- Floki Inu price has been consolidated for nearly a month, trading at $0.00003378.

- FLOKI holders have been absent on-chain as the active addresses ratio stood at 0.45%.

- Floki Inu will eventually lose its only upper hand of being a meme token as investors move away from the trend.

Floki Inu has kept its head down, charting no growth but simply moving sideways for the last month. While investors are hoping this is the build-up before FLOKI marks a recovery to yearly highs, the meme coin might not be able to do so primarily because these very investors are the reasons for the lack of a rally.

Floki Inu price needs a push

Floki Inu price has been consolidated within the $0.00004112 and $0.00003235 range since mid-March. The upper and lower range has been tested as resistance and support levels multiple times now, but the meme coin is still not observing any growth despite the broader market still maintaining a bullish tone.

FLOKI/USD 1-day chart

One of the reasons behind this is the fact that Floki Inu holders lack genuine commitment. While broader market cues do have a major impact on price action, investor participation plays an equally important role. And in the case of Floki Inu, this participation has been significantly low.

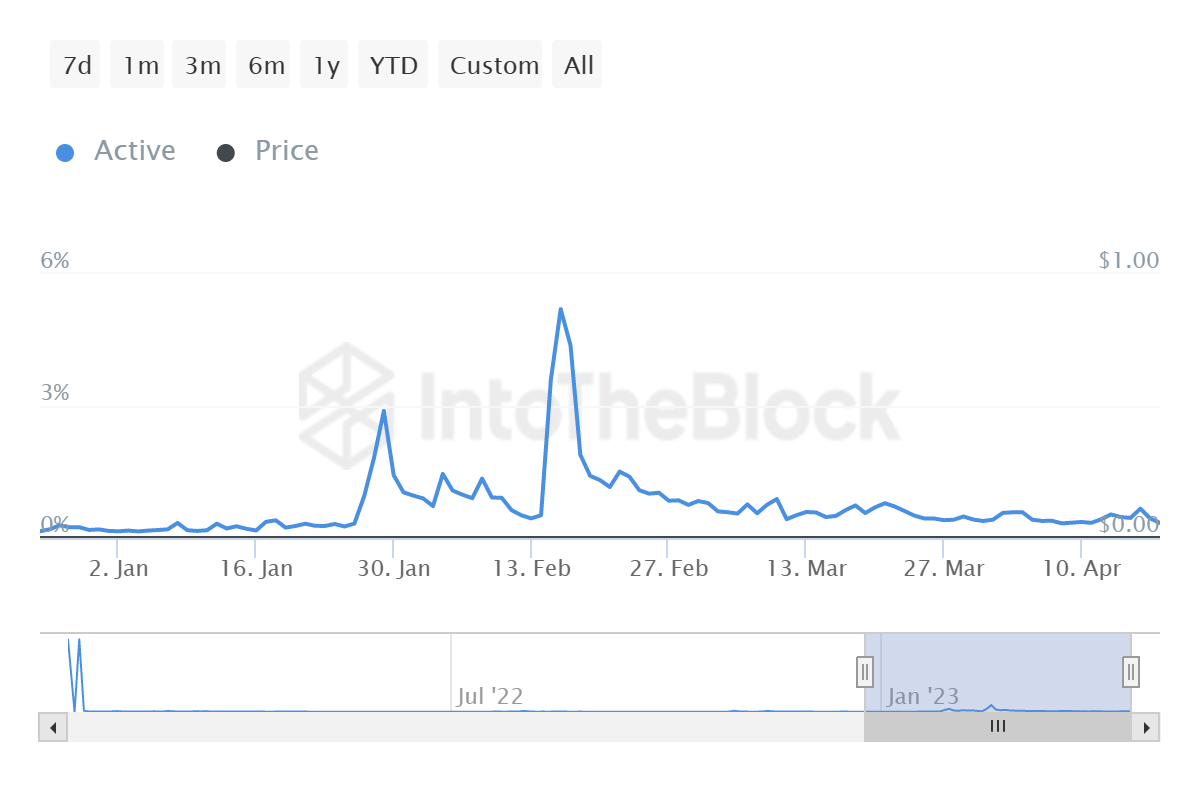

The active addresses ratio has been hovering around the 0.23% to 0.45% range. This metric shows the number of active addresses on the chain in a day in comparison to the total number of addresses with a balance in existence.

While a 5% range is typically observed even for large market cap tokens, anything below 1% suggests a lack of earnestness at the hands of investors.

Floki Inu active address ratio

The only spike noticed in this regard is during broader market rallies that pushed FLOKI’s price up as well. This further suggests that altcoin holders only become active when there is an incentive, i.e., they are only in it for the money.

This is also verified by the fact that during times of relatively lower volatility, Floki Inu’s network growth declines. The network adoption reduction indicates that the number of new addresses forming on the network is low due to the project noting no traction.

Floki Inu adoption

Thus, the only driving factor when it comes to meme coins is the moment when either Dogecoin, Shiba Inu or Elon Musk are trending or when the rest of the market led by Bitcoin is painting green on the charts. However, eventually, the meme coin hype will die out, and the likes of Floki Inu could suffer at the hands of its own investors if the participation stays low.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH and XRP stabilize as SEC Crypto Task Force prepares for First roundtable discussion

Bitcoin (BTC) price hovers around $84,500 on Friday after recovering nearly 3% so far this week. Ethereum (ETH) and Ripple (XRP) find support around their key levels, suggesting a recovery on their cards.

XRP sees growing investor confidence following SEC ending legal battle against Ripple

Ripple's XRP trades near $2.43 on Thursday after seeing a rejection at the $2.60 resistance. The remittance-based token has seen a 400% growth in network activity since the beginning of March. The growth may continue, considering the SEC recently dropped its appeal against Ripple.

SEC confirms Proof-of-Work crypto mining doesn't fall under securities laws

The Securities & Exchange Commission's (SEC) Division of Corporation Finance released a statement on Thursday clarifying its position on proof-of-work (PoW) crypto mining.

Swiss National Bank rejects Bitcoin reserve proposal

Swiss National Bank has rejected a proposal to adopt Bitcoin as a reserve asset, citing concerns over volatility, security, and liquidity.

Bitcoin: BTC at risk of $75,000 reversal as Trump’s trade war overshadows US easing inflation

Bitcoin price remained constrained within a tight 8% channel between $76,000 and $84,472 this week. With conflicting market catalysts preventing prolonged directional swings, here are key factors that moved BTC prices this week, as well as key indicators to watch in the weeks ahead.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

%20[02.23.59,%2020%20Apr,%202023]-638175382794457220.png)