Floki Inu price could rally 30% ahead of this FLOKI announcement

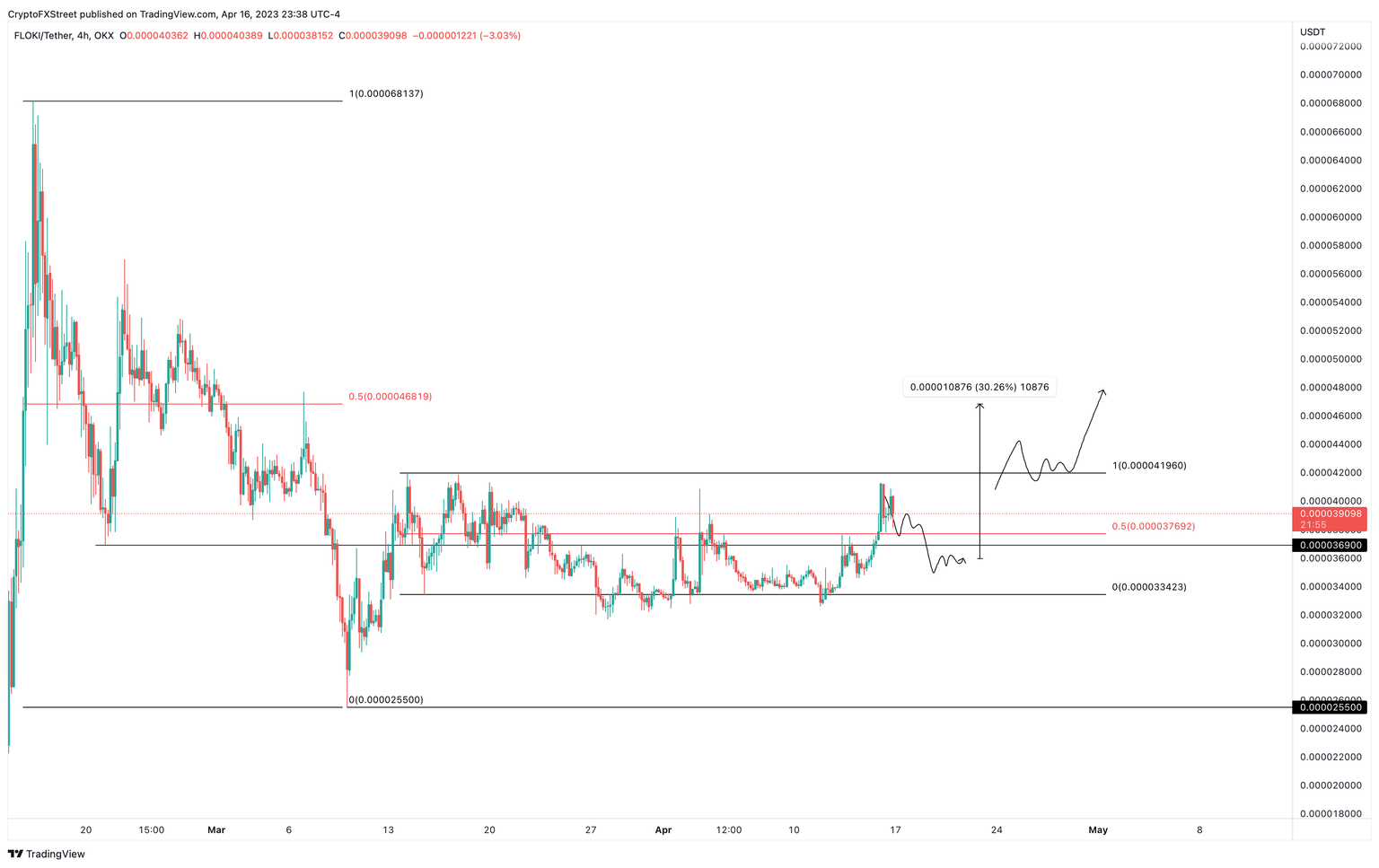

- Floki Inu price shows a tight consolidation between the $0.0000419 to 0.0000334 range.

- A minor retracement could provide an accumulation opportunity for FLOKI holders before skyrocketing 30% to $0.0000468.

- A four-hour candlestick close below the $0.0000334 level will invalidate the bullish thesis.

Floki Inu (FLOKI) price has been moving sideways, trading inside a range for more than a month. This situation could change quickly for FLOKI holders after the recent run-up that retested the range high.

Additionally, the official Twitter account of Floki Inu noted that there will be a special announcement on April 17 at 6 PM UTC. This news could be the catalyst that will determine where FLOKI will head next.

#Flokish news coming! Join us on Twitch for a special announcement on Monday, April 17th at 6pm UTC.

— FLOKI (@RealFlokiInu) April 12, 2023

Follow https://t.co/kxhbIQHZGP to make sure you don't miss it! pic.twitter.com/tF4S1Umrlh

Read more: Floki Inu could witness a 17% upswing with latest FLOKI exchange listing

Floki Inu price ready to make hay while the sun shines

Floki Inu price rallied 230% between February 13 and 16, setting up a local top at $0.0000681. This bullish move was immediately followed by a retracement as investors rushed to book profits, resulting in a 62% retracement.

As Floki Inu price attempted a recovery, the altcoin was forced into a rangebound movement, where it currently trades. This range extends from $0.0000419 to $0.0000334 and the recent spurt in bullish momentum pushed FLOKI to attempt a retest of the range high.

Investors can expect one of two things to occur for Floki Inu price going forward - a retracement or a continuation of the uptrend. A pullback to the $0.0000359 level gives a chance to reaccumulate. If this move does manifest, investors need to wait for a flip of the range high at $0.000419. A successful development could see FLOKI tag the midpoint of the 62% crash at $0.000468.

In total, this move for Floki Inu price would constitute a 30% gain.

FLOKI/USDT 4-hour chart

While the outlook for Floki Inu price seems optimistic, investors need to pay attention to Bitcoin price, which could ruin the party. In the case that BTC retraces, it will take weak altcoins with it. Hence, a retracement could be in the works for FLOKI, but if this correction produces a four-hour candlestick close below the $0.0000334 level, it will invalidate the bullish thesis.

In such a case, Floki Inu price could crash 23% to tag the $0.0000255 support floor.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.