Flow Price Prediction: FLOW coils up before 55% rally

- Flow price edges closer to breaching the cup and handle setup.

- The technical formation forecasts a 55% breakout rally to $1.44.

- A three-day candlestick below $0.69 will create a lower low and invalidate the bullish thesis.

Flow (FLOW) price has been consolidating for nearly 300 days below a critical hurdle. During its sideways movement, FLOW has formed a bullish pattern that awaits a swift move to the upside.

Also read: Week Ahead: Bitcoin inches closer to $50,000, altcoins likely to explode

Flow price edges closer to breakout

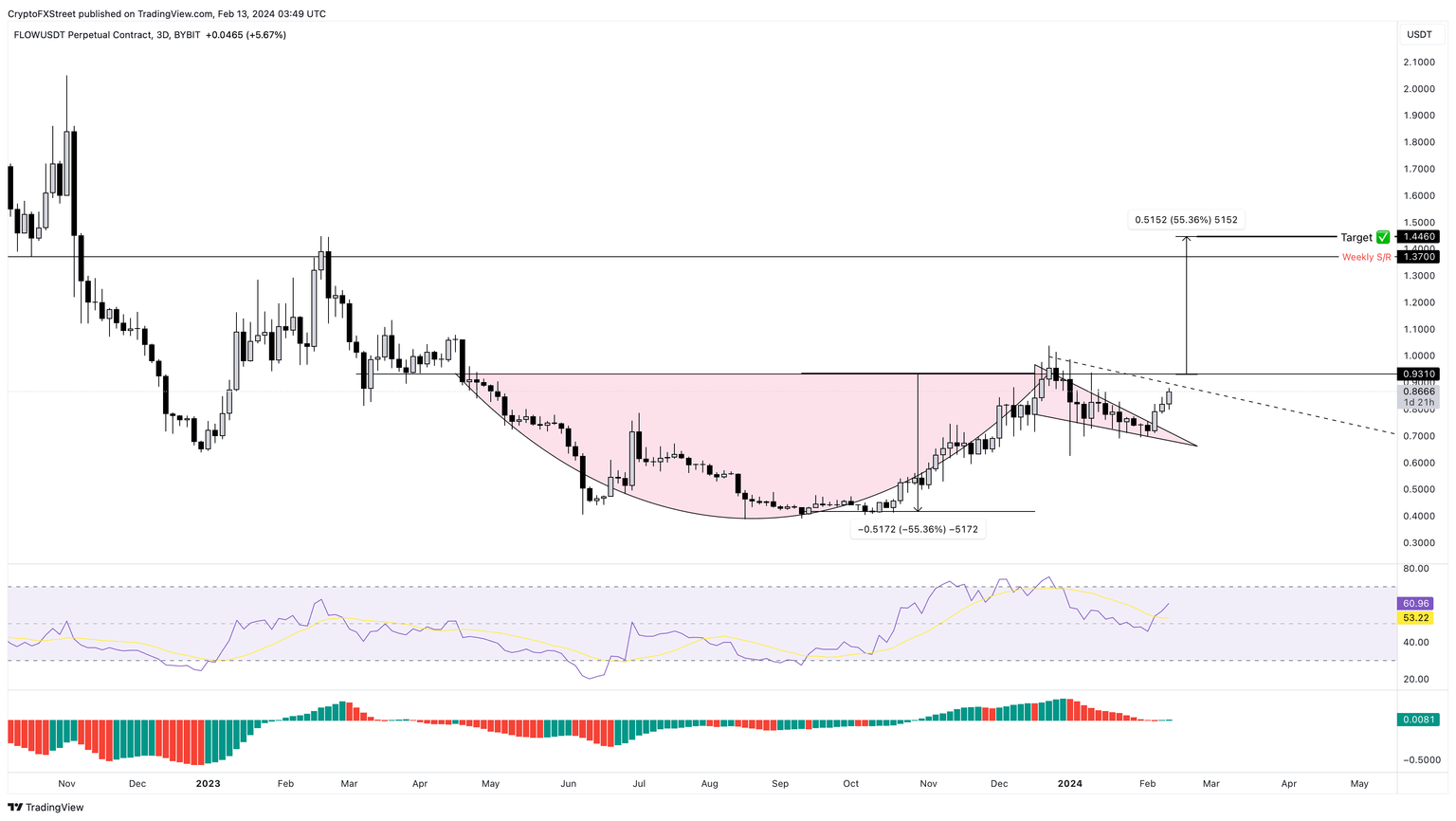

Flow price slipped below the $0.93 support level on April 19, 2023, and has been trading below it ever since, leading to a cup and handle setup. This technical formation contains a rounded bottom followed by a small consolidation below a horizontal resistance level.

For Flow price, the eight-month consolidation below $0.93 formed the rounded bottom. The consolidation that occurred in the form of a falling wedge right after is the handle. The breakout from the falling wedge has kickstarted a bounce that is fast approaching the breakout level of $0.93.

The technical formation forecasts a 55% upswing to $1.44, which is obtained by adding the distance between the horizontal resistance level and the bottom of the rounded bottom to the breakout point of $0.93.

Read more: Dogecoin price eyes double digit gains as DOGE bulls make a comeback

FLOW/USDT 3-day chart

While the optimistic outlook for Flow price is dependent on a successful breakout, investors need to pay close attention to $0.93. Rejection at this level could send FLOW spiraling lower. Under these conditions, if the altcoin produces a three-day candlestick below $0.69, it will create a lower low and invalidate the bullish thesis. Following this development, Flow price could slide 10% and revisit the January 1 low at $0.62.

Alos read: Avalanche price could reclaim $50.00 with AVAX Durango upgrade on Fuji testnet

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.