- Floki Inu price is currently trading at $0.000033, facing a key barrier at $0.000035 in the form of a 50-day EMA.

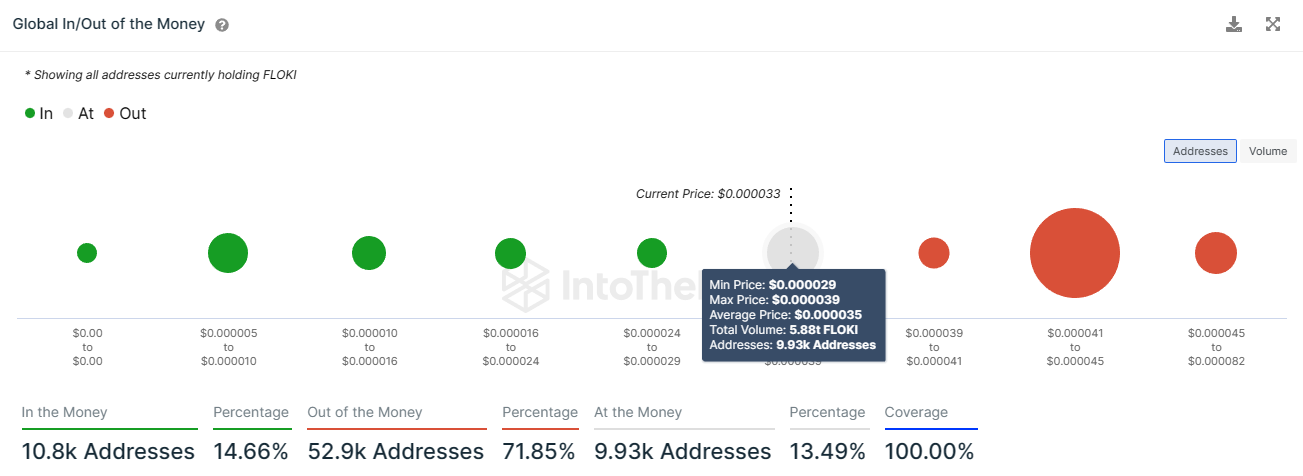

- At the same price level stands a demand wall of almost six trillion FLOKI worth $205 million.

- The MVRV ratio shows FLOKI is in the opportunity zone; investors are likely to hold off selling.

Floki Inu price has been straying away from broader market cues, charting its own path without following cues from Bitcoin or Dogecoin. This fluctuation of price has left a significant portion of the supply in limbo, which, when turned into profits, could potentially push the price up.

Floki Inu price needs to go against the odds

Floki Inu price trading at $0.0000033 is observing rather negative signs at the moment, with the price indicators all signaling a potential decline in price. The Relative Strength Index (RSI) is in the bearish zone, just under the neutral line at 50.0.

At the same time, the Moving Average Convergence Divergence (MACD) is also observing a bearish crossover, with the signal line (red) crossing over the MACD line (blue).

However, Floki Inu price is still standing above the 100-day Exponential Moving Average (EMA), which has been acting as a support level throughout the month. As long as this support level is maintained, FLOKI has the potential to breach the resistance level at $0.000035 coinciding with the 50-day EMA.

FLOKI/USD 1-day chart

This point also marks the average price at which more than 5.88 trillion FLOKI worth $205 million was purchased. The almost 10,000 addresses that bought these tokens are patiently waiting for the supply to turn profitable.

Floki Inu GIOM

Looking at the Market Value to Realized Value (MVRV) ratio, the meme coin does have the potential to rise to the aforementioned resistance level. This potential is due to the indicator sitting in the opportunity zone, which is marked by the presence of an MVRV ratio below -10%.

This zone has historically been synonymous with recoveries since investors are generally underwater at this time. Thus to prevent losses, they hold on to their assets that act in favor of a price rise.

Floki Inu MVRV ratio

Although once this happens, Floki Inu price could be susceptible to profit-taking and could then take a hit. Until then, the meme coin would have the opportunity to rally back to April 2023 highs of $0.000044.

If this fails to happen and bearish cues intensify even before the demand wall is breached, Floki Inu price could decline to $0.000030 and beyond.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH and XRP struggle despite Trump’s Bitcoin Reserve order

Bitcoin price extends its decline, trading around $87,000 on Friday after falling more than 7% so far this week. Ethereum and Ripple prices declined nearly 15% and 16% respectively despite Trump signing an executive order to create the US Strategic Bitcoin Reserve on Thursday.

Litecoin price tumbles below $100 as XRP and ADA take center stage for White House Summit

Litecoin price dipped below the $100 mark on Thursday, losing 22% in the past week as markets reacted to updates to US trade tariffs and speculation surrounding White House Crypto Summit to be held on Friday.

Bitcoin News Today: President Trump confirms new BTC policy, Sacks blames Democrats for 195,000 BTC sell-off

Bitcoin price dipped 5% to hit $85,000 on Monday as skittish sentiment around US Trade policy and Non-Farm Payrolls data introduced fresh volatility ahead of the White House Crypto Summit. However, a recent Bitcoin Strategic reserve announcement from Trump's Crypto Czar David Sacks could spark more gains.

Trump signs executive order to create US Strategic Bitcoin Reserve as crypto summit attracts top industry leaders

AI and Crypto Czar David Sacks confirmed on Thursday President Trump's executive order to create a Strategic Bitcoin Reserve, and a list of key crypto industry figures attending the White House Crypto Summit.

Bitcoin: BTC bloodbath continues, near 30% down from its ATH

Bitcoin (BTC) price extends its decline and trades below $80,000 at the time of writing on Friday, falling over 15% so far this week. This price correction wiped $660 billion of market capitalization from the overall crypto market and saw $3.68 billion in total liquidations this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

%20[04.12.34,%2018%20May,%202023]-638199638176454862.png)