First Mover Asia: Bitcoin rally stalls after US central bank chair’s comments; Ether rises

The largest cryptocurrency by market capitalization saw three consecutive days of healthy gains end after Jerome Powell signaled that the U.S. Federal Reserve might accelerate the ending of its easy-money policies; ether approaches $4,800 before falling back.

Good morning. Here’s what’s happening this morning:

Market moves: Bitcoin dropped on U.S. Fed Chair Powell’s comment, while ether gained more market share.

Technician’s take: Support levels remain intact, which could establish a tight trading range between $55,000-$60,000 BTC into the Asian trading day.

Prices

Bitcoin (BTC): $57,157 -1.3%

Ether (ETH): $4,642 +4.4%

Markets

S&P 500: $4,567 -1.9%

Dow Jones Industrial Average: $34,483 -1.8%

Nasdaq: $15,537 -1.5%

Gold: $1,772 -.80%

Market moves

Bitcoin’s price sank after U.S. Federal Reserve Chair Jerome Powell warned Tuesday that the risk of higher inflation has “increased,” signaling the central bank would consider fastening the reduction of its asset purchase policies that have boosted the markets for risky assets.

“A faster Fed taper and increased [interest] rate hike expectations was bad news for bitcoin,” Edward Moya, senior market analyst at foreign-exchange broker Oanda, wrote in a market commentary. “Bitcoin is trading more like a risky asset than an inflation hedge.”

On the other hand, ether, the second-largest cryptocurrency by market capitalization, ended Tuesday with its fourth straight day of gains, trading above $4,600, according to CoinDesk’s data.

“Ethereum is still the favorite crypto bet for most traders and seems like it will make another run towards $5000 once risk appetite returns,” Moya added.

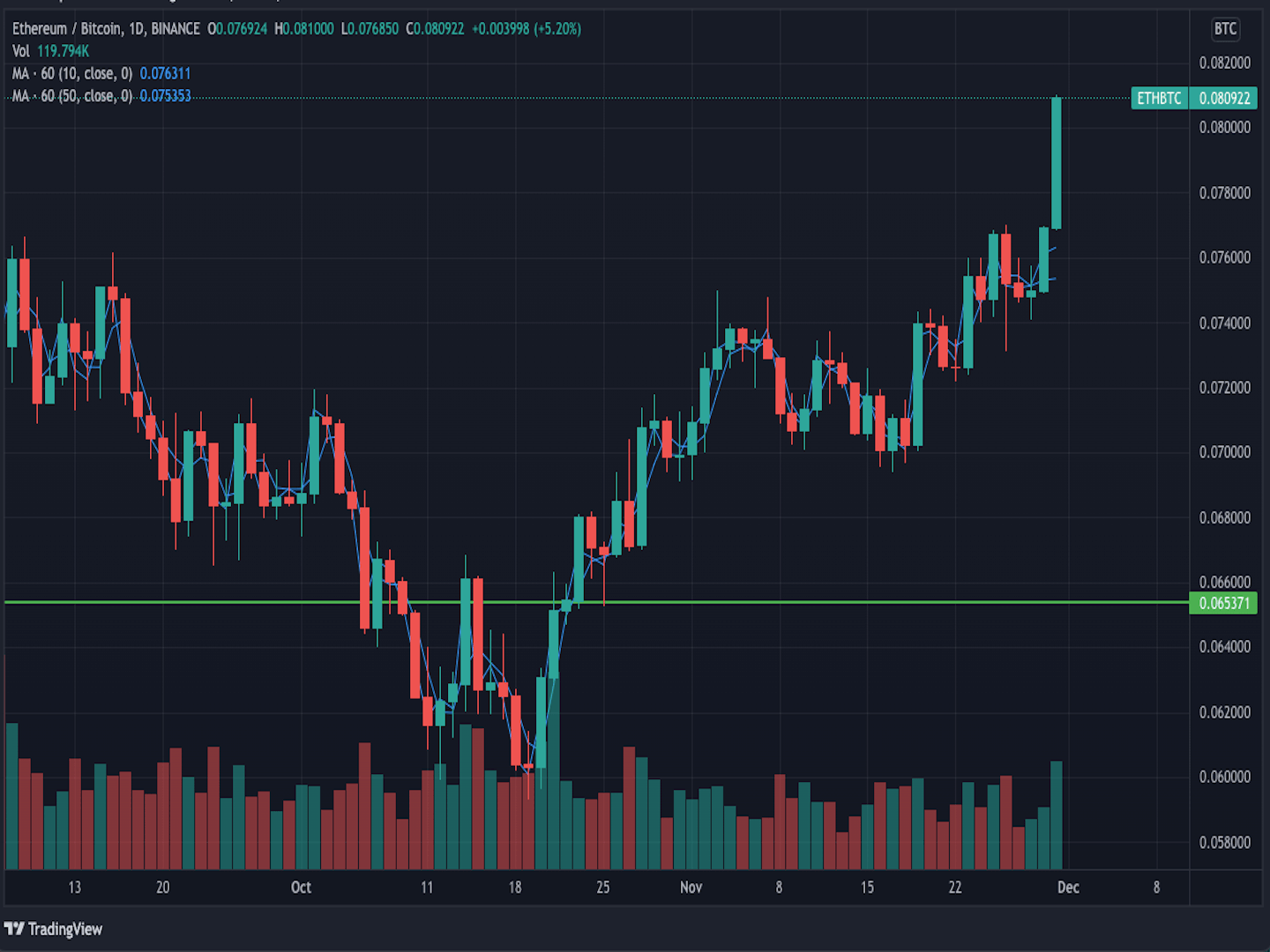

Ether’s growing market dominance is also reflected on the ether-bitcoin (ETH/BTC) chart: The ETH/BTC daily chart on crypto exchange Binance was up by more than 5.2%, at the time of writing, according to TradingView.

ETH/BTC daily chart on Binance (TradingView)

Other layer 1 blockchain-associated tokens also posted gains on Tuesday, led by Terra blockchain’s LUNA token, which logged a new record high price.

Technician’s take

Bitcoin four-hour price chart shows support/resistance levels (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) buyers failed to sustain Monday’s price bounce, although support around $53,000-$55,000 could stabilize the current pullback.

The cryptocurrency is down about 2% over the past 24 hours and is roughly flat over the past week.

The downward-sloping, 100-day moving average on the four-hour chart indicates a short-term downtrend. This means buyers have consistently taken some profit on rallies over the past month.

Recently, the $60,000 resistance level has been a key hurdle for buyers despite oversold readings on the charts. So far, support levels remain intact, which could establish a tight trading range between $55,000-$60,000 into the Asian trading day. BTC was trading around $57,800 at press time.

Important events

8:30 a.m. HKT/SGT (12:30 a.m. UTC): Jibun Bank Manufacturing purchasing managers’ index (Nov.)

8:30 a.m. HKT/SGT (12:30 a.m. UTC): Australia gross domestic product (Q3/YoY/QoQ)

9:45 a.m. HKT/SGT (1:45 a.m. UTC): Caixin China purchasing managers’ index (Nov.)

3 p.m. HKT/SGT (7 a.m. UTC): Germany retail sales (Oct. YoY/MoM)

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.