Four on-chain metrics suggest Arbitrum’s ARB could be the next Layer 2 token to breakout

- Arbitrum price hovers around $1.02 with signs of a bottom forming.

- A key observation from on-chain metrics is that investor interest is rising steadily.

- Additionally, investors seem to have booked profits, resetting some critical sell signals that emerged last week.

- Investors could get a buying opportunity at key support levels before ARB bounces to the $1.12 and $1.29 hurdles.

Arbitrum price shows signs of reversing the short-term corrective trend. A bottom formation could suggest that buyers are slowly accumulating before the 2023 rally continues.

Read more: Why this Layer 2 token towers over MATIC, OP, ARB and MNT in YTD performance

Crypto market sentiment turns bullish

Analysts forecast that the Bitcoin Exchange-Traded Fund (ETF) is all but approved after the Binance settlement with the US regulators. Bloomberg analysts have suggested a 90% probability of the ETF approval in January 2024. If this decision comes to pass, it will cause a massive buying frenzy that propels all altcoins.

The latest update includes Grayscale, BlackRock and other ETF filers meeting with the US Securities and Exchange Commission (SEC).

Update: New Grayscale S-3/Prospectus #Bitcoin ETF filing to convert $GBTC. Right off the bat the biggest update is the plan to change $GBTC's ticker to $BTC (which was expected). Skimming through the rest now. pic.twitter.com/W9uNdAHLMv

— James Seyffart (@JSeyff) November 22, 2023

Read more: Nearly 60% of ARB holders are underwater despite 50% rally in Arbitrum price, why?

Arbitrum on-chain metrics to flash buy signals soon

The Arbitrum network has noted a 160% spike in Active Addresses (AA) from 11,357 to 29,435 between November 21 and November 23. This uptick shows that sidelined buyers are interested in ARB at the current level. Considering that ARB price slid 21% in the last two weeks, these investors could be buying the dip.

Additionally, the Network Growth indicator, which measures the new addresses joining the ARB blockchain, also spiked by 160% on November 21. This growth can be attributed to the influx of capital and adds to the bullish outlook of ARB.

ARB Active Addresses, Network Growth

According to the Network Realized Profit/Loss (NPL) indicator, there was a capitulation event on November 23, where $3.06 million of ARB was sold at a loss. These capitulation events are where short-term holders sell, allowing long-term holders to accumulate, and these signs are often viewed as buy signals.

ARB Network Realized Profit/Loss

Unrealized profits are very harmful to bulls, but Arbitrum seems to be in the clear. Santiment’s 30-day Market Value to Realized Value (MVRV) ratio shows that the unrealized profits from holders that purchased ARB in the past month have dropped from nearly 38% on November 10 to 4% as of this writing.

This decline shows that unrealized gains have been reset, which increases the odds of a rally that is not threatened by sellers.

ARB 30-day MVRV

All in all, the outlook for Arbitrum looks bullish, not just from an on-chain perspective but also from a technical point of view.

ARB price likely to kickstart explosive rally

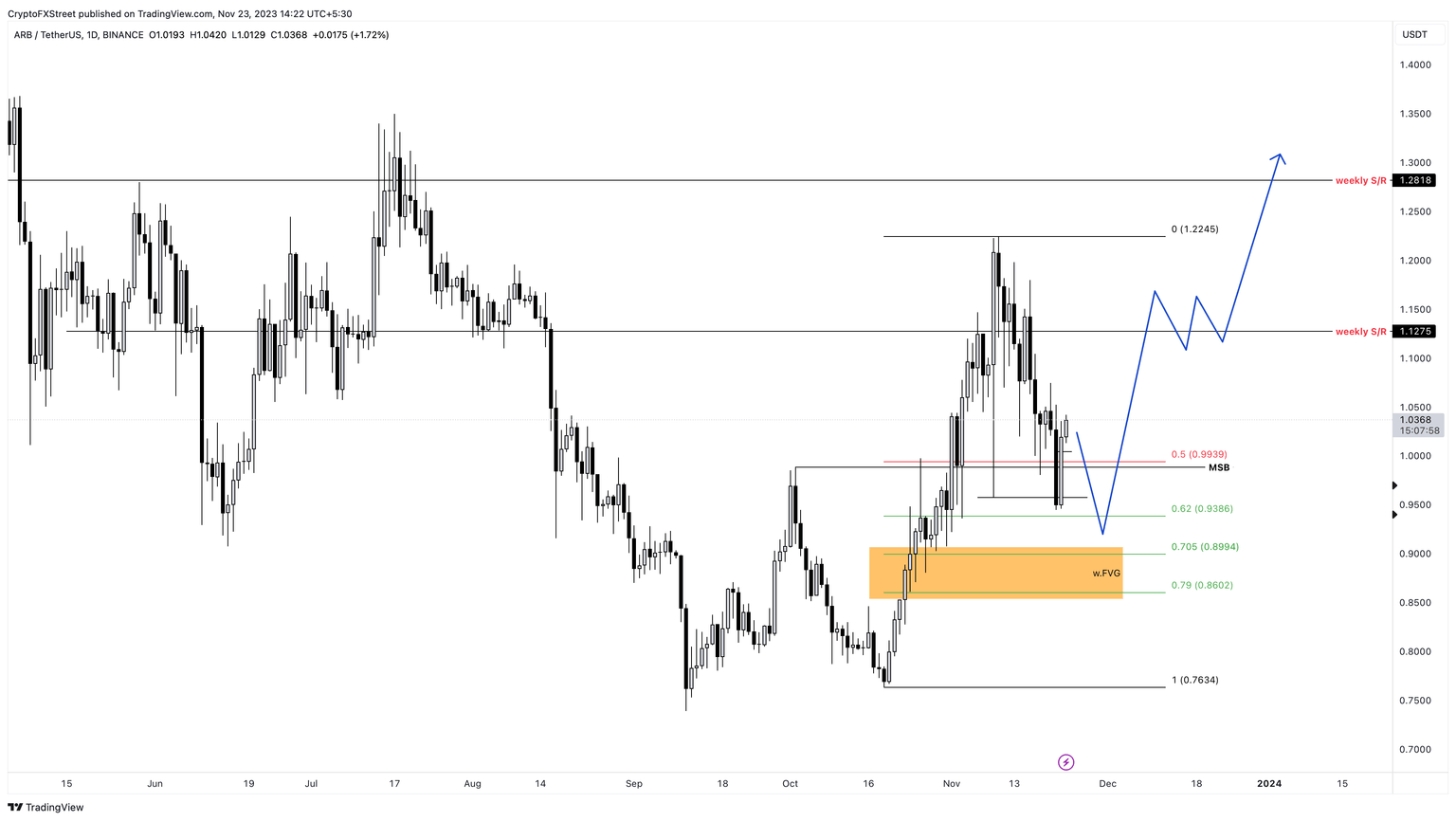

Arbitrum price exchanges hands at $1.03, but if bulls are persistent, it could move up by 9% and tag the weekly resistance level at $1.12. A successful flip of this hurdle into a support floor on the daily time frame will be confirmation of increased bullish momentum.

In such a case, ARB could eye a retest of the next key resistance level at $1.28. This move would constitute a 24% gain from the current position.

Another way this bullish scenario could play out is by retracing lower before triggering a northbound move. In this case, ARB buyers could accumulate at $0.938, $0.907 and $0.853 barriers. A bounce from roughly $0.900 to the $1.28 hurdle would constitute a 40% gain.

ARB/USDT 1-day chart

On the other hand, if Arbitrum price fails to hold above $0.853 and continues to produce lower highs and lower lows, it would confirm that the bears are in control. In such a case, ARB could eye a sweep of the range low at $0.763.

Also read: Bitcoin supply inactive for a year hits record high of 70%

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.

%2520%5B12.53.27%2C%252023%2520Nov%2C%25202023%5D-638363268295939613.png&w=1536&q=95)

%2520%5B11.00.19%2C%252023%2520Nov%2C%25202023%5D-638363268746878159.png&w=1536&q=95)

%2520%5B11.00.40%2C%252023%2520Nov%2C%25202023%5D-638363268914961653.png&w=1536&q=95)