Floki Inu price rallying by 50% triggers investors’ interests, lives up to the “meme coin standard”

- Floki Inu price, on April 24, noted the second biggest single-day rally of the year.

- FLOKI holders that had been absent from participating on the network emerged and conducted transactions worth $20 million.

- The rally also revived the whales that only appear during moments of rallies to book profits.

Floki Inu price, unlike the rest of the altcoins, had a rather stellar reaction to the news of a crucial development of the cryptocurrency. In response, FLOKI holders pulled a move that has now become a meme coin standard where investors only appear when it is beneficial for them, essentially leaving the token to fend for itself.

Floki Inu price brings back its holders to life

Floki Inu price noted a 55% rally on April 24 following the announcement of its listing on Binance.US. The reaction to this news led to FLOKI marking the second biggest single-day rise this year, which was soon followed by a 16.44% crash the very next day, bringing the meme coin to trade at $0.00003654.

FLOKI/USD 1-day chart

However, for the brief period of the rally, Floki Inu noted something rather unusual - the presence of its investors on the network. The rapid emergence of multiple meme/shit coins was solely due to the trend generated by the likes of Dogecoin and Shiba Inu. While this trend did entice investors to invest in these tokens, it failed to secure their loyalty.

As a result, most of the meme/shit coin holders only make an appearance or conduct a transaction when it is profitable to them and hold no concern for the token. Consequently, rallies worth 55% and crashes running up to 25% are observed in a single day. This has become the "meme coin standard" when it comes to investors.

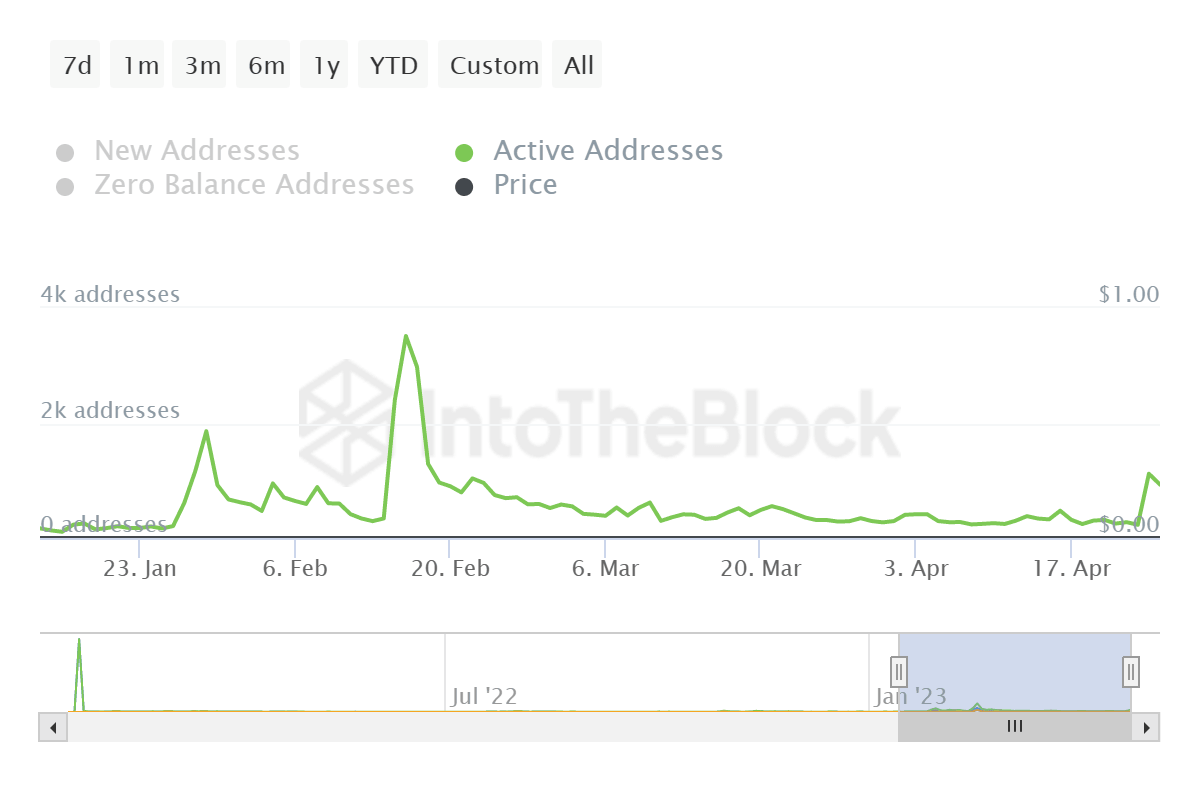

Similarly, on April 24, Floki Inu observed a sudden surge in active addresses. Investor participation increased by 339% from an average of 250 to 1,125 within 24 hours. The last time these many investors were active at the same time was in February.

Floki Inu active addresses

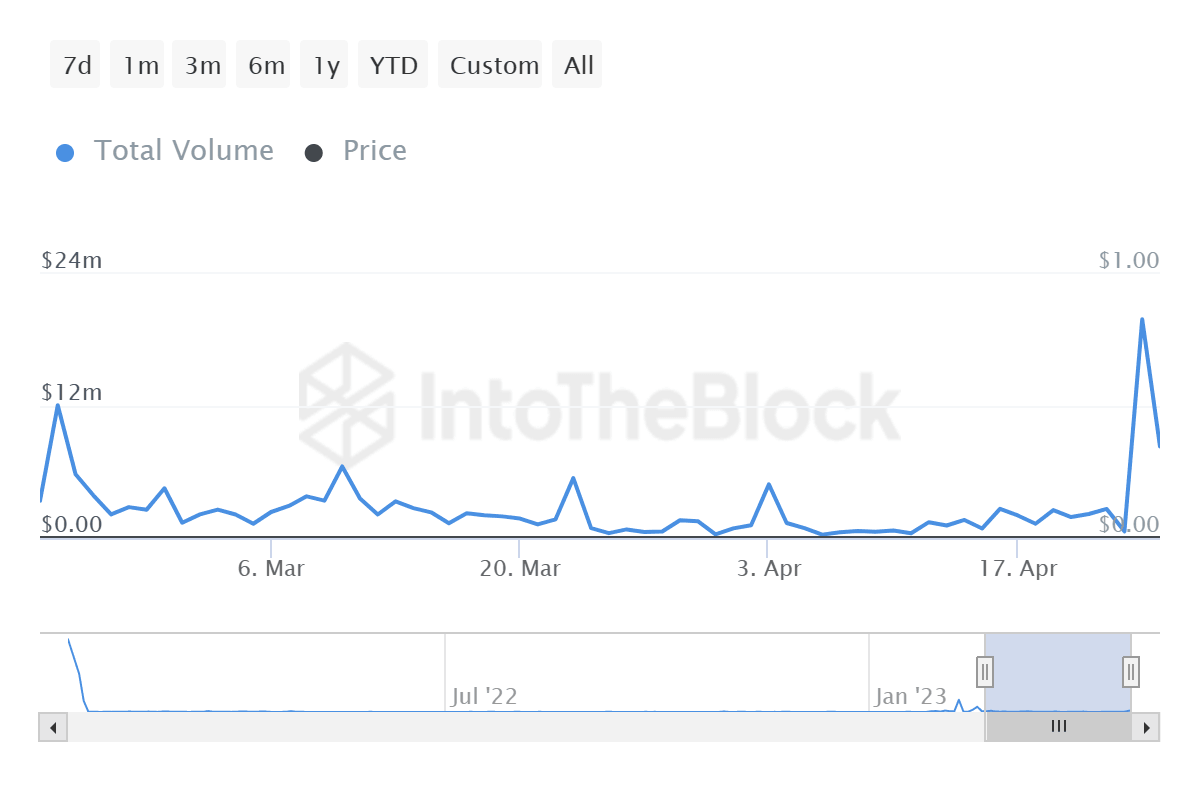

The presence of these FLOKI holders resulted in an increase in the total volume transacted on the day, touching the high of $20 million. Out of the total volume, about a quarter of the transactions worth around $5.1 million were conducted by large wallet holders majority of which were whales.

Floki Inu transaction volume

Not too long after the rally came to an end, these investors returned to their normal state and are expected to emerge again only when Floki Inu price marks a green candle on the charts.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.