ALSO: The SEC's move on Kraken's staking program last week shouldn't be seen as an indictment of staking as a whole.

Good morning. Here’s what’s happening:

Prices: Bitcoin might test $20,000 or below, but there's still reason to be bullish about the world's largest digital asset.

Insights: The Securities and Exchange Commission's move against Kraken's staking program isn't an attack on staking as a whole.

Prices

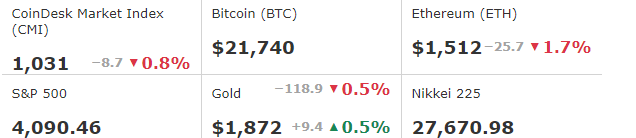

BTC/ETH prices per CoinDesk Indices, as of 7 a.m. ET (11 a.m. UTC)

Bitcoin Is Seeking Support

Happy Monday.

As Asia started the working week, the CoinDesk Bitcoin Price Index (XBX) fell to $21,750 and ether is down 1.8% to $1,514.

Joe DiPasquale of BitBull Capital says that bitcoin is now making an “underside test” having already lost the $23K and $22K levels that will determine if it will reclaim the $23K mark or fall to $20K “rather quickly.”

“The market is also reliant on macroeconomic developments, and given how December consumer prices were found to be higher than previously expected, the market may start to consider a bigger rate hike in the next FOMC,” he told CoinDesk in a note.

In looking for support, bitcoin is also digesting regulatory developments too. Last week, Kraken – but not Coinbase – was fined $30 million by the Securities and Exchange Commission (SEC) for its staking program. The Wall Street Journal also reports that Paxos is next on the SEC’s hit list as it targets the Binance USD stablecoin.

“Regulations are also a concern for the crypto space, especially after the $30 million fine the SEC imposed on Kraken exchange,” DiPasquale said. “That being said, we believe it is better to get regulatory clarity in a slow market, as opposed to stricter developments during a full-fledged bull market.”

Despite all this, DiPasquale said his firm remains bullish on bitcoin – even if it blows through support levels.

“[We] would be looking to accumulate more if prices drop sub-$20,000.”

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Solana | SOL | +2.7% | Smart Contract Platform |

| Shiba Inu | SHIB | +0.4% | Currency |

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Loopring | LRC | −5.3% | Smart Contract Platform |

| Decentraland | MANA | −5.0% | Entertainment |

| Gala | GALA | −4.3% | Entertainment |

Insights

Ether Liquid Staking Platforms Will Benefit as SEC Actions Likely Fail to Knock Out DeFi

Crypto exchange Kraken and the U.S. Securities and Exchange Commission (SEC) have settled over staking.

The regulated Kraken exchange has to pay a $30 million penalty and immediately cease its U.S. service. But, more importantly, staking continues in the United States. Staking refers to locking tokens for a set period to help support the operation of a blockchain. Liquid staking, on the other hand, issues a derivative token that represents the amount of locked tokens to user, allowing them to access decentralized finance (DeFi) services such as lending and borrowing.

The way Kraken offered staking was unique, which is why the exchange’s service was shuttered and the SEC didn’t go after Coinbase or make a move on decentralized liquid staking protocols.

Central to the SEC’s statement is a lack of transparency on Kraken’s part. Yes, on-chain data shows that Kraken is one of the largest validators, operating a big staking pool. But the SEC seems to be concerned about fund flow: Is ether deposited into Kraken intended for staking really going to staking? Or is it being lent out?

Liquid staking protocols such as Lido and Rocket Pool wouldn’t have that same problem. One could track their ether from their wallet into the pool via a block explorer or other chain monitoring tools.

In the initial hours after the market learned about the SEC’s interest in going after staking, via a Brian Armstrong tweet, liquid staking tokens such as Lido’s LDO surged and surged again when Kraken’s U.S. staking shop closed its doors.

A more reasonable explanation of the surge could come down to the SEC’s current "Yellow Light" towards staking. Staking as an investment strategy is not allowed, but staking as a technical service is.

As crypto lawyer Gabriel Shapiro tweeted: “Validation-as-a-service is not like an ‘earn’ program, not like taking capital into a business or fund. It’s a ministerial tech service.”

One thing that’s rather telling is that the total value locked of liquid staking protocols like Lido or Rocket Pool didn’t rise in the aftermath.

Since the start of the year, the total value locked in Lido has remained stable: It began the year at 4.9 million ether on Jan. 1, and is now around 5.19 million ether. Rocket Pool staked ether rose from around 472,000 to 608,000 during the same time period.

Important events

10:50 p.m. HKT/SGT(14:50 UTC) Japan Gross Domestic Product (QoQ)

6:00 a.m. HKT/SGT(22:00 UTC) United Kingdom Claimant Count Change (Jan)

6:00 a.m. HKT/SGT(22:00 UTC) United Kingdom ILO Unemployment Rate (Dec)

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.