- XRP price hints at signs that it is ready for an explosive second half of the year.

- Investors can expect Ripple to rally roughly 83% from the current position to $0.639 soon.

- A daily candlestick close below $0.340 will invalidate the bullish thesis for the remittance token.

XRP price shows promise that it is ready to trigger a massive run-up as the first half of the year comes to an end. There are three reasons why investors should be bullish on Ripple.

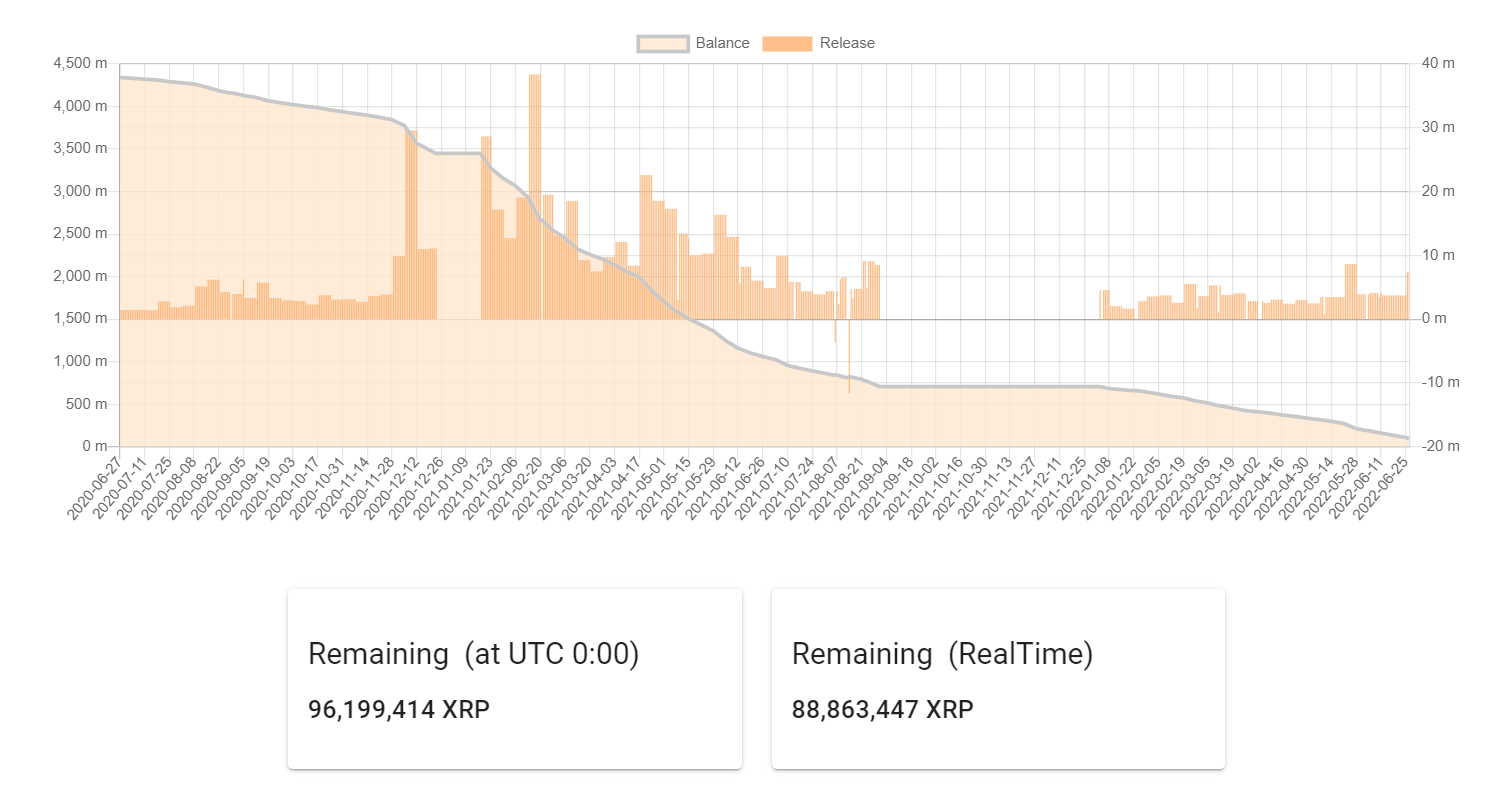

- Jed McCaleb’s ‘Taco’ wallet which held roughly 9 billion XRP tokens now holds only 96.19 million tokens.

- The technicals of XRP price are showing promise as the recent recovery has overcome multiple high-time-frame hurdles.

- Lastly, the wild card that could explode the market value of XRP is the ongoing battle between the SEC and Ripple.

Let’s take a closer look at each of these factors.

XRP dumping spree by Ripple co-founder Jed McCaleb

XRP price was at the mercy and behest of the Ripple co-founder Jed McCaleb. After a successful launch of the blockchain, the founders and members close to the project were gifted 80 billion XRP tokens.

Jed McCaleb received 9 billion, but after an internal scuffle, which to date, remains shrouded in mystery, the co-founder exited the project.

Since then, McCaleb has been offloading his holdings. To prevent a price dump, Ripple struck a deal that blocked him from selling more than a specific amount of XRP each year for the next seven years

As of June 28, the “Taco” wallet owned by McCaleb now has only 96.19 million XRP tokens.

Jed McCaleb’s XRP holdings

The co-founder has been offloading roughly 3 to 7 million XRP tokens every single day, which serves as a major source of selling pressure that has been present since 2014 when the deal was first struck.

A few more weeks will see this wallet go to zero, which will remove a massive amount of selling pressure from the ecosystem. From a supply-demand perspective, this is a significant development that will favor the bulls.

XRP price recovery remains healthy

XRP price shows strength after recently flipping the $0.340 hurdle into a support floor. To further add credence to the upswing, the following pullback bounced off the said barrier. As a result, investors can expect the recovery rally to continue.

While the recent move is without a doubt bullish, market participants need to note that the XRP price will face a confluence at $0.380, which comprises a horizontal resistance barrier at the 34-day Exponential Moving Average (EMA).

Hence, overcoming this hurdle will be key in triggering further ascent to a high-time-frame resistance barrier at $0.439. This is likely where the upside is capped for XRP price and will constitute a 25% gain from the current position at $0.349.

In some cases, where the sidelined buyers step in due to FOMO, it could potentially flip the $0.439 blockade into a foothold. Such a move could open the path for XRP price to retest the 100-day EMA at $0.508 or the subsequent high-time-frame resistance barrier at $0.639. Interestingly, this level coincides with the 200-day EMA, making it the short-to-mid-term target for the remittance token.

XRP/USDT 1-day chart

While things are looking up for XRP price, a daily candlestick close below $0.340 will flip the support level into a resistance barrier. This would mean that the efforts and rallies between June 18 and June 24 were undone.

This development will invalidate the bullish thesis for the remittance token and potentially trigger a 5% decline to the $0.322 support level for XRP price.

SEC v. Ripple: The wild card

The SEC has been battling against Ripple since December 2020. After multiple jabs and back and forths, it seems that the defendants have the upper hand.

John E Deaton, the founder of Crypto Law US, tweeted recently that Gary Gensler, the Chairman of the Securities and Exchange Commission (SEC) is likely to settle.

He added,

It’s logical: take a win while you can. It could have the opposite affect: roll the for a win to say “see we were right.

Ben Armstrong, another popular Crypto YouTuber tweeted,

They already tried to settle and Ripple said no. They are going for the jugular.

If Ripple comes out on top of this lawsuit, it would be a historic win for not just Ripple or the crypto ecosystem, but it would also help propel XRP price.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Cardano stabilizes near $0.62 after Trump’s 90-day tariff pause-led surge

Cardano stabilizes around $0.62 on Thursday after a sharp recovery the previous day, triggered by US Donald Trump’s decision to pause tariffs for 90 days except for China and other countries that had retaliated against the reciprocal tariffs announced on April 2.

Solana signals bullish breakout as Huma Finance 2.0 launches on the network

Solana retests falling wedge pattern resistance as a 30% breakout looms. Huma Finance 2.0 joins the Solana DeFi ecosystem, allowing access to stable, real yield. A neutral RSI and macroeconomic uncertainty due to US President Donald Trump’s tariff policy could limit SOL’s rebound.

Bitcoin stabilizes around $82,000, Dead-Cat bounce or trendline breakout

Bitcoin (BTC) price stabilizes at around $82,000 on Thursday after recovering 8.25% the previous day. US President Donald Trump's announcement of a 90-day tariff pause on Wednesday triggered a sharp recovery in the crypto market.

Top 3 gainers Flare, Ondo and Bittensor: Will altcoins outperform Bitcoin after Trump's tariff pause?

Altcoins led by Flare, Ondo and Bittensor surge on Thursday as markets welcome President Trump's tariff pause. Bitcoin rally falters as traders quickly book profits amid Trump's constantly changing tariff policy.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.