- XRP price has transformed into a new, high probability opportunity.

- Yesterday, Ripple rewarded the buy the dip investment philosophy.

- 43rd treasurer of the United States joins Ripple board of directors.

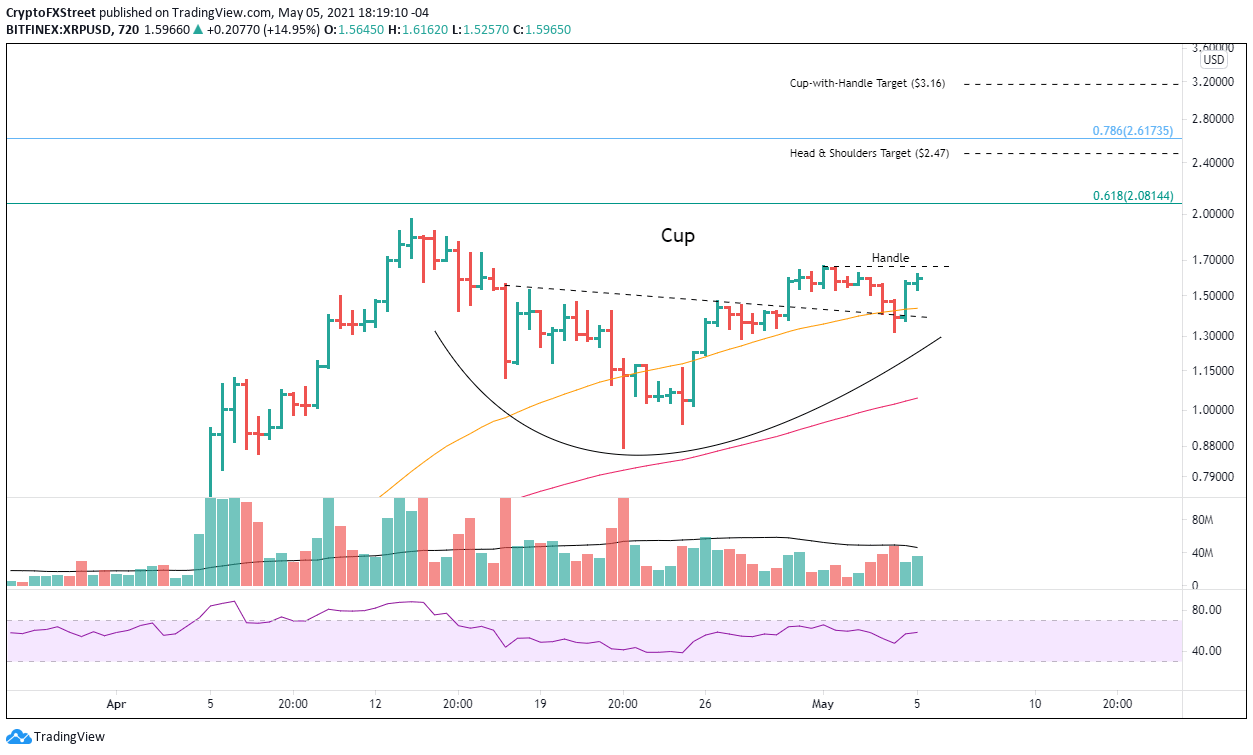

XRP price opportunity began as an inverse head-and-shoulders pattern, but it has evolved into a bullish cup-with-handle base on the intra-day charts. Ripple’s compelling transformation has it on the cusp of a sizable rally, putting the all-time high at speculator’s fingertips.

Former US treasurer joins Ripple’s board of directors

To begin, it is essential to mention that the 43rd treasurer of the United States, Rosa Gumataotao Rios, has joined Ripple’s board of directors. She served as the treasurer from 2009 to 2016 under the Obama administration.

As treasurer, she led all currency and coin production activities with an annual budget of $5 billion. In general, her career has primarily concentrated on economic development, urban revitalization and real estate finance.

In Ripple’s blog post, Rios emphasized her commitment to financial inclusion and empowerment and how innovation plays a significant role in that pursuit. She also articulated the view that cryptocurrency is the what and Ripple is the how.

I’ve dedicated my career to financial inclusion and empowerment, which requires bringing new and innovative solutions to staid processes. Ripple is one of the best examples of how to use cryptocurrency in a substantive and legitimate role to facilitate payments globally.

It is an exciting coup for Ripple, considering the ongoing battle with the SEC and whether to define XRP as a security or as a currency. No doubt, the Rios appointment adds the credibility necessary for Ripple to navigate the halls of the US political and legal establishments.

XRP price battles the skeptics

On April 29, XRP price triggered the neckline of an inverse head-and-shoulders pattern, lifting Ripple 13% for the day. At the time, the projected move for the bottom formation was $2.47 or a gain of 70% from the neckline. The anticipated rally would crush the psychologically important $2.00 and the 61.8% Fibonacci retracement of the 2018-2020 bear market at $2.08.

XRP price failed to capitalize on the superior breakout. It slipped into a minor pullback until it jumped 13% today, reclaiming the neckline of the inverse head-and-shoulders pattern and originating the potential for a cup-with-handle base.

A trade above $1.66 will trigger the Ripple cup-with-handle base and offer new speculators the opportunity to capitalize on a timely entry price. XRP price will encounter resistance at the April 13 high at $1.96, but the more significant challenge will be $2.00 and $2.08. An acceleration in the rally should propel XRP price to the inverse head-and-shoulders measured move target of $2.47, a gain of 70% from the neckline breakout on April 29.

The focus of this outlook is the cup-with-handle measured move target of $3.16. To achieve the thesis projection, XRP price will have to conquer resistance at the 78.6% Fibonacci retracement of the 2018-2020 bear market at $2.61 and then $3.00.

A rally of this magnitude would put XRP price within reach of the 2018 all-time high at $3.30.

XRP/USD 12-hour chart

Ripple is a classic high-risk, potentially high-return cryptocurrency opportunity, and for that reason, speculators need to be aware of the critical support levels. A decline below the handle low of $1.31 would be a warning that XRP price was vulnerable to a larger pullback and, as a result, a more complex bottoming process.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

XRP gains as traders gear up for futures ETFs debut this week

XRP climbs over 3% on Monday, hovering around $2.33 at the time of writing. The rally is likely catalyzed by key market movers like XRP futures Exchange Traded Funds (ETFs) approval by the US financial regulator, the Securities and Exchange Commission (SEC), and a bullish outlook.

Bitcoin Price Forecast: BTC eyes $97,000 as institutional inflow surges $3.06 billion in a week

Bitcoin (BTC) price is stabilizing above $94,000 at the time of writing on Monday, following a 10% rally the previous week. The institutional demand supports a bullish thesis, as US spot Exchange Traded Funds (ETFs) recorded a total inflow of $3.06 billion last week, the highest weekly figure since mid-November.

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum (ETH) recovered the $1,800 price level on Saturday after US spot Ether ETFs (exchange-traded funds) recorded their first weekly inflows since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation (formerly Janover) filed a registration statement with the Securities & Exchange Commission (SEC) on Friday, signaling its intent to offer and sell a wide range of securities, including common and preferred stock, debt instruments and warrants for the purchase of equity

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.