- The minutes from the June 13-14 meeting of the Federal Open Market Committee suggested inflation is expected to fall back to 2% – but not until 2025.

- Almost all of the officials of the Committee, in their projection, noted additional rate increases would be appropriate in 2023.

- Bitcoin price, along with the rest of the market, did not react significantly with the digital asset trading at $30,560.

The Federal Open Market Committee (FOMC), during their last meeting on June 13-14, decided to pause hiking rates after ten consecutive raises. The decision was taken partly out of concern for tightening credit conditions and to wait and see the effect of past policy measures. Despite the pause, the minutes show most members foresee the need for at least one more rate hike before the Fed is ‘done’

As far as the Big Crypto goes, the release only caused a slight uptick in BTC price, which continues to churn at around the $30,500 level.

Some of the highlights from the FOMC minutes:-

- Almost all members of the Committee favored holding the rates steady at the June meeting.

- All bar two of the 18 officials noted in the Summary of Economic Projections (SEP) that additional rate increases would be appropriate in 2023.

- Staff still see a mild recession later this year, followed by a moderately paced recovery.

During the meeting, the FOMC also discussed inflation and stated,

“Reflecting the effects of the easing in resource utilization over the projection, core inflation was forecast to slow through next year but remain moderately above 2 percent. In 2025, both total and core PCE price inflation were expected to be close to 2 percent.

The recent meeting of the FOMC made headlines after the Federal Reserve hit the pause button on ongoing rate hikes. The month of June was the first to notice no increase in interest rates after ten consecutive rate hikes in the span of 15 months.

The Fed was seeking to achieve maximum employment and inflation at a rate of 2% over the longer run. In order to make this happen, the Fed refrained from increasing the interest rate stating,

“In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 5 to 5-1/4 percent. Holding the target range steady at this meeting allows the Committee to assess additional information and its implications for monetary policy.

However, in subsequent speeches, Federal Reserve Chair Jerome Powell noted that two more rate hikes are likely necessary this year. These hikes would allow the central bank to bring the inflation rate down to the current 2% target.

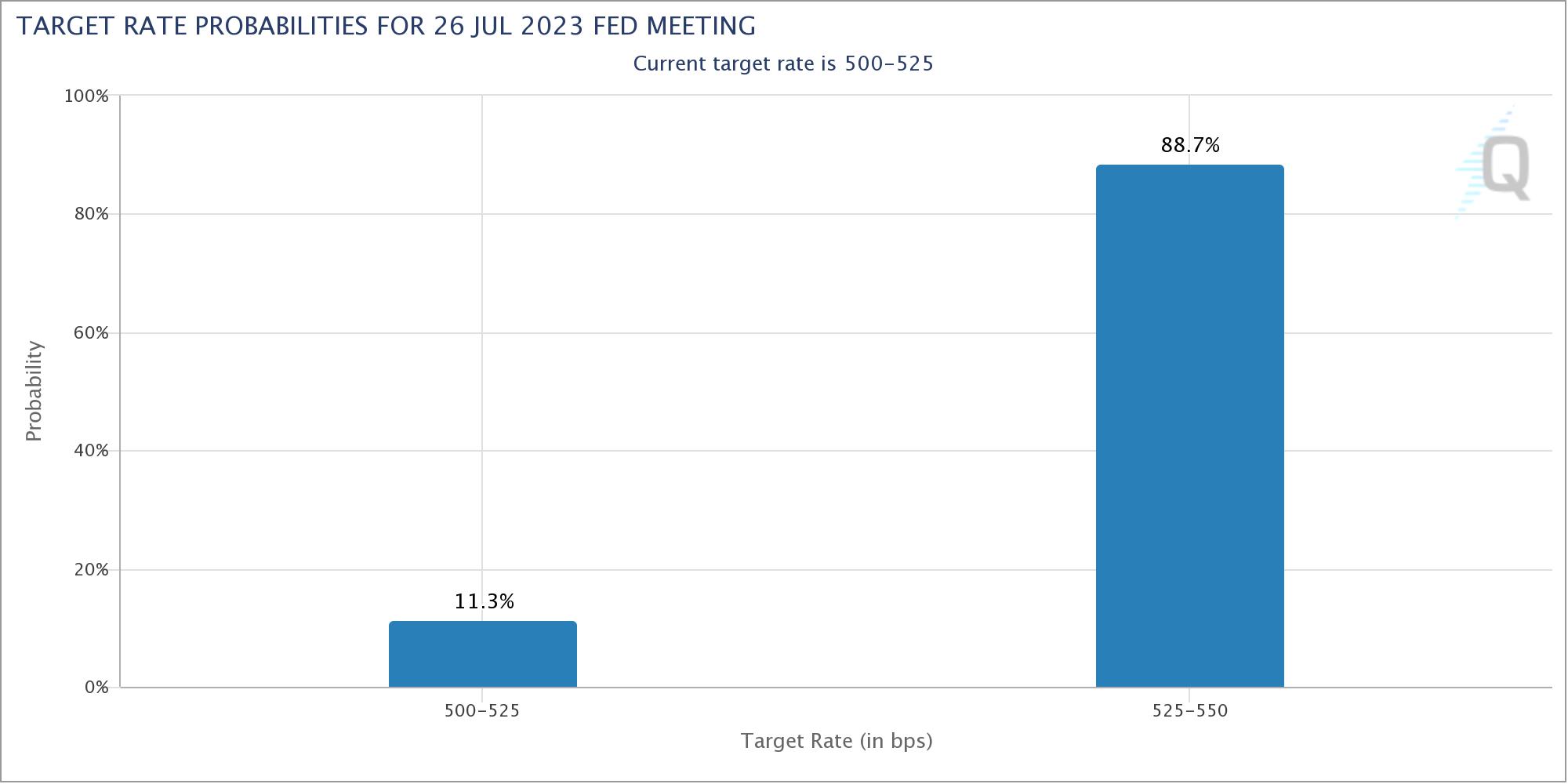

At the time of writing, the CME FedWatch tool is suggesting an 88.7% chance of the Fed raising interest rates by 25 basis points (bps) during the next meeting set to be held on July 26. This probability has only been increasing since the last meeting, and over the past week, the possibility has risen by 7%.

Rate hike probability

Thus the next meeting could very possibly result in the target rate rising to 5.25% - 5.50%. Naturally, this will also impact Bitcoin price, which has been rather well for the past few weeks.

Bitcoin price notes a neutral reaction

Following the release of the FOMC minutes, Bitcoin price observed a 0.11% rise. The cryptocurrency could be seen trading at $30,560 at the time of writing, keeping above the $30,000 mark.

BTC/USD 1-day chart

Altcoins did not observe much change either, with Ethereum price standing at $1,912. XRP price remained unchanged in the last hour, bringing the altcoin to trade at $0.476. Similarly, Cardano price also did not observe the change in the market price trading at $0.284.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto fraud soars as high-risk addresses on Ethereum, TRON networks receive $278 billion

The cryptocurrency industry is growing across multiple facets, including tokenized real-world assets, futures and spot ETFs, stablecoins, Artificial Intelligence (AI), and its convergence with blockchain technology, as well as the dynamic decentralized finance (DeFi) sector.

Bitcoin eyes $100,000 amid Arizona Reserve plans, corporate demand, ETF inflows

Bitcoin price is stabilizing around $95,000 at the time of writing on Tuesday, and a breakout suggests a rally toward $100,000. The institutional and corporate demand supports a bullish thesis, as US spot ETFs recorded an inflow of $591.29 million on Monday, continuing the trend since April 17.

Meme coins to watch as Bitcoin price steadies

Bitcoin price hovers around $95,000, supported by continued spot BTC ETFs’ inflows. Trump Official is a key meme coin to watch ahead of a stakeholder dinner to be attended by President Donald Trump. Dogwifhat price is up 47% in April and looks set to post its first positive monthly returns this year.

Cardano Lace Wallet integrates Bitcoin, boosting cross-chain capabilities

Cardano co-founder Charles Hoskinson announced Monday that Bitcoin is integrated into the Lace Wallet, expanding Cardano’s ecosystem and cross-chain capabilities. This integration enables users to manage BTC alongside Cardano assets, providing support for multichain functionality.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.