First mover Asia: Filecoin struggles amid China exposure, cost of subsidy concerns

Prices

Crypto flat as Powell heads to Congress

Good morning Asia, here’s how the markets are moving today.

Bitcoin and ether are opening the Asia business day flat. The world’s largest digital asset is down 0.2% to $22,412 while ether is stuck at $1,565.

Trading volume is significantly down, according to CoinGecko data, with 24-hour volume for bitcoin at $16 billion on Monday, March 6 compared to $27 billion on Friday, March 3.

A report from CryptoQuant points to funding rates and argues that the current market is bearish and betting on further declines.

“I don’t think we’re out of the woods yet, clearly inflation is still both rampant and here,” Hany Rashwan, CEO of crypto investment product firm 21.co, said on CoinDesk TV. “How much the market has priced that in right now is difficult to show.”

All eyes are likely on Fed Chair Jerome Powell as he heads to Congress to testify Tuesday morning at the Senate Banking Committee and on Wednesday to the House Financial Services panel.

Powell is in a predicament, as the economy seems resistant to the cooling effects of interest rate hikes.

January’s blow-out job numbers, where the U.S. added nearly three-times as many jobs as expected, showed observers that the Fed has some work to do to bring down inflation.

CME’s FedWatch tool is putting a 69% chance of a 25 basis point rise, and a 30% chance of a 50 basis point increase. Prediction market PolyMarket is showing an 80% chance of a 25 bps increase during the March meeting and a 23% chance of a 50 bps increase after.

Insights

Filecoin's China, cost woes

Filecoin has a market cap of just over $2.4 billion, and has a storage capacity of more than 13.41 exabytes (1 exabyte is equal to 1 million terabytes). Of these 13.41 exabytes, 626 petabytes (1 petabyte is 1,000 terabytes) are currently used.

The $2.4 billion question is, what is stored within these 626 petabytes?

There’s plenty of data archived on Filecoin from scientific or historical projects. Atlas CERN stores 10,240 tebibytes (equal to 11,258 terabytes) of data from the Large Hadron Collider on the Filecoin Network; the USC Shoah Foundation stores 3,046 tebibytes (this is because of a $2 million grant from the Filecoin Foundation); the Internet Archive stores 503 tebibytes (another grant, this time worth $10 million); UC Berkeley stores 121 tebibytes.

The only commercial entities on the list are a China-based post-production house called XingChi Media, which says it's backing up data on Filecoin for disaster recovery, and NFT.Storage, which is a product of Protocol Labs – the organization which supports Filecoin’s code.

A spokesperson for Protocol Labs also highlighted that NFT marketplace OpenSea stores the metadata for its NFTs on Filecoin. Important, yes, for the continuity of the NFT industry in the face of disaster but not exactly something that requires a lot of storage.

Filecoin’s China centralization

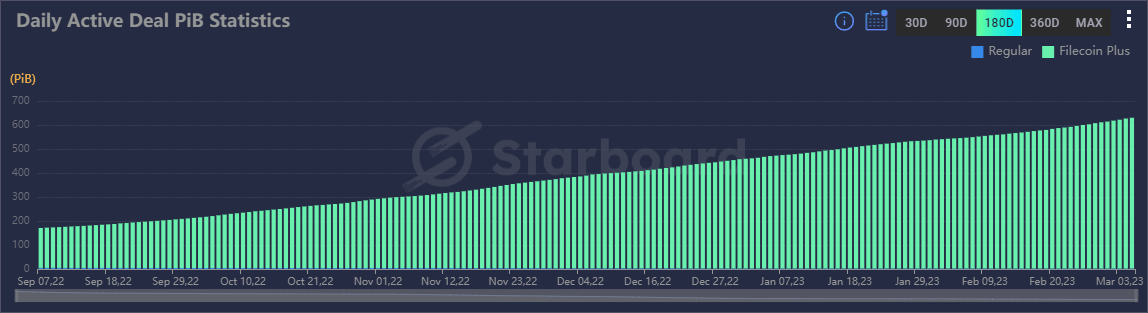

There’s no question that the Filecoin protocol is being used and demand for storage is increasing.

(Starboard)

On-chain data shows that the daily active Filecoin deals are trending upward.

But perhaps the reason you don’t see a large number of actual enterprise-grade clients using Filecoin – and just scientific data repositories and proof-of-concept initiatives – is because of Filecoin’s heavy exposure to China.

In 2021, miners in China jumped on the ability to add Filecoin to the mix, with billions being spent in buying up hard disks, which are to Filecoin what GPUs were to Ethereum, and building out facilities.

Bella Yang, a research manager with IDC China’s enterprise research team, told CoinDesk in a note that Filecoin miners were buying a large number of storage servers known as JBODs. These are uncomplicated arrays of HDDs designed to scale a company’s ability to archive data quickly.

“During this time, a large number of JBOD products were sold directly to mining companies and prices of high-capacity HDDs began to rise, even driving many out of stock when there was a shortage of 8 terabyte-plus HDDs,” Yang said, explaining that the Filecoin-induced demand for HDDs came as COVID closed factories in China.

Although bitcoin mining has largely left China, and ether mining has been made redundant with the Merge, Filecoin miners still have a large presence in-country.

A 2022 study by Italy’s University of Pisa showed Filecoin's large degree of centralization around its top 10 miners, many of which are based in China and owned by cloud storage companies.

“The fact that the most important miners are linked to cloud storage companies highlights that Filecoin is far from being concretely decentralized market storage because these companies are dominating the storage market and monopolizing the mining operations,” the authors wrote.

Filecoin knows the market is skeptical

For Filecoin, the answer to its woes is Filecoin Plus (FIL+), which seeks to carve out quality storage providers from the ones that pollute the protocol with junk data, which many miners in China were doing in the early days of the protocol.

It also allows users, perhaps ironically, to pick their storage provider. Centralization is a cure for decentralization’s pitfalls.

All this is coming at a cost, as CoinDesk has previously reported, with massive subsidies required in the form of a 10x larger block reward to make Filecoin Plus work.

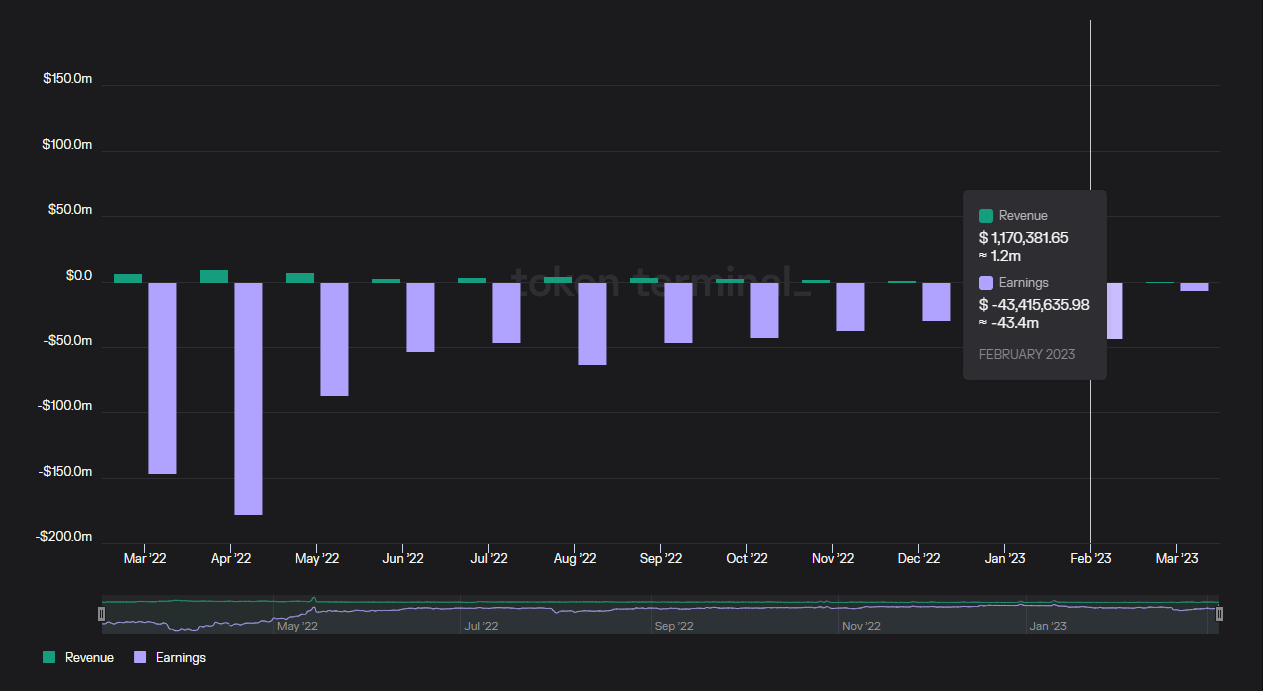

Data from Token Terminal shows that revenue for the protocol has imploded during the last year despite more use of the protocol. In February, heavy incentives meant that earnings were a net negative to the tune of $43.4 million against revenue of $1.2 million.

(Filecoin)

“What I think is going to be the most important thing to watch there is if the storage demand can still keep up when storing data is no longer free,” Messari enterprise research analyst Sami Kassab said earlier to CoinDesk.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.