Bitcoin’s drop-off coincides with a strengthening U.S. dollar; ether declines.

Good morning. Here’s what’s happening this morning:

Market moves: Bitcoin fell as U.S. stocks sagged and the U.S. dollar strengthened.

Technician’s take: Buying activity remains weak, which reduces the chance of a significant price rise into January.

Prices

Bitcoin (BTC): $48,123 -4.7%

Ether (ETH): $4,183 -5.3%

Markets

S&P 500: $4,667 -0.7%

Dow Jones Industrial Average: $35,754 -0.0001%

Nasdaq: $15,517 -1.7%

Gold: $1,775 -0.4%

Market moves

Bitcoin fell toward $48,000 on Thursday, sliding nearly 5% after hovering over $50,000 for much of the previous two days.

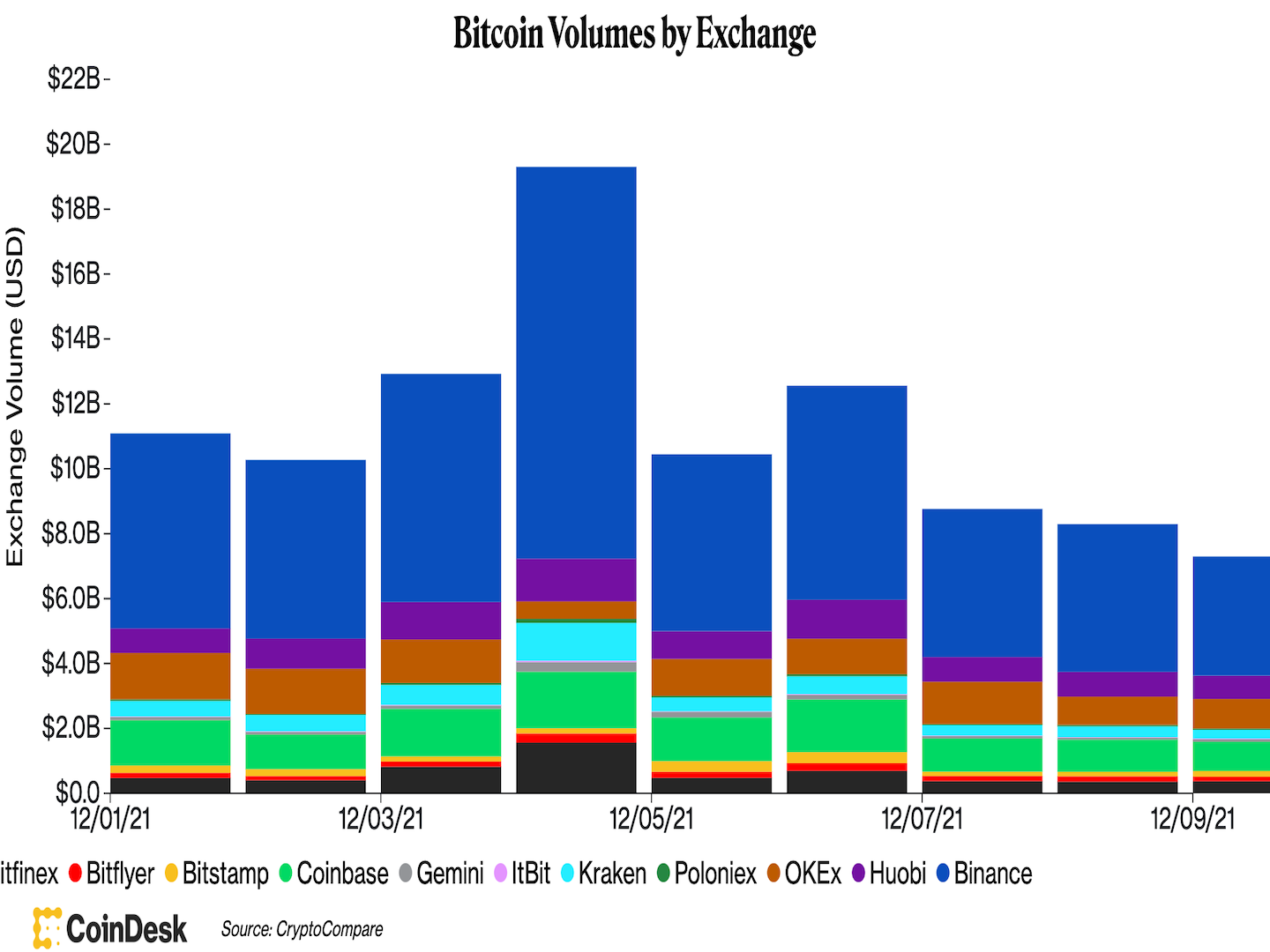

Trading volume of the No.1 cryptocurrency by market capitalization across major centralized exchanges, however, continued to drop.

Credit: CoinDesk/CryptoCompare

The majority of the crypto market was also in red: Ether was down by more than 5% to around $4,000. The bearish market performance occurred as U.S. stocks fell and the dollar index (DXY), which tracks the greenback’s value against major fiat currencies, rose by 0.28%.

As CoinDesk reported, a strengthened U.S. dollar brings downside pressure on bitcoin’s prices.

“The long-term bull case remains for bitcoin, but everything in the short-term seems bearish,” Edward Moya, senior market analyst at Oanda, said in an email. “Bitcoin will need to overcome growing expectations for a stronger dollar, an extended altcoin season and short-term bearishness for risk assets as Omicron derails reopening momentum.”

Technician’s take

Bitcoin's four-hour price chart shows support/resistance levels with RSI in second panel (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) continued to struggle below the $50,000 resistance level.

The short-term downtrend over the past month remains in effect, which could limit further upside beyond $50,000-$60,000.

The cryptocurrency is down about 4% over the past 24 hours, although support around the 200-day moving average (currently at $46,500) could stabilize the current pullback.

BTC buying activity remains weak despite several oversold signals on the charts. That reduces the chance of a significant price increase heading into January, especially given the loss of upside momentum on the weekly and monthly charts.

Important events

3 p.m. HKT/SGT (7 a.m. UTC): U.K. trade balance (Oct.)

3 p.m. HKT/SGT (7 a.m. UTC): U.K. industrial production (Oct. YoY/MoM)

3 p.m. HKT/SGT (7 a.m. UTC): Germany consumer price index (Nov. YoY/MoM)

9:30 p.m. HKT/SGT (1:30 p.m. UTC): U.S. consumer price index (Nov. YoY/MoM)

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

Is Altcoin Season here as Bitcoin reaches a new all-time high?

Bitcoin reaches a new all-time high of $98,384 on Thursday, with altcoins following the suit. Reports highlight that the recent surge in altcoins was fueled by the victory of crypto-friendly candidate Donal Trump in the US presidential election.

Shanghai court confirms legal recognition of crypto ownership

A Shanghai court has confirmed that owning digital assets, including Bitcoin, is legal under Chinese law. Judge Sun Jie of the Shanghai Songjiang People’s Court shared this opinion through the WeChat account of the Shanghai High People’s Court.

BTC hits an all-time high above $97,850, inches away from the $100K mark

Bitcoin hit a new all-time high of $97,852 on Thursday, and the technical outlook suggests a possible continuation of the rally to $100,000. BTC futures have surged past the $100,000 price mark on Deribit, and Lookonchain data shows whales are accumulating.

Shiba Inu holders withdraw 1.67 trillion SHIB tokens from exchange

Shiba Inu trades slightly higher, around $0.000024, on Thursday after declining more than 5% the previous week. SHIB’s on-chain metrics project a bullish outlook as holders accumulate recent dips, and dormant wallets are on the move, all pointing to a recovery in the cards.

Bitcoin: New high of $100K or correction to $78K?

Bitcoin surged to a new all-time high of $93,265 in the first half of the week, followed by a slight decline in the latter half. Reports highlight that Bitcoin’s current level is still not overvalued and could target levels above $100,000 in the coming weeks.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.