First Mover Asia: Malaysia may be Asia's next crypto hub; Major cryptos decline as Russia onslaught intensifies

The country, where CoinGecko was founded, retains the institutional use of English as well as a common-law court system; bitcoin declined for the third day.

Good morning. Here’s what’s happening:

Prices: Bitcoin (BTC), ether (ETH) and other major cryptos decline.

Insights: Malaysia has the ingredients to become Asia's next crypto hub.

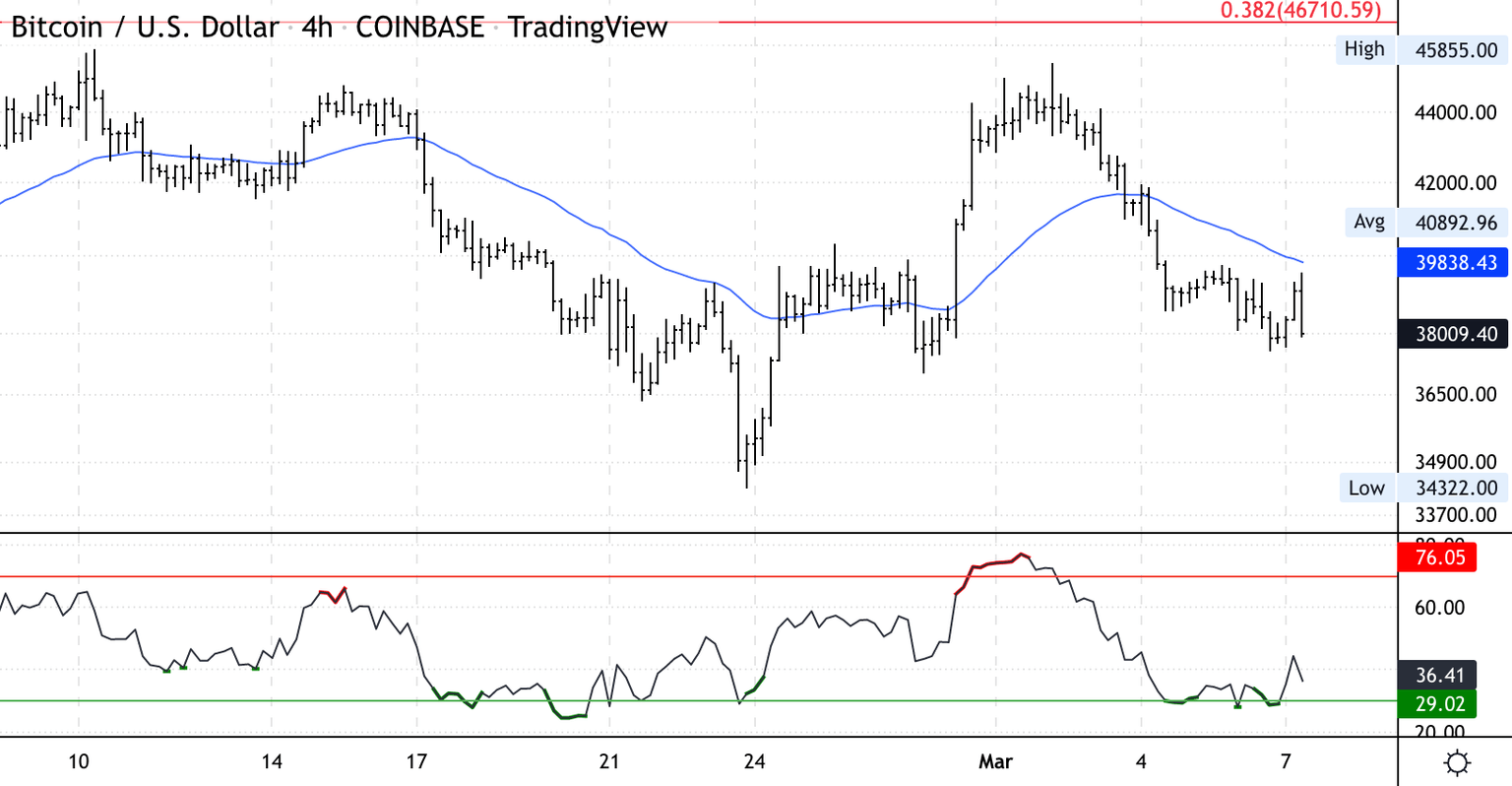

Technician's take: BTC appears to be oversold on intraday charts, although momentum has weakened.

Prices

Bitcoin (BTC): $38,311 .2%

Ether (ETH): $2,510 -1.7%

Top Gainers

| Asset | Ticker | Returns | Sector |

|---|---|---|---|

| Cosmos | ATOM | +1.8% | Smart Contract Platform |

| XRP | XRP | +0.0% | Currency |

Top Losers

| Asset | Ticker | Returns | Sector |

|---|---|---|---|

| Chainlink | LINK | −4.3% | Computing |

| Polkadot | DOT | −3.2% | Smart Contract Platform |

| Cardano | ADA | −2.8% | Smart Contract Platform |

Bad news continued flowing from the Ukraine on Monday, pushing investors away from cryptocurrency and other higher-risk assets.

At the time of publication, bitcoin was trading at about $38,300, off slightly over the past 24 hours. Ethereum was changing hands just above $2,500, down 1.7%. Most other major cryptos were firmly in the red. It was the third consecutive day of crypto declines, which started late on Friday as faint hopes for a ceasefire or targeted truce to allow civilians to evacuate besieged cities evaporated.

Ukrainian civilian casualties mounted as Russia continued to bomb non-military targets. Delegations from the Ukraine and Russia failed in their latest attempt to negotiate safe passage for citizens of the Black Sea port of Mariupol and other major Ukraine cities that are under bombardment.

Investors worried about rising energy prices that have already increased significantly over the last few months and wider inflationary pressures. The average price of gasoline rose to $4.009 per gallon on Sunday, according to the travel and other services organization, American Automobile Association (AAA). That was not far off the all-time high of $4.11 set in July 2008.

Oil is a tax on everything," Ben McMillan, the chief investment officer for IDX Digital Assets, told CoinDesk TV's First Mover show Monday. "Oil at this level, which we haven't seen for more than 10 years is just a drag on economies globally. So I think the big question really is 'how bad does this war get, how long does it persist.'"

The tech-heavy Nasdaq composite fell 3.6% and the S&P 500 nearly 3% as equity markets slogged through their worst day in over a year.

McMillan noted that bitcoin had "priced in a lot of bad news" and that "the war in Ukraine certainly didn't help." But he also struck a somewhat upbeat note, highlighting investors recent preference for the two largest cryptos by market cap, bitcoin and ether, over other digital assets.

"We are at a period now below $40,000 where historically we've started to see the buyers come out of the woodwork," he said. "The structural bull case is intact. I think part of that is there was a migration or consolidation within the crypto sphere around core holdings of Bitcoin and Ethereum."

Markets

S&P 500: 4,201 -2.9%

DJIA: 32,817 -2.3%

Nasdaq: 12,830 -3.6%

Gold: $1,998 +1.3%

Insights

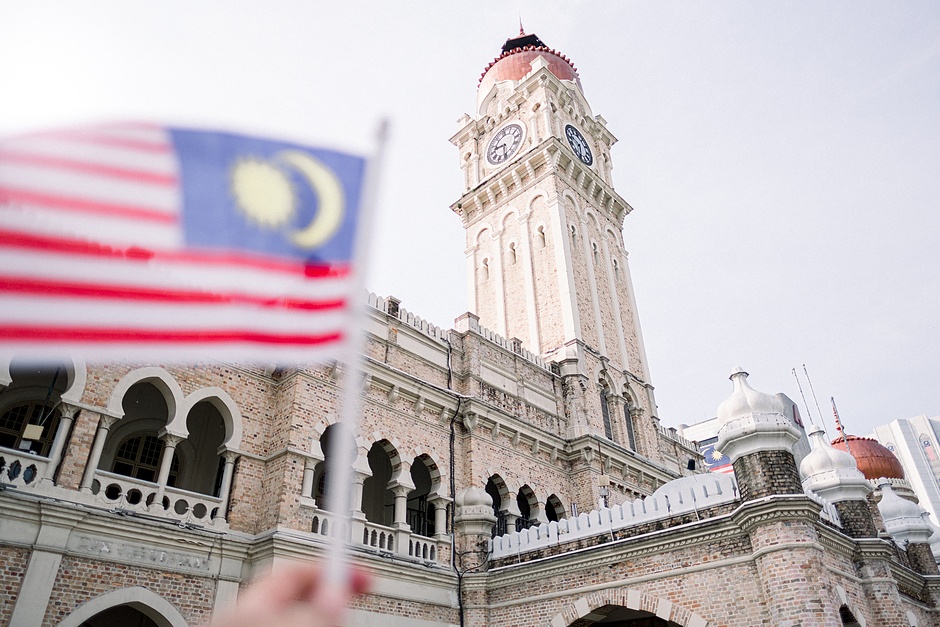

Is Malaysia the Future Crypto Hub for Asia?

Financial centers usually need three things: nice weather, common law and a bilingual workforce.

When people think of financial centers in Asia, Hong Kong or Singapore usually come to mind. The two cities share a lot of similarities as they retain a common law court system, and the workforce has a high command of English as artifacts of Britain’s legacy of colonialism.

Singapore is often called Asia’s crypto hub, and that term makes sense on the surface. The Monetary Authority of Singapore’s regulatory framework has been thought of as a comprehensive approach to crypto that understands the unique complexity of the asset class while Hong Kong takes a fragmented approach that often feels like there’s a square peg in a round hole happening despite everyone’s best efforts.

But we’re forgetting about Malaysia. Also a former Crown colony, Malaysia retains the institutional use of English as well as a common law court system. There’s no erosion of this legacy like in Hong Kong, the beaches are better than Singapore and the cost of living is low.

Yes, Malaysia isn’t spotless and graft-free like the Lion City but it didn’t have Gigachad Lee Kuan Yew at the helm to fight corruption. Sovereign wealth funds get raided (to bankroll the Wolf of Wall Street no less) and police take the occasional bribe. But they know it's wrong and people get prosecuted; parties get tossed at the ballot box in their raucous democracy.

The judicial DNA is in the right place, and the "bones" of the system are solid. A land title, for example, is secure through the use of the Torrens system of title, another fine commonwealth legacy that enshrines property rights through professional surveying and a central registry not a mishmash of fiefdoms. Singapore and Malaysia used to be one, in fact, until Malaysia’s parliament voted to expel the island from their confederation making Singapore the only country to gain independence involuntarily (take that, Taiwan).

One key thing Malaysia has going for it, with the British common law in place, is its ability to pull in case law (law that is based on judicial decisions) when making a regulatory decision. Because of its clarity, case law is always a preferred method of dealing with an evolving landscape that statute or regulation isn’t a precise enough tool to hit. Lawyers who specialize in regulatory affairs in common law jurisdictions get a bit uneasy when authorities decide to use statute to rule by enforcement.

This seems to be going well for Fusang, based in Malaysia’s Labuan territory. Labuan, formed in 1990, is being marketed as Malaysia’s Hong Kong, a midshore jurisdiction that’s in the country but exempt from some of its rules and tax burden. Labuan was a bit underground and not well known until Fusang put it on the map with its digital equities and bond offerings.

“Paper shares today, digital shares tomorrow” is how its CEO Henry Chong puts it, explaining that this isn’t a novel asset class in need of a new set of rules. Clarity is already there, because there are existing securities rules.

Chong thinks there is plenty of clarity on the market about digital assets. Those that say otherwise are complaining about having to follow the rules.

But what Malaysia doesn’t have is the sophisticated capital market of Hong Kong. Kuala Lumpur isn’t synonymous with being a financial center the same way that Hong Kong is. Singapore, looking at the numbers, isn’t even there either.

“In the digital world, geography starts to matter a lot less. Financial centers typically grew up around geography – Hong Kong is a prototypical example. There’s proximity there,” Chong said. “Hong Kong became Hong Kong because people wanted to meet and interact.”

Jurisdictions will start competing more, Chong said, and the case is there for Malaysia to become this next hub.

Chong isn’t the first one to champion this. CoinGecko, a fierce competitor to CoinMarketCap, was founded in Malaysia and continues to operate there while maintaining a presence in Singapore. Malaysia remains free of capital gains tax on crypto, and its educated, English-speaking workforce is quickly making a good impression on stakeholders in the decentralized finance (DeFi) industry.

Hong Kong’s response to COVID-19 has caused a mass exodus that might just be Malaysia’s gain. Published statistics show that since March 2020, 76,000 more people have left the city than arrived, and the tempo of departures has increased in the last week as the City tries to enforce its most restrictive covid rules yet (even its most vocal fans are deciding now is the time to go).

Some are headed back to Europe, others for a staycation in Thailand, and perhaps some to Malaysia. Work will still be the order of business, as remote working is the norm. But the question is, how many will return? This could be what it takes for the industry to consider decentralizing – especially to areas that share the same legal DNA.

Technician's take

Bitcoin (BTC) traded lower over the weekend after buyers were unable to break above the $40,000 price level. Immediate support is at $37,000, which could stabilize the pullback, although stronger support is seen at $35,000.

The cryptocurrency continues to trade in a tight price range and is down 2% over the past 24 hours to about $38,000.

Upside momentum is slowing on the daily chart, which points to further consolidation around the current price. Resistance is seen at $45,000.

The relative strength index (RSI) on the four-hour chart is rising from oversold levels, similar to what occurred during the last week of February, which preceded a price jump. Still, the RSI can remain in oversold territory for a few days before confirming an upswing (typically with a reading above 50).

Important events

12:30 a.m. HKT/SGT(8:30 a.m. UTC): National Australia Bank's Business Conditions (Feb.)

12:30 a.m. HKT/SGT(8:30 a.m. UTC): National Australia Bank's Business Confidence (Feb.)

1 p.m. HKT/SGT (5 a.m. UTC): Japan Eco Watchers Survey: Current (Feb.)

1 p.m. HKT/SGT(5 a.m. UTC): Japan Eco Watchers Survey: Outlook (Feb.)

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.