Trading activity could be light in the coming week because of the U.S. Thanksgiving holiday; ether holds steady above $4,300.

Good morning. Here’s what’s happening this morning:

Market moves: Bitcoin continues to drift below $60,000 as Biden tees up his pick for Federal Reserve chair.

Prices

Bitcoin (BTC): $59,172 -0.8%

Ether (ETH): $4,327 -1.81%

Market moves

Bitcoin continued to drift below $60,000, as cryptocurrency analysts looked ahead to a week of possible, reduced trading activity as a result of the U.S. Thanksgiving holiday on Thursday. Ether held steady for much of the weekend above $4,300.

Investors following bitcoin as an inflation hedge will also look for an early read on how holiday shoppers are responding to the fastest consumer-price increases in three decades. That’s especially true as supply-chain bottlenecks stymie deliveries on some items while discouraging retailers from offering deep discounts.

Another highlight this week could come from an expected announcement from U.S. President Joe Biden for his pick to lead the Federal Reserve. The announcement could have implications for cryptocurrency industry regulation and monetary policy, although some experts say the two top candidates – current Chair Jerome Powell and Fed Governor Lael Brainard – are so similar in their policy positions that the choice may not make a big difference.

The weekend saw little evidence of any breakout from the recent market pattern, where bitcoin appears to be establishing a new price range around the pivotal $60,000 level.

“Prices will likely be contained, with a slight bearish bias,” the digital-asset firm Eqonex wrote Sunday in a newsletter.

A failure to hold above $58,850 could see prices drift down toward $56,670, and from there, “a deeper retracement” to $53,165 is possible, according to Eqonex. A move higher could quickly see prices trade up to $61,750, but gains are likely to be capped around $64,850.

Technician’s take

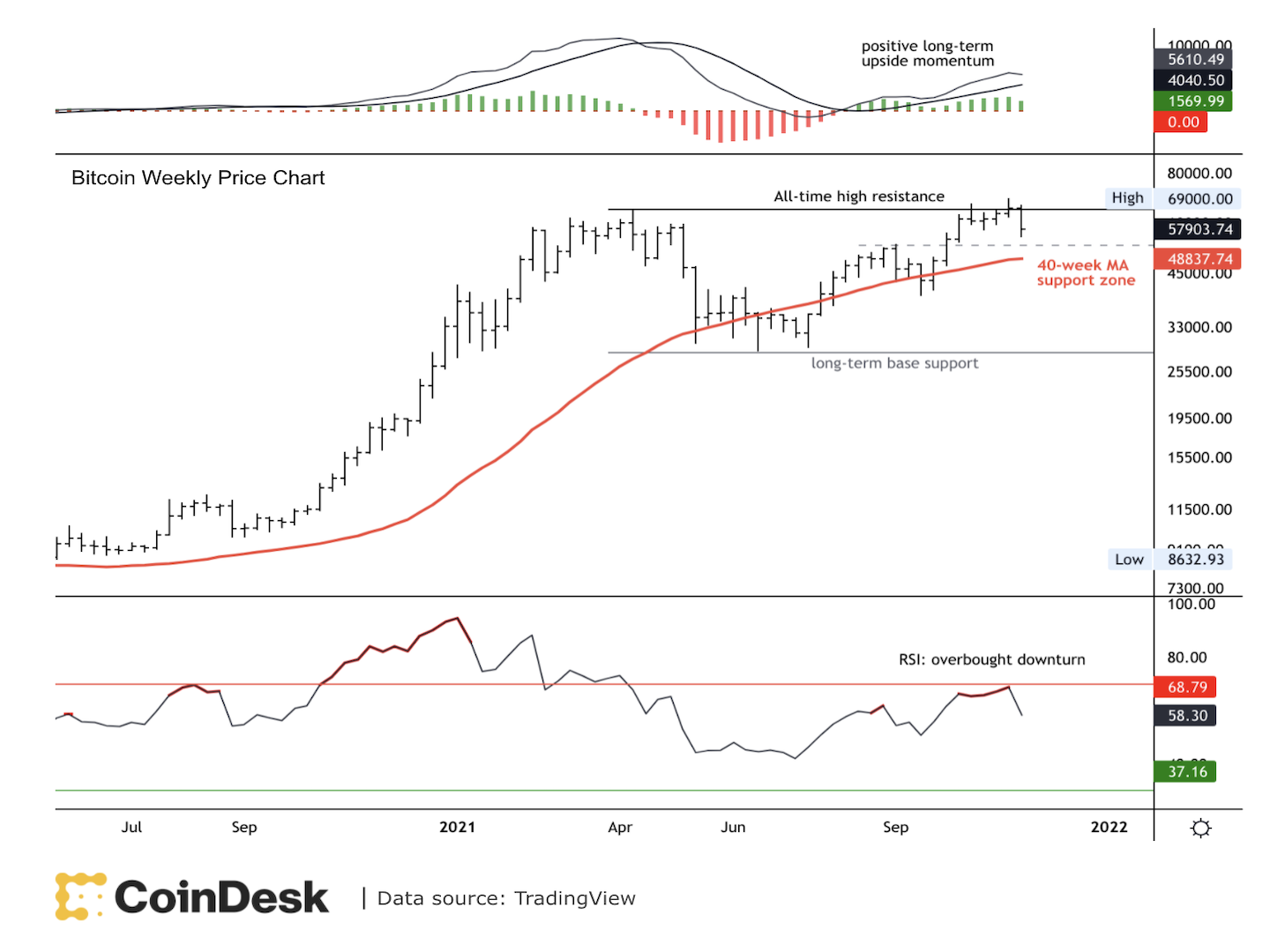

Bitcoin (BTC) is stabilizing after a near 10% decline over the past week. The cryptocurrency is holding initial support above $56,000, although resistance around $65,000 could limit further upside over the short term.

The relative strength index (RSI) is oversold on intraday charts, which could encourage brief buying activity. On the daily chart, the RSI is approaching oversold conditions similar to late September, which preceded a price recovery.

On the weekly chart, bitcoin’s long-term uptrend remains intact given the upward sloping 40-week moving average. Momentum is still positive on a weekly basis, which is consistent with a bullish uptrend. And the monthly price chart shows no signs of upside exhaustion yet.

However, the weekly RSI is declining from overbought levels, albeit less extreme relative to January. This means bitcoin is vulnerable to higher volatility as buyers take some profits.

For now, bitcoin will need to hold support and sustain a breakout above $69,000 in order to yield an upside target toward $85,000.

Important events

- 6 p.m. HKT/SGT (10 a.m. UTC): European Commission consumer confidence Index (Nov.)

- 6 p.m. HKT/SGT (10 a.m. UTC): U.S. existing home sales (Oct. MoM)

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

XRP Price Prediction: Bearish technicals, on-chain indicators signal 68% potential crash

XRP faces increasing bearish sentiment from macro, micro and fundamental factors in April. Weak on-chain indicators ranging from network growth, total supply and active addresses reinforce an impending crash.

Bitcoin Price Forecast: Tariff volatility sweeps over $200 billion from crypto markets

Bitcoin price hovers around $83,000 on Thursday after it failed to close above the $85,000 resistance level the previous day. Volatility fueled by Trump’s tariffs swept $200 billion from total market capitalization, liquidating over $178 million in BTC.

SOL is the winner as Solana chain turns into battleground for meme coin launchpad and DEX

Solana (SOL) gains nearly 2% in the last 24 hours and trades at 118.28 at the time of writing on Thursday. A Decentralized Exchange (DEX) and a meme coin launchpad built on the Solana blockchain have waged a war for users and compete for the trade volume on the chain.

Shibarium, built for the Shiba Inu blockchain, reaches 1 billion in transactions in 18 months after its launch

Shibarium, a Layer-2 blockchain for the Shiba Inu ecosystem, reaches 1 billion transactions 18 months after its launch. This milestone reflects growing adoption and Shibarium’s robust performance.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.