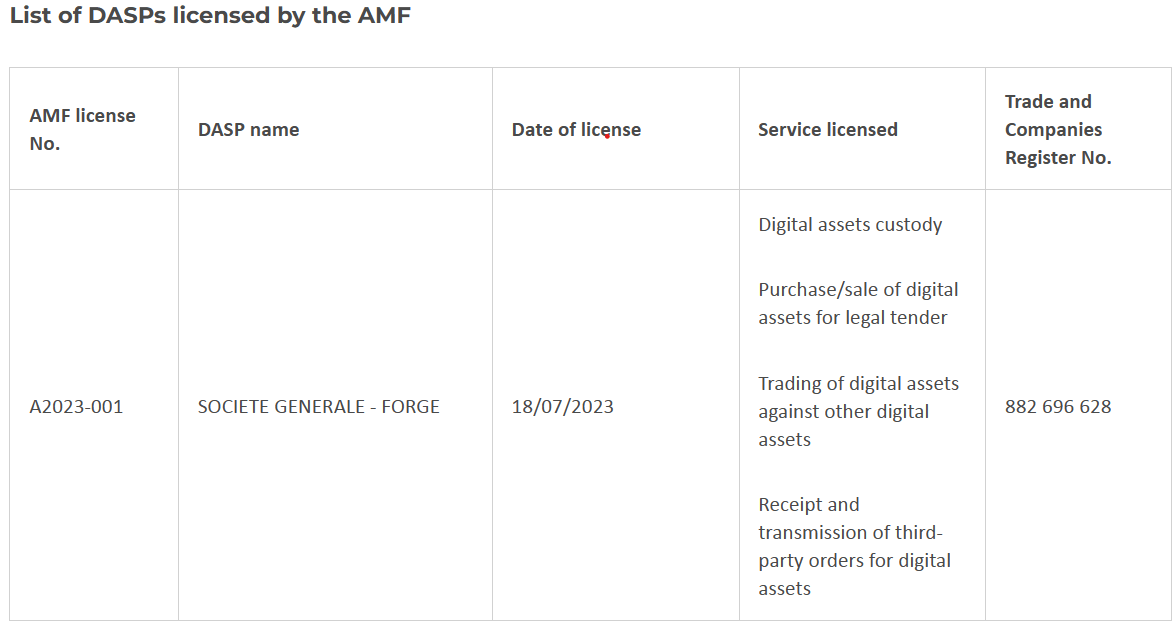

French bank Societe Generale became the first mainstream financial institution to be issued a crypto service provider license in France. The bank's crypto unit Forge was designated as a digital asset service provider (DASP) by the Autorité des Marchés Financiers (AMF) this Tuesday.

Societe Generale Forge crypto license

After obtaining the license, Forge will be able to act as a custodian for crypto assets in the country. The license also allows the country's third-largest bank's crypto unit to fulfill the institutional clients' needs for digital assets. This includes the purchase and sale of cryptocurrencies as well as the trading of digital assets.

Announcing the issuing of license, Societe Generale Forge stated,

"As the first DASP-licensed company, SG-FORGE anticipates the implementation of the European MiCA regulation, which aims to regulate and secure the crypto-asset market at European Union level by 2024.

Receiving a full license has been mandated under the MiCA rules, and all crypto service providers must ensure the same is achieved by them by January 2025. Only then these companies will be allowed to operate in the European Union countries.

While institutional crypto adoption has been growing at a rapid pace in the world, Europe is still catching up with the leader United States. Digital asset products in the week ending July 14 observed institutional inflows of $137 million across the world, out of which the US alone was responsible for $109 million.

Institutional inflows by country

In fact, year to date, European countries have seen a total institutional inflow of $232 million, out of which France only contributed about $1 million. This is despite the fact that the country has over 3.8 million crypto users, representing nearly 6% of the entire population.

Thus, with MiCA, more companies would likely be motivated to obtain a license, in return, improving the crypto landscape in the country.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.