First Mover Asia: Bitcoin sinks below $30k amid renewed risk fears

Major altcoins fared worse in Wednesday trading, reversing most gains from the U.S. holiday weekend rally; South Korea takes a harder look at crypto.

Good morning. Here’s what’s happening:

Prices: Bitcoin and other major cryptos decline.

Insights: South Korea's government is taking a harder look at cryptocurrencies.

Technician's take: Long-term momentum remains negative, capping upside moves in price.

Prices

Bitcoin (BTC): $29,784 -6.2%

Ether (ETH): $1,818 -6.2%

Bitcoin and Other Cryptos Sink

Investors on Wednesday decided that bitcoin wasn't such a good deal after all – or nearly any other major cryptocurrency, for that matter.

The largest cryptocurrency by market capitalization was recently trading just below $30,000, a more than 6% drop over the past 24 hours that relinquished much of the gains posted during a U.S. holiday weekend surge. Bitcoin was changing hands over $32,000 as recently as Tuesday morning as markets responded to the relaxation of COVID-19 restrictions in China and the faint possibility that the U.S. central bank might relax its monetary hawkishness much later this year.

All that good faith had faded into the mists by early Wednesday, with investors returning whole hog to the risk-aversiveness that has colored their moves for much of the past eight months. Ether was also down over 7% over the same period, trading at about $1,800. Other major cryptocurrencies sank even deeper with Luna Classic (LUNC), the new name for the original LUNA on the Terra protocol, falling 61% at one point. SOL and ADA both declined about 12%, while DOT was down roughly 9%.

"Bitcoin's price action today is not entirely surprising," Joe DiPasquale, the CEO of crypto fund manager BitBull, wrote to CoinDesk. "Not only is it facing pressure from traditional markets, it has also been struggling to breach the resistance zone between $31K-$32K, resulting in a breakdown from the range it set over the weekend."

Major stock indexes dropped with the tech-heavy Nasdaq and S&P 500 each closing off 0.7% as investors renewed their concerns about high inflation and the prospect of recession. Gold and the 10-year Treasury yield both rose.

At a business conference Wednesday, JPMorgan Chase CEO, and crypto skeptic, Jamie Dimon told investors and analysts the bank would be conservative with its balance sheet, and to prepare for rough economic times. Dimon said he was worried about central bank quantitative tightening and the continued fallout from Russia's invasion of Ukraine. “Right now, it’s kind of sunny, things are doing fine, everyone thinks the [U.S. Federal Reserve] can handle this,” Dimon said. “That hurricane is right out there, down the road, coming our way.

Bitcoin closed May, a historically strong month, well in the red, although it outpaced altcoins. That reflected investors preference for the digital asset considered least risky. Still, BitBull's DiPasquale was skeptical that Bitcoin could turn upward quickly. ”Moving forward, Bitcoin will need to see significant buying activity and a major sentiment shift for any hopes of a quick reversal," he wrote.

Markets

S&P 500: 4,101 -0.7%

DJIA: 32,813 -0.5%

Nasdaq: 11,994 -0.7%

Gold: $1,846 +0.5%

Insights

South Korea has been a hotbed of interest in cryptocurrencies.

That was clear less than three months ago when South Korea's two main presidential candidates were jockeying to see who could appeal to younger voters as the most crypto friendly.

But the country's lawmakers have been taking a harder look at digital assets in recent weeks, particularly after the collapse of the TerraUSD stablecoin (UST) and the luna token that supported it. The UST implosion swept up an estimated 280,000 Korean investors.

According to a report on Tuesday by the Korean news outlet NewsPim, the South Korean government will form a Digital Assets Committee, perhaps as early as this month, specifically to oversee the digital assets market in light of the Terra debacle. The committee will provide criteria for the listing of coins by exchanges, introduce investor protections measures and monitor unfair trading.

The initiative comes followed widespread calls for the establishment of an entity that could function similar to regulatory agencies that protect stock market investors. That responsibility for crypto currently falls to a range of government departments and watchdogs, such as the Ministry of Strategy and Finance, the Financial Services Commission and the Ministry of Science and ICT (information and communications technology).

Calls for increased oversight of the crypto industry were raised at a National Assembly emergency seminar last week. "We need to make exchanges play their proper role, and toward that end it is crucial for watchdogs to supervise them thoroughly," Rep. Sung Il-jong of the ruling People Power Party said.

How the creation of a crypto-focused committee dovetails with the proposal by Yoon Suk-yeol, the conservative candidate who won the March presidential election, "to confiscate crypto profits gained through illegitimate means and return them to the victims" is not clear.

Technician's take

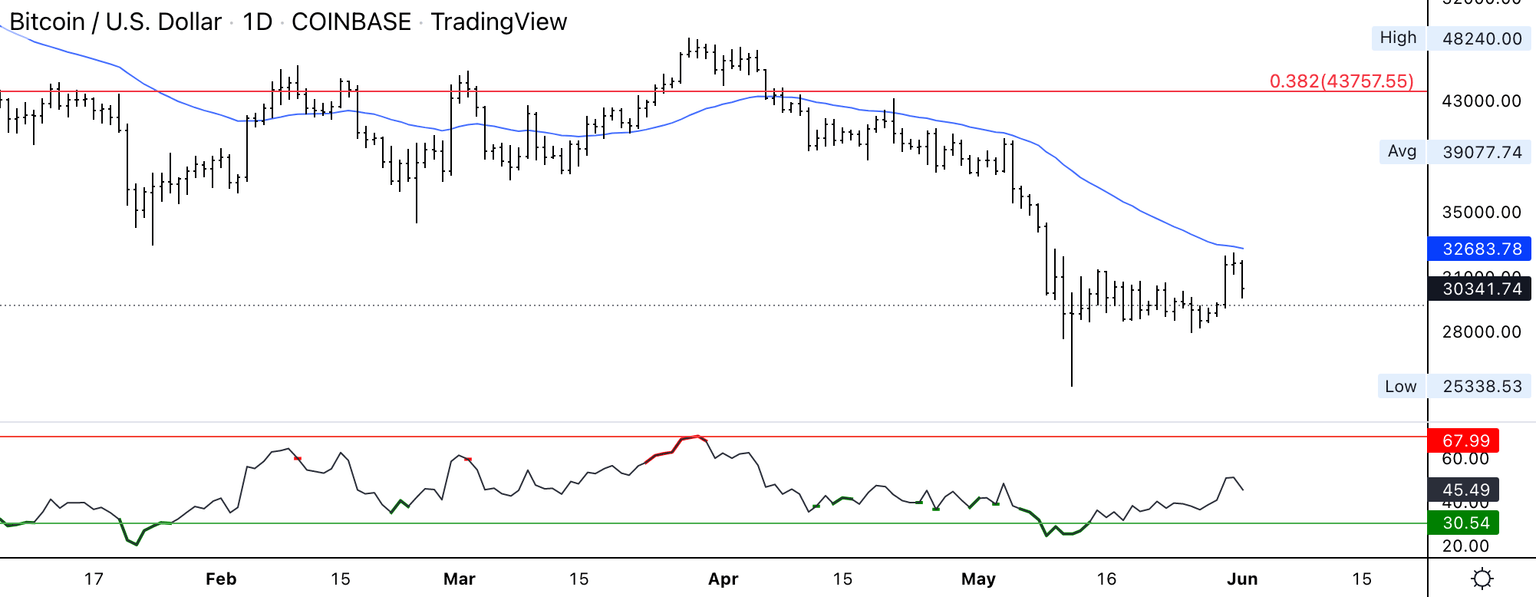

Bitcoin daily price chart shows support/resistance with RSI on bottom (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) pared earlier gains after buyers took some profits below the $33,000 resistance level. The cryptocurrency could find support, initially at $27,500 and then at $25,000.

The relative strength index (RSI) on the four-hour chart reached oversold levels on Monday, which preceded the current pullback in price. And on the daily chart, the RSI returned below the 50 neutral mark, indicating a temporary loss in upside momentum.

On the weekly chart, bitcoin appears to be oversold, albeit with negative momentum signals. That suggests upside could be limited beyond $35,000.

For now, BTC is roughly one week away from registering a downside exhaustion signal, which previously occurred on June 7 of last year and on Jan. 10 this year. Still, a weekly close above $30,000 is needed to confirm a bullish short-term signal.

If further breakdowns occur, secondary support is seen at $17,673.

Important events

Blockchain Fest Singapore 2022

9 a.m. HKT/SGT(1 a.m. UTC): Opec and non OPEC ministerial meeting

10 a.m. HKT/SGT(2 a.m. UTC): Eurostat producer price index (MoM/YoY/April)

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.