Floki Inu price ready to retest $0.000200; Successful bulls would aim higher for $0.000225

- Floki Inu price has tested moves towards new all-time lows.

- Thus far, the $0.000120 value area has held as a strong support level.

- A retest of $0.000200 likely if bears unable to breach support.

Floki Inu price continues to trade in a direction it has traded since its inception: lower. However, some developing evidence may limit how much of a decrease FLOKI might experience.

Floki Inu price establishing new floor, bulls must hold it to prevent any future collapse

Floki Inu price has thus far spent December testing a support level in the $0.000120 value area. Bears have consistently tested this range but have yet to create a sustained move through that zone. Floki Inu has held that zone while its peers have suffered major price collapses is a bullish signal.

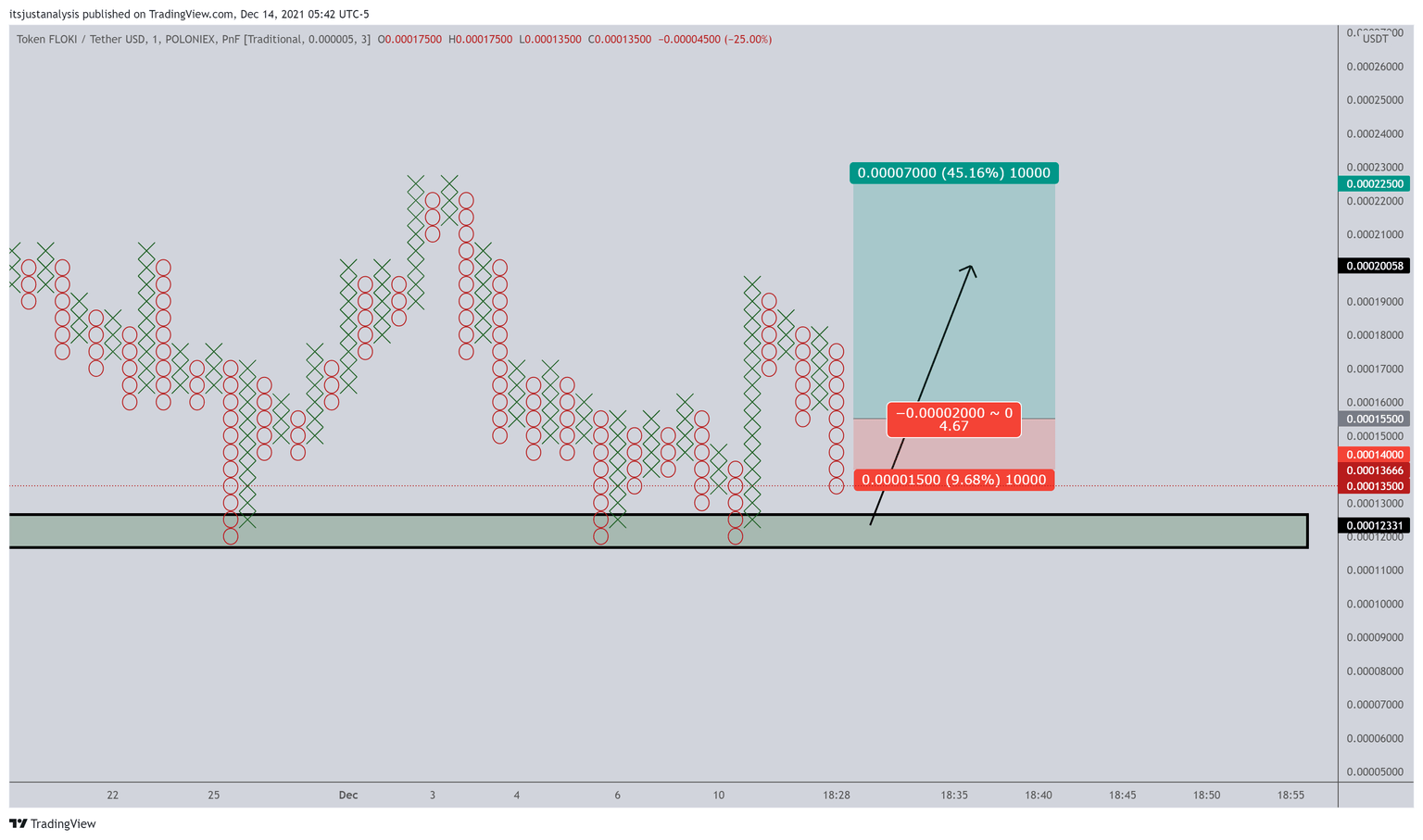

The current O’s column on the $0.000005/3-box Reversal Point and Figure chart represents the fifth attempt to breach the $0.000120 support zone. In addition, the column describes a Pole Pattern in Point and Figure analysis and presents a hypothetical buy opportunity for Floki Inu.

The entry on a Pole Pattern is when price has moved 50% of the range of the last column – in this case, the current O-column. However, note that the hypothetical entry remains dynamic and would adjust lower if price moves lower because this O-column has not had a retracement yet.

The hypothetical long entry is a buy stop at $0.000155, a stop loss at $0.000135, and a profit target at $0.000225. This trade idea represents a 4.67:1 reward to risk ratio. A trailing stop of two to three boxes would help protect any implied profit post entry.

FLOKI/USDT $0.000005/3-box Reversal Point and Figure Chart

Downside momentum and pressure are still a concern. Despite Floki Inu price showing resilience near the $0.000120 value area, a breakdown below that level will likely add another zero to Floki Inu as it pushes lower to the $0.000080 zone.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.