First Mover Asia: Bitcoin drops with stocks after fed official's hawkish remarks

After soaring past $45,000, the largest cryptocurrency by market cap plummeted to under $44,000 later in the day; ether and other major altcoins were in the red.

Good morning. Here’s what’s happening:

Market moves: Bitcoin fell as U.S. stocks dipped further on hot inflation data.

Technician's take: BTC is approaching overbought levels, although pullbacks could stabilize at between $40K and $43K.

Prices

Bitcoin (BTC): $43,807 -1.4%

Ether (ETH): $3,105 -4.1%

Top Gainers

| Asset | Ticker | Returns | Sector |

|---|---|---|---|

| Ethereum Classic | ETC | +3.7% | Smart Contract Platform |

| Bitcoin | BTC | +2.4% | Currency |

| Bitcoin Cash | BCH | +2.0% | Currency |

Top Losers

| Asset | Ticker | Returns | Sector |

|---|---|---|---|

| Internet Computer | ICP | −3.2% | Computing |

| Filecoin | FIL | −3.1% | Computing |

| Algorand | ALGO | −2.7% | Smart Contract Platform |

Markets

S&P 500: 4,504 -1.8%

DJIA: 35,421 -1.4%

Nasdaq: 14,185 -2.1%

Gold: $1,826 +1%

Market moves

Bitcoin (BTC) struggled to remain above $44,000 on Thursday, as U.S. stocks fell further following hawkish remarks by a Federal Reserve official.

Responding to a surprisingly high rate of inflation, Federal Reserve Bank of St. Louis President James Bullard said he supported raising interest rates by a full percentage point by July, Bloomberg reported. His comments came after the U.S. Labor Department on Thursday reported that the consumer price index (CPI) for January hit 7.5%, which was higher than what analysts expected earlier.

Bitcoin started falling as stock prices fell further from an initial drop earlier in the day. At the time of publication, the oldest cryptocurrency was changing hands at $43,807 down 1.4% in the past 24 hours, according to CoinDesk data.

Meanwhile, ether, the second biggest cryptocurrency by market capitalization, was down over 4% to $3,105 in the same period.

“Things like gold and BTC often have a brief drop in hot CPI prints because the market starts quickly assuming faster rate hikes by the Fed,” Lyn Alden Schwartzer, the founder of Lyn Alden Investment Strategy, explained in her tweet on Thursday.

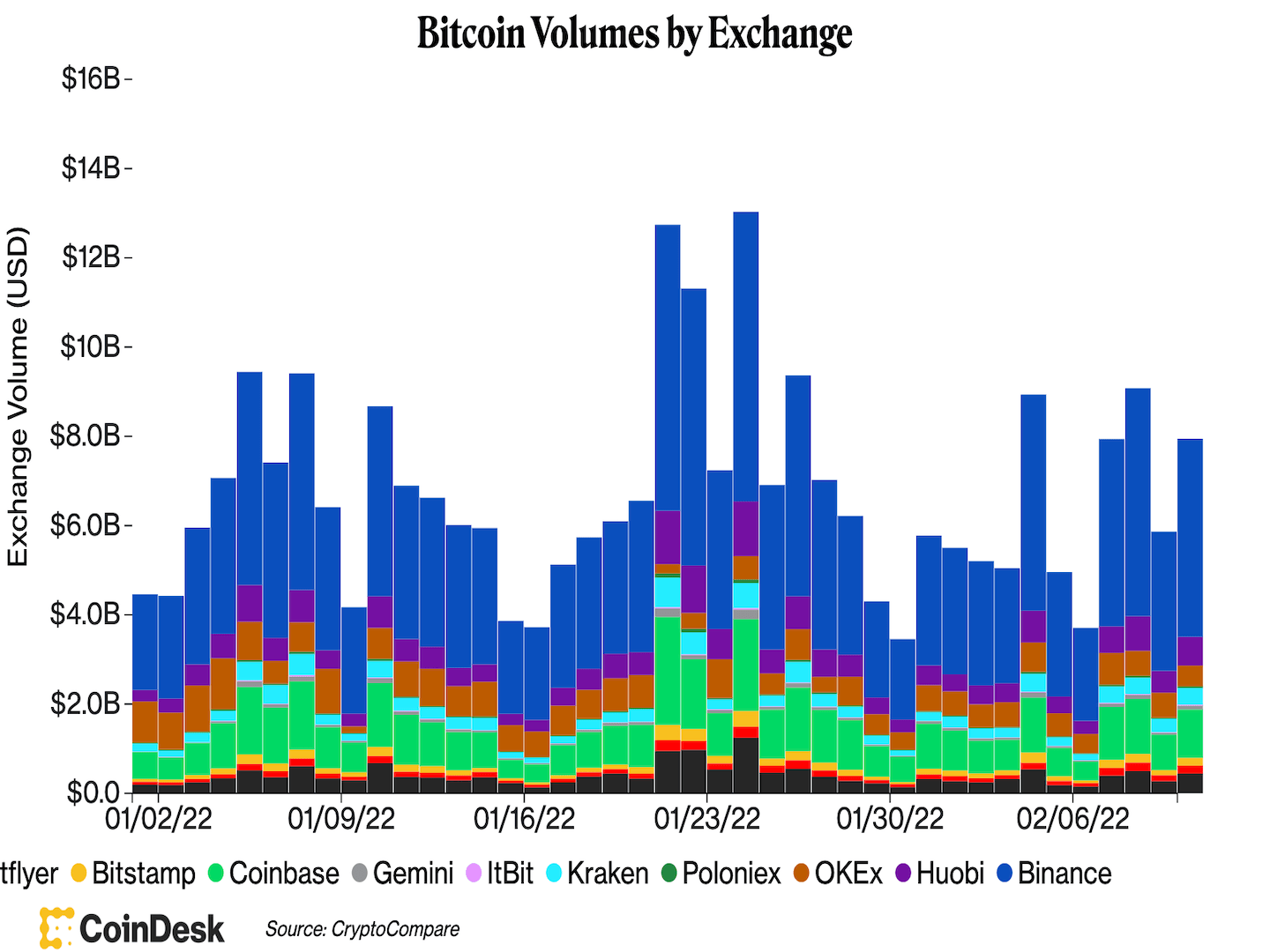

Bitcoin's spot trading volume across centralized exchanges also rose on Thursday from a day ago. Trading volume in general was higher than a week ago, based on data compiled by CoinDesk.

Technician's take

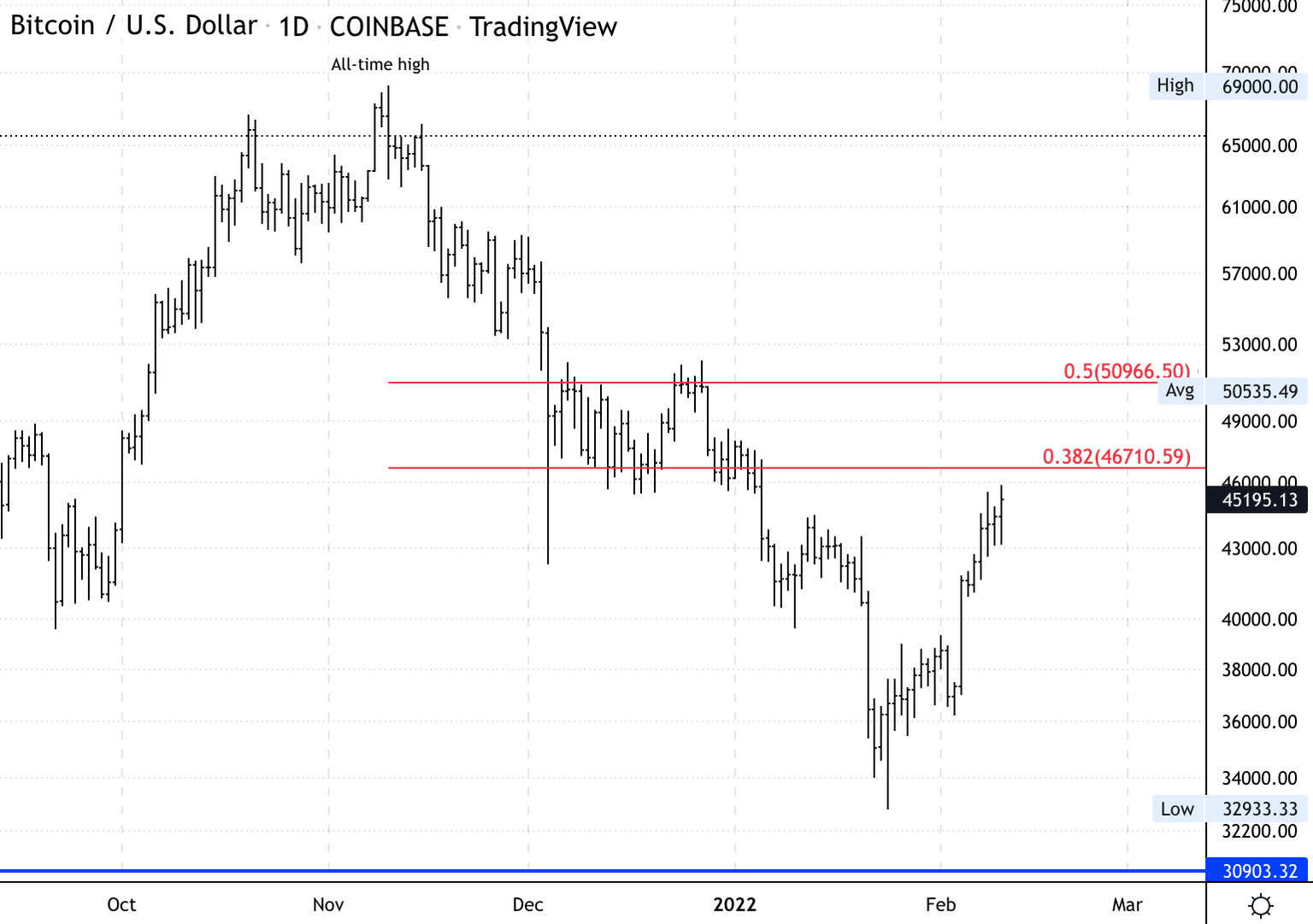

Buyers reacted quickly to a nearly 5% price drop early in the New York trading session and maintained short-term support at above $43,000.

The next level of resistance is at $46,710, which represents a 38% retracement of the previous two month-long downtrend. Buyers could start to exit positions as BTC approaches resistance heading into the Asia trading session.

For now, momentum signals are improving on intraday charts, although price action is volatile following the U.S. inflation report. Stronger resistance is seen at $50,000 if buyers sustain short-term momentum.

Pullbacks could stabilize in the $40,000-$43,000 range.

Important events

10 a.m. HKT/SGT (2 a.m. UTC): Reserve Bank of New Zealand inflation expectations (Q4/QoQ)

3 p.m. HKT/SGT (7 a.m. UTC): U.K. goods trade balance (Dec.)

3 p.m. HKT/SGT (7 a.m. UTC): U.K gross domestic product (Q4/QoQ/YoY preliminary)

3 p.m. HKT/SGT (7 a.m. UTC): U.K. industrial production (Dec. MoM/YoY)

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.