ALSO: As crypto prices rise, venture capital into the blockchain space is likely to rise. But will investment firms learn from their past overindulgences in the sector?

Good morning. Here’s what’s happening:

Prices: Bitcoin dipped below $23K earlier in the weekend and flattened on Sunday as investors await the next utterances from Federal Reserve Chairman Jerome Powell.

Insights: If crypto continues to rebound, venture capital in blockchain projects is likely to rise. Will venture capitalists avoid their past investment mistakes in the blockchain space?

Prices

Crypto Trades Flat as Investors Await Powell Speech, More Earnings

By Sam Reynolds

Major digital asset prices traded flat over the weekend, with bitcoin down 1.7% and ether in the red 2.3% over the weekend.

After a mediocre start to earnings season, investors are thought to be looking ahead to Federal Reserve Chairman Jerome Powell’s speech, scheduled for Tuesday afternoon, before making any big moves.

FactSet data shows that less than 1% of the companies in the S&P 500 reported earnings that were above estimates. This is below the five-year average of 8.6%, and the 10-year average of 6.4%.

"As a result, the earnings decline for the fourth quarter is larger today compared to the end of last week and compared to the end of the quarter," FactSet's senior earnings analyst John Butters wrote in a Friday market update. "If the index reports an actual decline in earnings for Q4 2022, it will mark the first year-over-year decline in earnings reported by the index since Q3 2020.”

Speaking late last week on CoinDesk TV, David Siemer, CEO of accounting software provider Wave Financial, said that the market is giving mixed signals – strong job numbers, but mediocre earnings results – and he still expects a recession this year, albeit a weak one.

“I am a little more optimistic that it won't be quite as severe a recession as in a great recession or major, major recession,” he said, pointing to the resilience of consumers. “The fact that the Fed's actions are having such a slow effect doesn't mean cumulatively they won't eventually have a major effect. We're probably still a quarter or two away from seeing what the Fed's actions have really actually done to the economy.”

And what does this mean to crypto prices, looking forward? BitBull Capital’s Joe DiPasquale wrote in a note to CoinDesk that crypto markets are “optimistic” after a modest rate increase and bitcoin will “oscillate around the $20K support level for the next few months, barring other unforeseen events and market action.”

Meanwhile, the U.S. Dollar Index (DXY) is opening the Asia trading week at 103.12, staying in what many analysts call a “defensive” position. The measure of the world’s largest fiat asset spent most of last year surging, hitting stock and crypto prices hard. Year-to-date it’s down 1.4%.

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Cardano | ADA | +1.4% | Smart Contract Platform |

| Cosmos | ATOM | +1.1% | Smart Contract Platform |

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Loopring | LRC | −5.0% | Smart Contract Platform |

| Terra | LUNA | −4.5% | Smart Contract Platform |

| Decentraland | MANA | −4.2% | Entertainment |

Insights

Can Crypto VCs Avoid the Mistakes of Last Year?

By Sam Reynolds

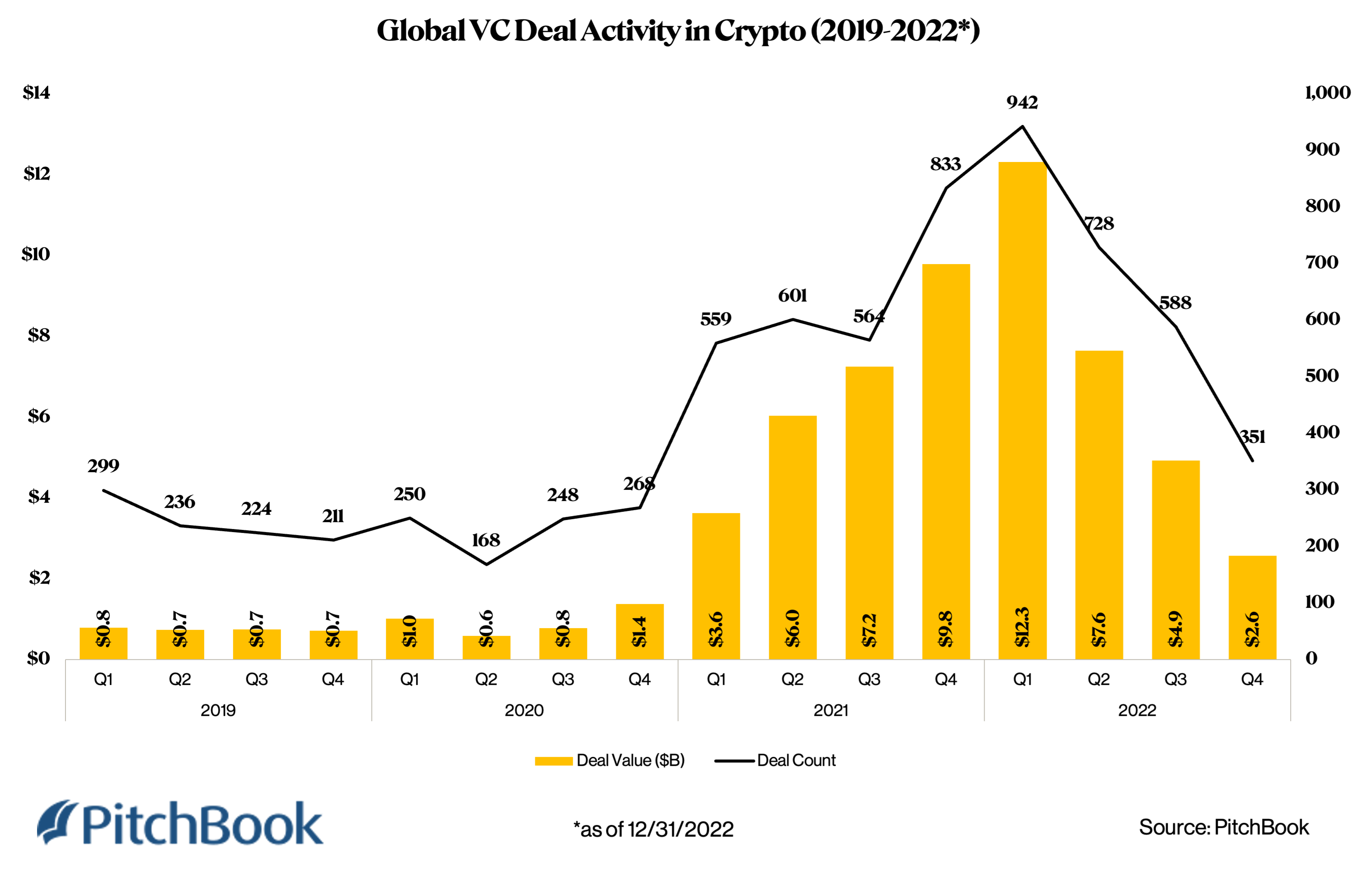

The last quarter of 2021 was the end of an unprecedented bull market that began the year before with Covid-included macroeconomic policy and finished with the Fed raising rates in 2022, and with a trio of collapses, most notably crypto exchange FTX and its trading arm Alameda Research. Venture capitalists enjoyed the ride on the way up, but certainly felt the pain on the way down in 2022 as cascading failures knocked the wind out of their portfolios.

For the industry, the trillion-dollar question will be: Did VCs learn anything, and can they avoid repeating the mistakes of last year that severely dented their profits. VCs invested furiously as crypto prices rose but their methods often seemed slapdash.

An upbeat January

Bitcoin and many altcoin categories had a fantastic January, with the world’s largest digital asset rising 40% on-month, some metaverse tokens making triple-digit gains, and Layer-1s like Aptos’ APT rising by over 300%. Some of the more bullish takes even predict bitcoin hitting $45,000 by Christmas.

But despite these data points indicating that crypto winter is thawing, VCs' investment in digital asset and blockchain projects fell 90% in January, according to a recent CoinDesk report.

"Over the past 18 months, VC investments into crypto reached a peak, with investments spread across the entire ecosystem. Diligence cycles were compressed to weeks and sometimes days during this time, with many investors shunned out of the round if they asked crypto startups follow-up diligence questions (this is partly why FTX was not properly diligenced),” Robert Le, a senior emerging technology analyst at Pitchbook, told CoinDesk in an email.

(PitchBook)

Le said that during the past six months, there has been a significant slowdown in the speed at which VCs do deals, with the diligence cycle now taking months.

“Capital is now concentrated into areas with business models and product market fit. There is also less appetite for pure token rounds, with many investors preferring equity," Le said.

Throughout the 2020-’22 bull market cycle, many observers found it almost comical how many projects of questionable merit, teams with negligible skills, and projects without a proper fit received a seemingly, never-ending bucket of funding.

The stats are sobering: CertiK says there was more than $3.7 billion in tokens stolen, scammed, or attacked in 2022; in 2021 there were over $2.8 billion in rug pulls, a term for teams absconding with investors’ tokens.

“Investors were very willing to underwrite risk, bet on exploratory and niche products, and take an optimistic view of the space,” Nate George, Venture Capital Co-Lead at Cumberland, told CoinDesk.

George said that investors tolerated poorly constructed legal documents with extremely limited investor protections, just to get into the sector. In turn, throughout the 2021-’22 cycle, funds employed a “scattershot approach” to investing with large collections of investors writing small checks demonstrating their low conviction to the project.

Effectively everyone who wanted it got funding.

“Startups were able to raise uncharacteristically sized rounds for their stage, commonly acquiring multiple years of runway pre-product, while over the course of the last six months, investors pivoted to underwriting fewer deals targeting higher conviction, more concentrated bets,” George told CoinDesk in a note. “During this period of time, investors began to re-evaluate their focus on what constitutes product market fit, realizing that large token incentive programs rewarding user participation creates distorted traction metrics and overlooks user stickiness.”

Moving into Spring

A lot must be going through investors’ minds at the moment. On one hand, there’s lots of data – in the form of bloody red losses on profit-and-loss statements – to show that a slower, high-conviction approach to investing is better for both the industry and the fund’s return.

But at the same time, this is the season of altcoins. SHIB is up nearly 50% this past month. Metaverse tokens, despite the questionable traction platforms like Decentraland have, are doing very well.

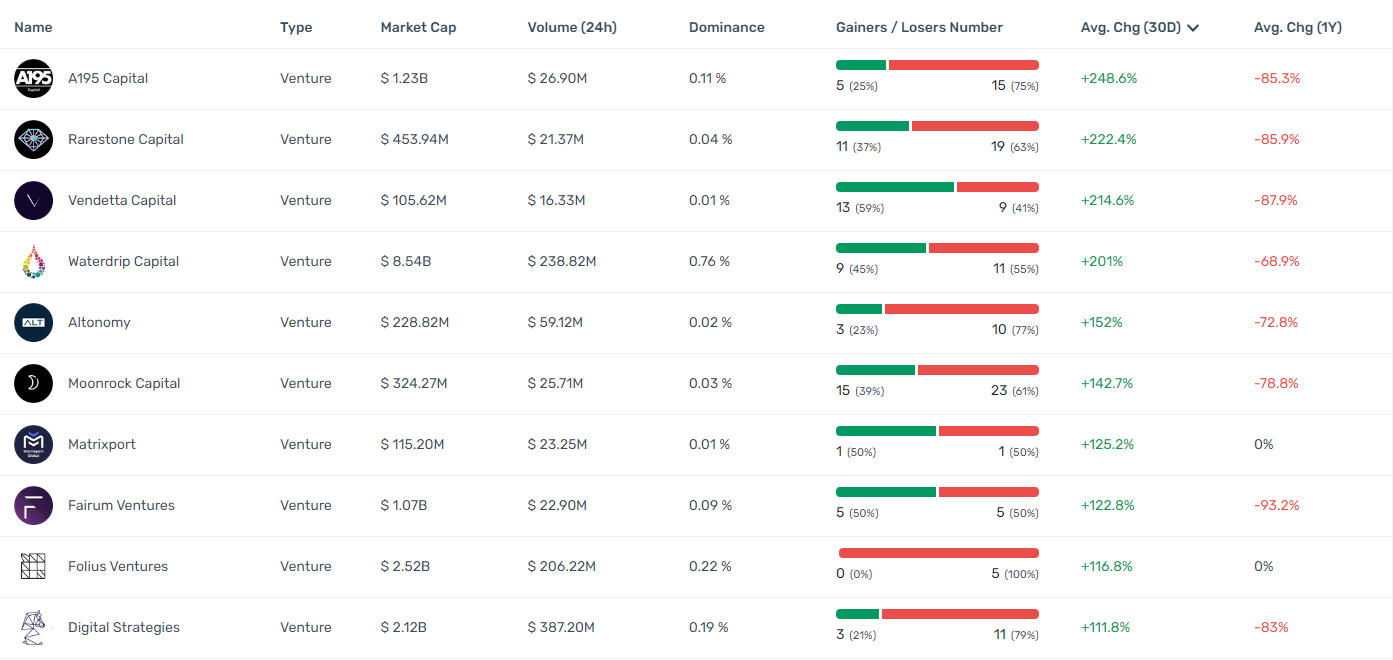

Data from CryptoRank shows that smaller, more nimble funds are making the triple-digit returns.

(CryptoRank)

And what are they investing in? Lesser known protocols. The stuff that climbs fast and falls hard. Stuff that would be part of a “scattershot” portfolio.

That’s not to say that the largest funds aren’t doing well in the last month.

(CryptoRank)

Coinbase Ventures, which was very busy throughout 2022 with 121 closed deals according to Pitchbook, has seen its token portfolio rise by 56% over the past month. Andreessen Horowitz (a16z) is around the same. Animoca Brands, which was rumored to be suffering from serious financial strife at the end of last year, has had its fortunes turn around in a big way.

But which thesis will win?

Important events

9:00 a.m. HKT/SGT(1:00 UTC) Eurozone Retail Sales (YoY/Jan)

10:30 p.m. HKT/SGT(14:30 UTC) Japan Overall Household Spending (YoY/Dec)

2:30 a.m. HKT/SGT(18:30 UTC) Reserve Bank of Australia Interest Rate Decision

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

Crypto Today: BNB, OKB, BGB tokens rally as BTC, Shiba Inu and Chainlink lead market rebound

Cryptocurrencies sector rose by 0.13% in early European trading on Friday, adding $352 million in aggregate valuation. With BNB, OKB and BGB attracting demand amid intense market volatility, the exchange-based native tokens sector added $1.9 billion.

US SEC may declare XRP a 'commodity' as Ripple settlement talks begins

The US SEC is considering declaring XRP as a commodity in the ongoing settlement talks with Ripple Labs. FOX News reports suggest Ethereum's regulatory status remains a key reference for XRP’s litigation verdict.

Cardano Price Prediction: ADA could hit $0.50 despite high probability of US Fed rate pause

Cardano price stabilized above $0.70 after posting another 5% decline in its 3rd consecutive losing day. Multiple ADA derivatives trading signals are leaning bullish, but the US trade war impact outweighs the positive shift in inflation indices.

Stablecoin regulatory bill receives green light during Banking Committee hearing

The US Senate Banking Committee voted on Thursday to advance the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, which aims to establish proper regulations for stablecoin payments in the country.

Bitcoin: BTC at risk of $75,000 reversal as Trump’s trade war overshadows US easing inflation

Bitcoin price remained constrained within a tight 8% channel between $76,000 and $84,472 this week. With conflicting market catalysts preventing prolonged directional swings, here are key factors that moved BTC prices this week, as well as key indicators to watch in the weeks ahead.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.