Fourth FTX ex-official pleads guilty as Sino Global Capital files a $67.3 million claim against the exchange

- Former FTX executive, Ryan Salame, is in talks with prosecutors about a possible plea deal as she pleads guilty.

- The ex-official is facing prosecution for campaign finance law violations.

- The supposed deal comes as Sino Global files a $67 million claim against FTX exchange and sister firm Alameda Research.

FTX is making headlines, only this time not for the right reasons unlike when the exchange was declaring plans for a do-over, to relaunch the cryptocurrency trading platform. Based on latest reports, two bearish events are taking place concurrently; an ex-official has added to the list of those who have bulged to pressure and that one of the victims of the collapse in now suing for claims.

FTX woes deepen

FTX misery continues, with the latest being that a former co-chief executive of its Digital Markets arm, Ryan Salame, pleading guilty to criminal charges imposed by the prosecutors following the collapse of Sam Bankman-Fried’s cryptocurrency empire, FTX.

The news follows a Bloomberg report, which cited persons close to the matter, noting that Salame is a Republican donor with a history of managing political donations from the exchange to politicians. While it remains unclear what Salame’s proposed plea deal with the prosecutors entails, he becomes the fourth company official to cop a plea, after Gary Wang, Caroline Ellison, and Nishad Singh.

Meanwhile, one of the companies that suffered exposure to FTX’s collapse in November 2022 has raised up in arms, claiming compensation after incurring losses. Sino Global Capital, a venture firm native to crypto, has filed a $67.3 million claim against the exchange. The filing comes after the company made a heavy investment in tokens that were exposed to FTX, and therefore suffered the brunt of a failed crypto conglomerate.

Besides the tokens, Sino Global Capital had also collaborated with the exchange on a 2021 fund, christened Sino’s Liquid Value fund, which had been raised with capital from external investors. The company was drawn to FTX based on the belief that it was a good actor focused on driving the industry. However, this stance changed after the exchange collapsed.

— SGC (@SinoGlobalCap) November 15, 2022

According to the venture firm, its “direct exposure to FTX exchange was confined to mid-seven figures held in custody.”

Notably, Sam Bankman-Fried featured among the indirect investors in the fund on 2022 filings by the US Securities and Exchange Commission (SEC), alongside Alameda Research, subsidiary Alameda Ventures, and Graham. Nevertheless, recent revelations suggest that the fund is no longer under the financial regulator’s registry despite continued operation under the Cayman Islands Monetary Authority (CIMA).

FTX token price implication

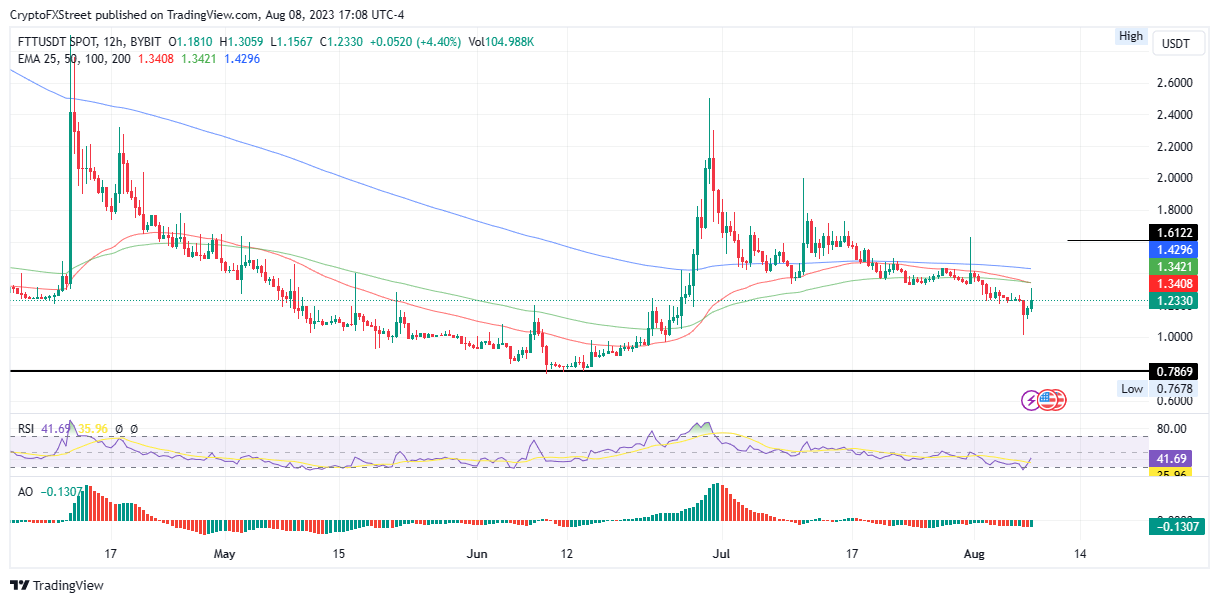

Despite the news, FTX token FTT is trading with a bullish bias after rising almost 10% in the last 24 hours. The Relative Strength Index (RSI) edging north suggests rising momentum that could soon see FTT price breach the resistance confluence between the 50- and 100-day Exponential Moving Average (EMA) at $1.340. In a highly bullish case, the altcoin could extend north to tag the $1.429 resistance level.

FTT/USDT 12-hour chart

Conversely, if the bullish outlook fails to play out, FTT price could retrace lower, possibly tagging the psychological support at $1.000 before the $0.786 support floor. Such a move would constitute a 35% drop below current levels.

Cryptocurrency prices FAQs

How do new token launches or listings affect cryptocurrency prices?

Token launches like Arbitrum’s ARB airdrop and Optimism OP influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

How do hacks affect cryptocurrency prices?

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

How do macroeconomic releases and events affect cryptocurrency prices?

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence risk assets like Bitcoin, mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

How do major crypto upgrades like halvings, hard forks affect cryptocurrency prices?

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs. This has been observed in Bitcoin and Litecoin.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.