Forget about the crypto winter; Bitcoin price readies to kick start the summer rally

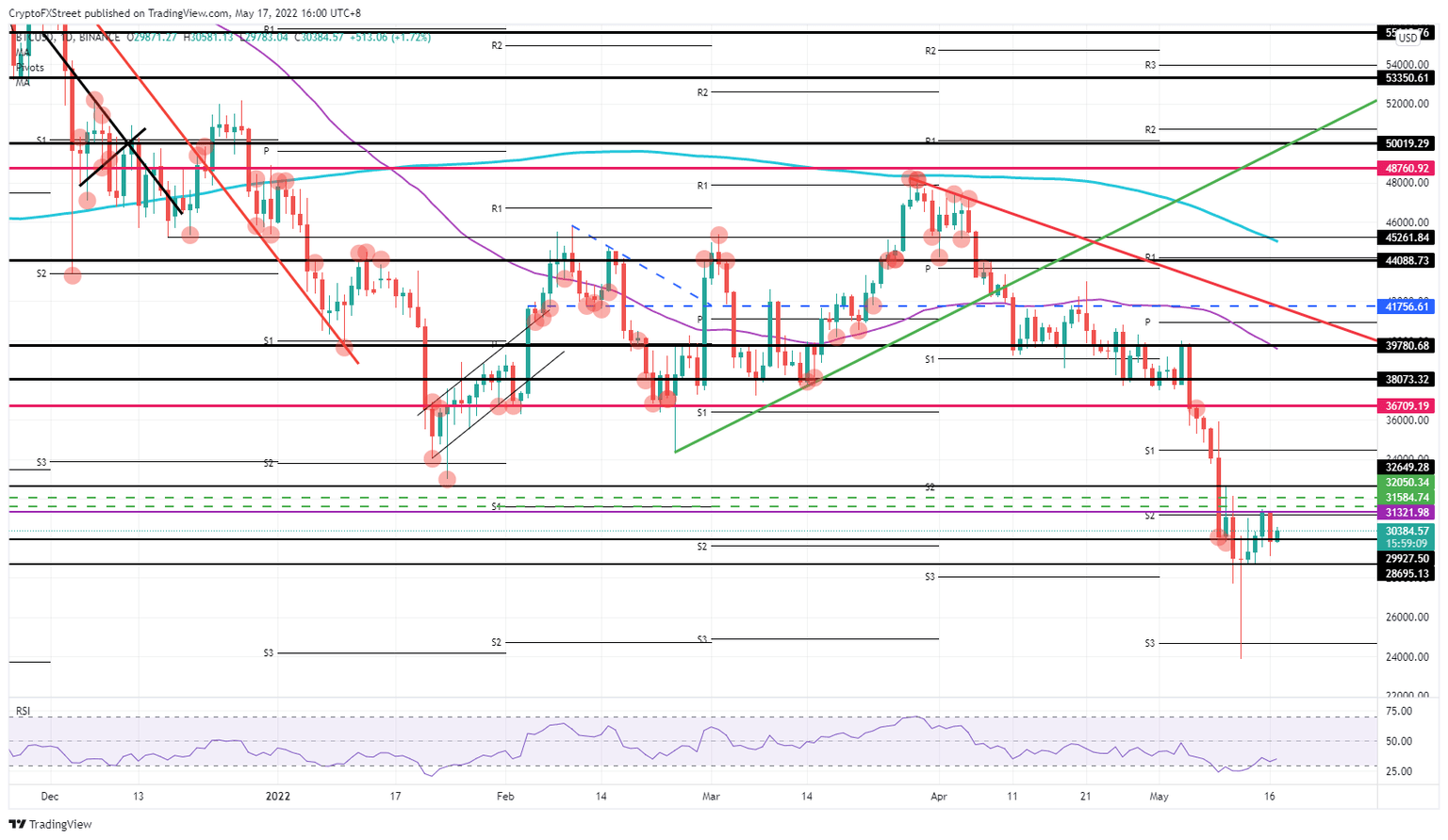

- Bitcoin price sees bulls popping back above $30,000 as it reclaims an important psychological area.

- BTC price is set to break above the high of last week and could rally to $36,709.19 by the end of this week.

- Expect to see a continuing rally with all stars aligned towards $44,088.73.

Bitcoin (BTC) price sees bulls returning to the scene to pick up the pieces from the scattered BTC price that saw slaughter in the past trading days. BTC price quoting at a lucrative discount has made the asset attractive for cherry-picking traders and investors. With the Relative Strength Index (RSI) showing that Bitcoin still has a heartbeat, expect to see a full recovery towards $45,261, claiming back some critical levels in the process.

BTC price set for complete recovery as heartbeat strengthens on the RSI

Bitcoin price is showing signs of recovery after it took a beating for over two whole trading weeks. The most significant catalyst in that case was the dollar and its impact on BTC price. With the balance outweighing, in favour of the mighty dollar, BTC price is currently trading at a very nice discount. Should Bitcoin price drop below $30,000 somewhere this week, expect it to be scooped up quite rapidly and to quickly trade higher as the RSI is leaving the oversold area, proving that demand is there.

BTC price thus sees investors and traders returning after a short hiatus as the dust settles over a few risk events, and some tail risks have gotten deflated. Hand in hand with that, the dollar is backing off, allowing some room for Bitcoin price to trade higher, with $36,709.19 acting as a line in the sand for this week. In case we see a weekly close above there, expect to see a rally next week towards $45,261.84, on the way up to the 200-day Simple Moving Average.

BTC/USD daily chart

Investors could be hesitant to pick up BTC prices after the image of cryptocurrencies got dented last week with Terra’s LUNA crash. Lack of interest could trigger a rejection at the first big hurdle at $31,321.98. Bears will probably use that level as entry to push price action back down and break below $30,000.00 again. As the price trades sideways, the risk is that interest fades and BTC price slips below $28,695 to test $24,000 to the downside.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.