- The shift from CeFi and DeFi continues to gain momentum.

- DeFi is set to disrupt the existing financial structure as it proves more beneficial.

Market participants seem to be divided on whether or not decentralized finance (DeFi) is set to disrupt the current centralized financial system. Given the rising number of issues that have led to millions of dollars lost within this sector, it is uncertain what the future will look like as blockchain technology begins to gain traction in the new economic order.

The challenges of centralized finance

Centralized finance can be defined as the current financial system that rules the world, where investors relinquish the custody of their funds to third parties. This economic structure relies on the trust that people have for financial institutions, while it promises improved accessibility to a range of services.

"CeFi is an extension of the existing financial model, but upgraded to the next level with crypto. It alleviates one of the biggest pain points of the traditional financial system — accessibility but keeps the usability and simplicity as it's more familiar to most people," affirms Bill Dashdorj, CEO at Pokket.

Centralized exchanges like Coinbase and Binance are good examples of CeFi services. These platforms are prone to several risks ranging from exit scams to hacks, as it happened with Mt. Gox in 2014. There have been many cases where investors cannot access their funds, as it is currently happening with OKEx users.

While the different features that CeFi provides are quite useful since there is someone to blame for any issues, these platforms do not completely satisfy the cryptocurrency industry's ethos.

Benefits of shifting to DeFi

On the other hand, DeFI creates an ecosystem that is based on a permissionless and decentralized model. It also enables access to cryptocurrencies and a wide range of financial services, where trust relies on the blockchain.

Some of the benefits of this new market sector include:

- Improved transparency: Being one of the core characteristics of cryptocurrencies in general, DeFi provides a high level of openness. It gives user autonomy, leveraging the blockchain to provide both transparency and accessibility.

- Better Transparency: The lack of adequate openness in traditional finance, particularly regarding how financial companies use clients' funds, was one thing that cryptocurrencies sought to fix. The CeFi model only brings a marginal improvement in transparency, while DeFi redefines transparency with the increasing use of on-chain data analysis.

- Less Third-Party Risk: DeFi's trustless system eliminates the need for a counterparty to validate transactions between two people or more, thereby making it safer to use.

- No Risk of Censorship: Eliminating any form of counterparty means that the DeFi ecosystem can operate without any suppression. Services cannot be stopped, and transactions are irrevocable.

While the absolute autonomy of funds ownership is attractive, it is a double-edged sword. It is impossible to look past its risks, making safeguarding private keys paramount as losing them can lead to an irrecoverable loss of assets.

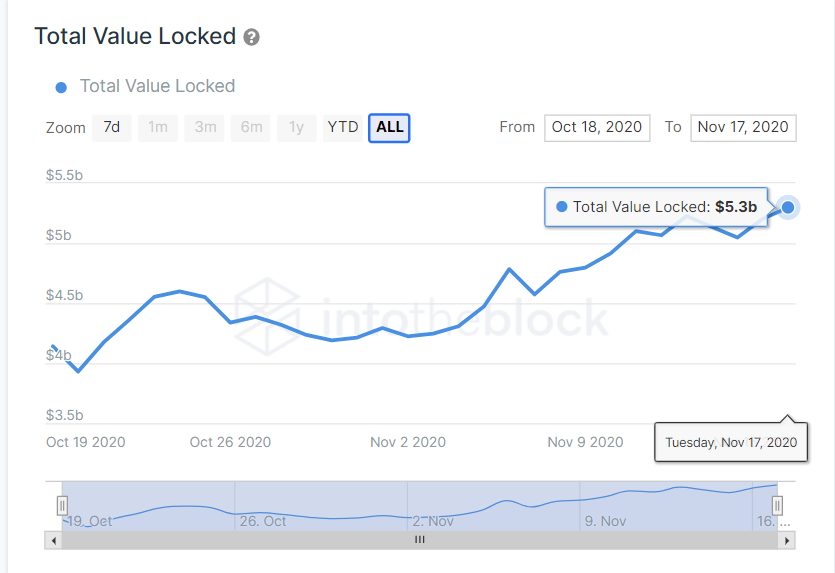

Nevertheless, the cryptocurrency industry is continuously evolving and adapting to provide a better inclusion to those unbanked. The rising usage of DeFi protocols indicates that trust for these services is also increasing, and more investors are adopting it.

Total value locked in DeFi as shown on IntoTheBlock

Albeit, the narrative that CeFi and DeFi can coexist is not far-fetched as the latter continues to metamorphose and gain more adoption within the cryptocurrency industry.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Shiba Inu eyes positive returns in April as SHIB price inches towards $0.000015

Shiba Inu's on-chain metrics reveal robust adoption, as addresses with balances surge to 1.4 million. Shiba Inu's returns stand at a solid 14.4% so far in April, poised to snap a three-month bearish trend from earlier this year.

AI tokens TAO, FET, AI16Z surge despite NVIDIA excluding crypto-related projects from its Inception program

AI tokens, including Bittensor and Artificial Superintelligence Alliance, climbed this week, with ai16z still extending gains at the time of writing on Friday. The uptick in prices of AI tokens reflects a broader bullish sentiment across the cryptocurrency market.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

XRP price could renew 25% breakout bid on surging institutional and retail adoption

Ripple price consolidates, trading at $2.18 at the time of writing on Friday, following mid-week gains to $2.30. The rejection from this weekly high led to the price of XRP dropping to the previous day’s low at $2.11, followed by a minor reversal.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.