First Mover Asia: Funds lost billions in the Terra collapse. Here are the ongoing effects; Bitcoin sees red

When a fund suffers a major dent to its token, the impact reverberates widely throughout the venture funding eco-system; most major cryptos fell despite gains in U.S. equity markets.

Good morning. Here’s what’s happening:

Prices: While stocks had a good day, bitcoin and other major cryptos continued to struggle.

Insights: The effects of the Terra collapse will continue to ripple through the investment eco-system.

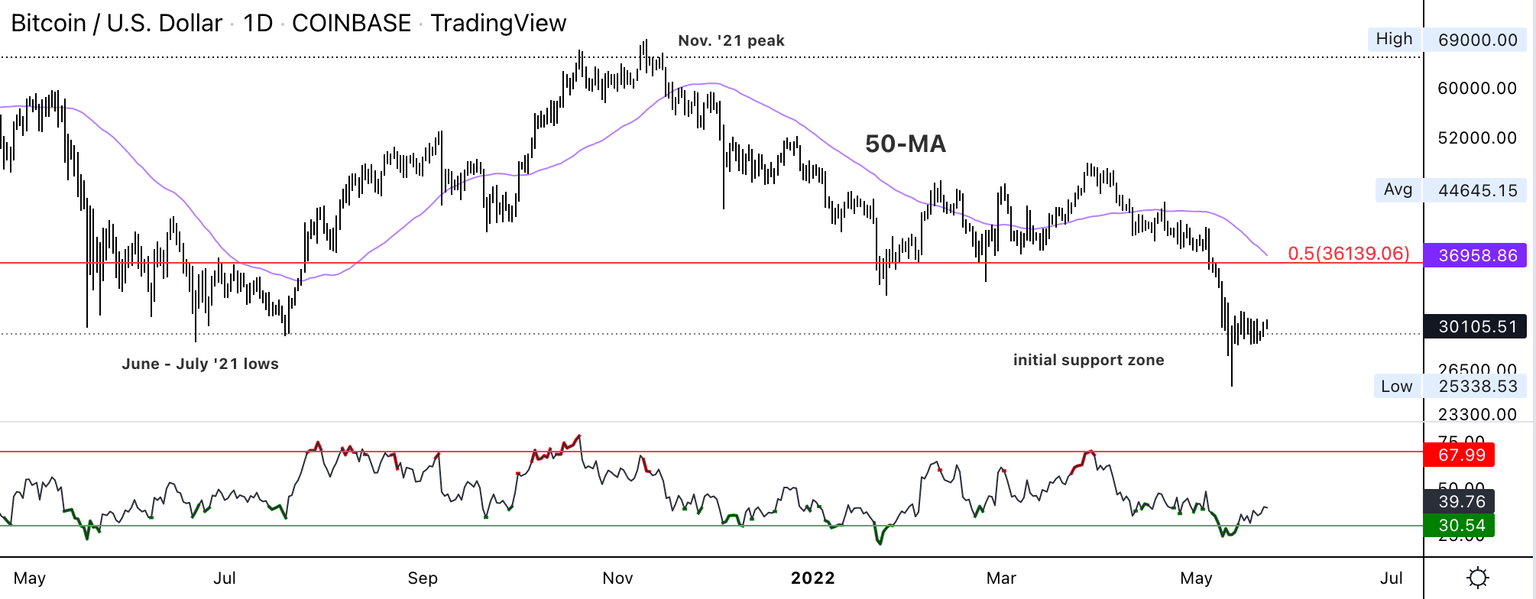

Technician's take: A brief relief bounce is likely, similar to what occurred in late February and late March.

Prices

Bitcoin (BTC): $29,137 -3.9%

Ether (ETH): $1,972 -3.5%

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Ethereum Classic | ETC | +3.8% | Smart Contract Platform |

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Algorand | ALGO | −6.9% | Smart Contract Platform |

| Solana | SOL | −6.6% | Smart Contract Platform |

| Internet Computer | ICP | −5.8% | Computing |

Stocks rise but cryptos fall

What happened to correlation?

While stocks spiked in Monday trading, major cryptocurrencies continued their recent trudge through a red gloom.

By early afternoon, bitcoin had fallen almost 4% over the past 24 hours to the low end of the $29,000-$30,000 range it has occupied for the nearly two weeks since the UST stablecoin and LUNA token that supports it imploded. The largest cryptocurrency by market capitalization, has dropped 26% from its high this month near $40,000 and roughly 55% since reaching its record peak last November. Ether, the second largest crypto by market cap, was down approximately 3.5% over the same period and changing hands a little below $2,000.

Most major cryptos spent much of the day in the red with AVAX recently off over 8% and GALA, ALGO and MANA each down more than 6% amid ongoing investor fears about inflation and a possible recession as central banks tighten monetary policy. Trading was choppy underlining these concerns.

"We don't have earnings [this week}, we haven't had a stablecoin lose $48 billion, and we haven't had a Presidential Executive Order," 3iQ Digital Asset's Head of Research Mark Connors told CoinDesk, adding: "It's about inflation and that's uncertain. So we are rangebound."

Stocks traveled a different paths, as they've done for most the past few days, rising after senior executives at JPMorgan Chase said that U.S. consumer credit market was in good shape short-term. The S&P 500, which spent a large portion of Friday in bear market territory, meaning that the index was trading at least 20% lower than its previous high, increased 1.8%. The Dow Jones Industrial Average and tech heavy Nasdaq climbed 1.9% and 1.5%, respectively. Last week, the indices plunged almost 3%.

Cryptos have spent much of the year tracking stocks so the latest separation represents at least a small twist in their evolving relationship. 3iQ's Connors said that digital assets will likely remain rangebound at least until the U.S. Bureau of Labor Statistics issues its next consumer price index report (CPI) in early June. The CPI may show if inflationary pressure is waning.

"For right now, you might have some people pushing uncertain markets to see what breaks but I don't think there will be breaks either way," Connors said.

Markets

S&P 500: 3,973 +1.8%

DJIA: 31,880 +1.9%

Nasdaq: 11,535 +1.5%

Gold: $1,853 +0.4%

Insights

The ongoing damage to Terra investors

The destruction of the Terra protocol has meant a significant hit on the balance sheets of all of its investors. Data about the carnage is available to view on Block explorers, including Korean VC firm Hashed’s staked tokens, which were at one time worth over $3.5 billion.

Hashed’s loss on luna and other Terra ecosystem tokens may not have adversely affected its cash position. Hashed got most of these tokens through its investment in Terraform Labs, and likely bought more of the tokens as it peaked – and probably sold some too.

But for any liquid crypto fund, cash is periphery. Cash is boring. Cash doesn’t have the same amount of leverage.

To understand the significance of crypto on the VC’s balance sheet — and why it matters so much for Hashed - let's look at how Singapore’s Three Arrows Capital made a $1.2 billion position (using January 2021 pricing) in the Grayscale Bitcoin Trust (GBTC). (New York-based Grayscale is owned by Digital Currency Group, the parent company of CoinDesk.)

Three Arrows Capital is licensed to manage assets of not more than SGD250 million (US$181 million) for its Singapore entity, according to a filing with the Monetary Authority of Singapore. It also has an entity in the British Virgin Islands, with which it has split the GBTC position equally, according to U.S. Securities and Exchange Commission filings. Even the 50-50 split would exceed the amount that Three Arrows Capital is authorized to manage.

Three Arrows likely accomplished this through leveraged bitcoin, as BTC has always been an option to buy into the GBTC. Three Arrows wanted to do this because its interest in GBTC is a premium harvesting play, exploiting its current discount with a hope that it returns to a premium or at least to market value.

Three Arrows’ history has shown this wasn’t a wise investment because of the market downturn through most of 2022 and GBTC’s structural problems.

Let's return to Hashed and the other VC firms that held Terra’s tokens in their liquid portfolios.

One scenario is that some firms used the LUNA they had staked as collateral for the leveraged purchase of further tokens for both trading, and to invest in funding rounds that used a Simple Agreement for Future Tokens (SAFT) or another investment vehicle.

Creating an agreement with an over-the-counter desk that pledged staked LUNA for crypto to buy into the SAFT would be a simple task for a fund. Once the lock-up period for the specific token was complete, the OTC desk could be repaid through gains from that token. And the best part of it all is that this could be done without touching its cash position.

So when a fund takes a massive hit on its token portfolio, the effect reverberates through the entire ecosystem. Now, post-LUNA, there will be billions less in dry powder available for VCs to deploy even if their cash positions are relatively sound.

Antalpha Technologies Managing Director Max Liao doesn’t think this will scare off institutional investors. Rather, he’s reminded of the early 2000s dot-com bubble where companies died as fast as they were born. Despite the dozens if not hundreds that imploded, taking with them billions in venture capital dollars, this gave us Amazon (AMZN), Google (GOOG) and PayPal (PYPL).

“While the importance of profit is a given, the events of the past few weeks have only underscored that due diligence and risk management are also critical factors in the execution of successful venture investment,” he said to CoinDesk. “It is imperative that emergent protocols and potential investors remember that businesses that can change the world learn from both their own success and the failure of others.”

For entrepreneurs and builders, this could mean a change of structure for that next investment that involves more cash and fewer tokens.

But the problem with cash is that it comes with much more conservative terms, particularly in the size of rounds and the risk investors are willing to take.

Technician's take

Bitcoin (BTC) has traded in a tight range between $28,500 and $30,000 over the past week. Despite short-term swings, the cryptocurrency has managed to hold support above $27,000, which could keep some buyers active.

BTC declined by as much as 2% over the past 24 hours.

Momentum signals are improving on the daily chart, similar to what occurred in late February and late March. Further, the relative strength index (RSI) on the daily chart continues to rise from oversold levels, which could point to a relief bounce in price.

Still, the daily RSI will need to rise above 50 to determine if a price bounce has staying power.

On the weekly chart, the RSI is the most oversold since March 2020, although momentum signals remain negative. That suggests upside could be limited for BTC, initially toward the $33,000-$35,000 resistance zone.

Important events

World Economic Forum

DC Blockchain Summit

CBDC hearing: Digital Assets and the Future of Finance

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.