- Floki price is approaching the bottom of the rising trendline, a key support level from which it is likely to rebound.

- On-chain data suggests that FLOKI’s development activity is rising, a bullish sign.

- A daily candlestick close below $0.000193 would invalidate the bullish thesis.

Floki (FLOKI) price could experience a nearly 30% rebound in the short-to-medium term, according to technical indicators and on-chain metrics, as the meme coin heads towards a key level that has previously acted as a support and amid a rise in development activity.

Floki price seems set for liquidity sweep

Floki price crashed more than 10% on Tuesday as it broke its previous support level at $0.000258. Currently, its price is heading towards the bottom of the rising trend line, which has previously acted as support.

Floki price – and more broadly, the cryptocurrency market – is likely to be volatile ahead of today's US Consumer Price Index (CPI) release for May and the US Federal Reserve (Fed) decision on interest rates. These key events for financial markets could trigger Floki to sweep out buy-side liquidity before rallying upside.

- In such a scenario, Floki could first crash up to 14% from its current price level of $0.000233 to find support on the following levels.

- The support zone extending between $0.000221 and $0.000211.

The 61.8% Fibonacci retracement level at $0.000201, drawn from a swing low of $0.000110 on April 13 to a swing high of $0.000348 on June 5, which roughly coincides with the rising trendline.

If FLOKI bounces off $0.000201, it could rally 29% to reach its previous resistance level of $0.000258.

If the overall crypto market outlook is positive due to favorable US economic data release, Floki could extend the rally to its next resistance level at $0.0.000348, constituting an additional 35% gain.

FlOKI/USDT 4-hour chart

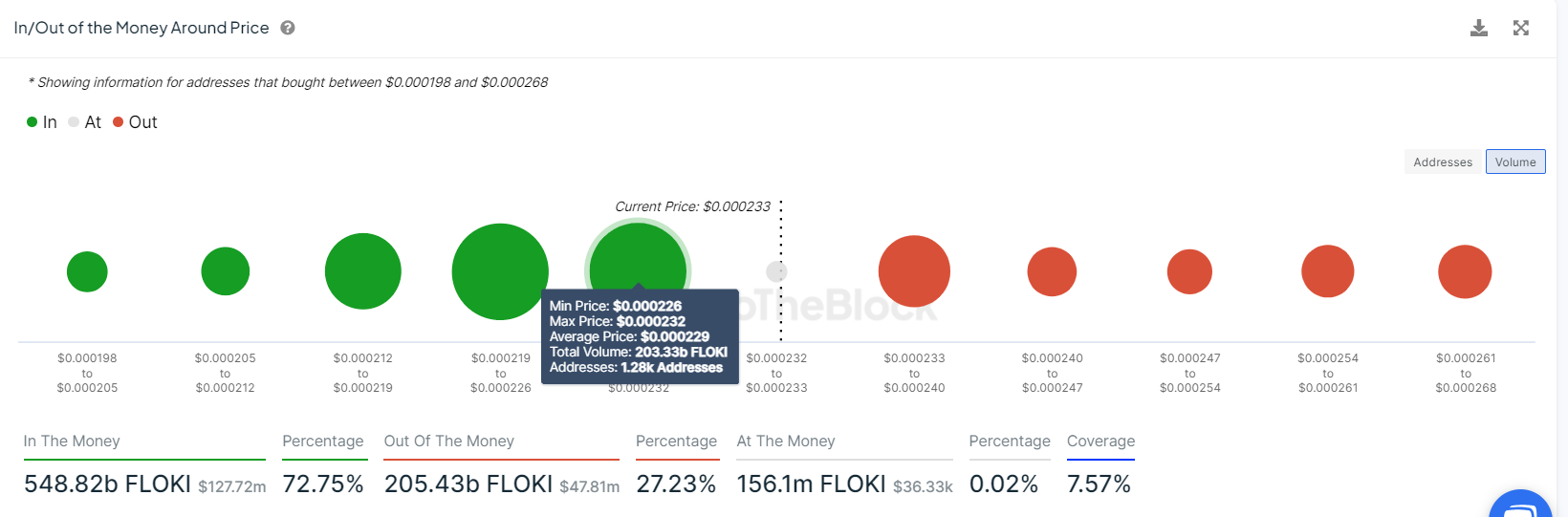

Based on IntoTheBlock's In/Out of the Money Map (IOMAP), nearly 1,280 addresses accumulated 203.33 billion FLOKI tokens between $0.000226 and $0.000232, making this area a key support zone.

Interestingly, the $0.000221 to $0.000211 zone mentioned from a technical analysis perspective coincides with the IOMAP findings, making this zone a key reversal zone to watch.

FLOKI IOMAP chart

Santiment’s Development Activity metric tracks the frequency of project development events recorded in the public GitHub repository over time.

A rise in this metric usually suggests continuous endeavors to uphold, innovate, and improve the protocol, which is generally seen as favorable by investors and stakeholders. Conversely, a decline in the metric might raise apprehensions about the project's endurance, capacity for innovation, and engagement with the community in the foreseeable future.

As in Floki’s case, the index rose from 0.476 on June 6 to 0.714 on June 11. The 50% rise in Floki's Developing Activity adds further credence to the bullish outlook.

%20[10.41.04,%2012%20Jun,%202024]-638537743252786907.png)

FLOKI Development Activity chart

Despite the bullish thesis signaled by both on-chain data and technical analysis, if the FLOKI daily candlestick closes below the May 20 low at $0.000189, the outlook will shift to bearish. This scenario could lead to a 16% crash to $0.000159, the swing low of May 13.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.