Cryptos were largely in the green, although trading was choppy; India crypto investors receive some upbeat news.

Good morning. Here’s what’s happening:

Prices: Cryptos climbed late in the date, but not enough to dispel the prolonged bearish sentiment.

Insights: Indian crypto investors receive some upbeat news.

Technician's take: BTC continues to trade at about $30,000 as indicators remain neutral.

Prices

Bitcoin (BTC): $30,600 +2.4%

Ether (ETH): $1,842 +0.3%

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Internet Computer | ICP | +25.7% | Computing |

| Cardano | ADA | +6.2% | Smart Contract Platform |

| Stellar | XLM | +4.7% | Smart Contract Platform |

Biggest Losers

There are no losers in CoinDesk 20 today.

Bitcoin Climbs Late, but the Mood Remains Bearish

A late afternoon surge on Thursday carried bitcoin past $30,000, but the mood among cryptocurrency investors remained pessimistic.

The largest crypto by market capitalization was recently trading at about $30,600, a more than 2% gain over the previous 24 hours. Ether was changing hands at just above $1,800, up slightly for the same period. Most other major cryptos rose late with ADA recently rising nearly 6%, and APE up over 4%. Trading was choppy as investors continued to shy away from riskier assets – their behavior a product of inflationary and recessionary fears that have mushroomed steadily this year.

"Bitcoin will get its groove back once bearish sentiment on Wall Street improves, but that will likely take several more weeks," Oanda Senior Markets Analyst Edward Moya wrote in an email.

Stocks rose as the tech-heavy Nasdaq jumped 2.6%, the S&P 500 climbed 1.8% and the Dow Jones Industrial Average gained 1.2%. Gold, a traditional safe haven in down markets, increased by more than a percentage point, underscoring the current uncertainty among investors.

The Organization of Petroleum Exporting Countries and allied countries said that they would boost the supply of oil by an unexpectedly large amount. The U.S. and other countries had been pressing the organization to loosen its current limits to help lower energy prices. The price of Brent crude oil, which is a widely watched measure of energy markets, rose to $118 per barrel, a more than 53% spike since the start of the year.

The looming prospect of recession continued to ripple through the technology sector on Thursday with Microsoft (MSFT) ratcheting back its earnings and sales projections for the current quarter. Amazon (AMZN) and Netflix (NFLX), among others, reported weak first-quarter financial results last month, noting the effects of Russia's invasion of Ukraine and unsettling macroeconomic conditions.

The crypto industry has also felt the impact of the current, dour economic mood with crypto exchange Coinbase announcing in a blog post by Chief People Officer L.J. Brock, that it would "extend our hiring pause for both new and backfill roles for the foreseeable future and rescind a number of accepted offers." The move came a just hours after crypto exchange and custodian Gemini, the brainchild of billionaire twins Cameron and Tyler Winklevoss, said it would lay off 10% of its workforce, approximately 100 employees.

The crypto industry is currently in a “contraction phase that is settling into a period of stasis,” also known as a “crypto winter,” the twins wrote in a blog post.

Oanda's Moya noted that investors' "risk appetite" will depend on "expectations" of what the U.S. central bank "will do beyond the summer."

"Bitcoin is forming a base but most traders are still licking their wounds," he wrote. "If bitcoin can recapture the $33,500 level, that is what is needed for technical buying to get triggered."

Markets

S&P 500: 4,176 +1.8%

DJIA: 33,248 +1.3%

Nasdaq: 12,316 +2.6%

Gold: $1,868 +1.2%

Insights

Upbeat News for Indian Crypto Investors

India's crypto investors had some upbeat news for a change with CoinSwitch Kuber's announcement on Thursday that it had launched a rupee-denominated index to provide real-time information on the performance of the eight largest cryptocurrencies by market capitalization.

The Crypto Rupee Index (CRE8) is a first in the Indian market, which has previously had to "rely on the international indices based on the US Dollar," CoinSwitch Kuber CEO and co-founder Kuber Ashish Singhal tweeted. "But these indices do not give the true picture of the Indian market and miss the supply-demand dynamics of India’s growing investor base," he added.

CoinSwitch Kuber is among the country's largest crypto exchanges with a self-reported 18 million users of its app. Its investors include venture capital heavyweights Andreessen Horowitz (a16z), Coinbase Ventures, Tiger Global and Sequoia Capital.

The announcement follows a difficult few months for the digital assets industry in India, despite the country's growing appetite for cryptocurrencies. In April, Indians began paying a 30% capital gains tax on crypto transactions after Parliament passed a controversial tax law. The legislation, which the industry vehemently opposed, will also require crypto investors in the country to pay a 1% tax deducted at source (TDS), as well as taxes on crypto gifts, with no ability to take deductions for losses, starting on July 1.

Trading volumes plunged on major Indian exchanges in the days after the capital gains tax went into effect with at least one analyst predicting that they would not return to pre-tax law levels. The industry was subsequently rocked by the rough launch of Coinbase's crypto trading services in the country.

CoinSwitch Kuber said CRE8 will be refreshed over 1,400 times a day to ensure it reflects real-time market movement, and that it will track eight crypto assets that represent over 85% of the total market capitalization of the crypto market traded in Indian rupees.

Singhal noted Indian investors' demand for better crypto services and information. "#CRE8 is a demonstration of our commitment to bring more transparency to the Indian crypto market and equip users with a simple, easy-to-understand measure of the Indian market. Indian investors and market observers no longer have to second-guess how the Indian Crypto market is behaving," Singhal tweeted.

Technician's take

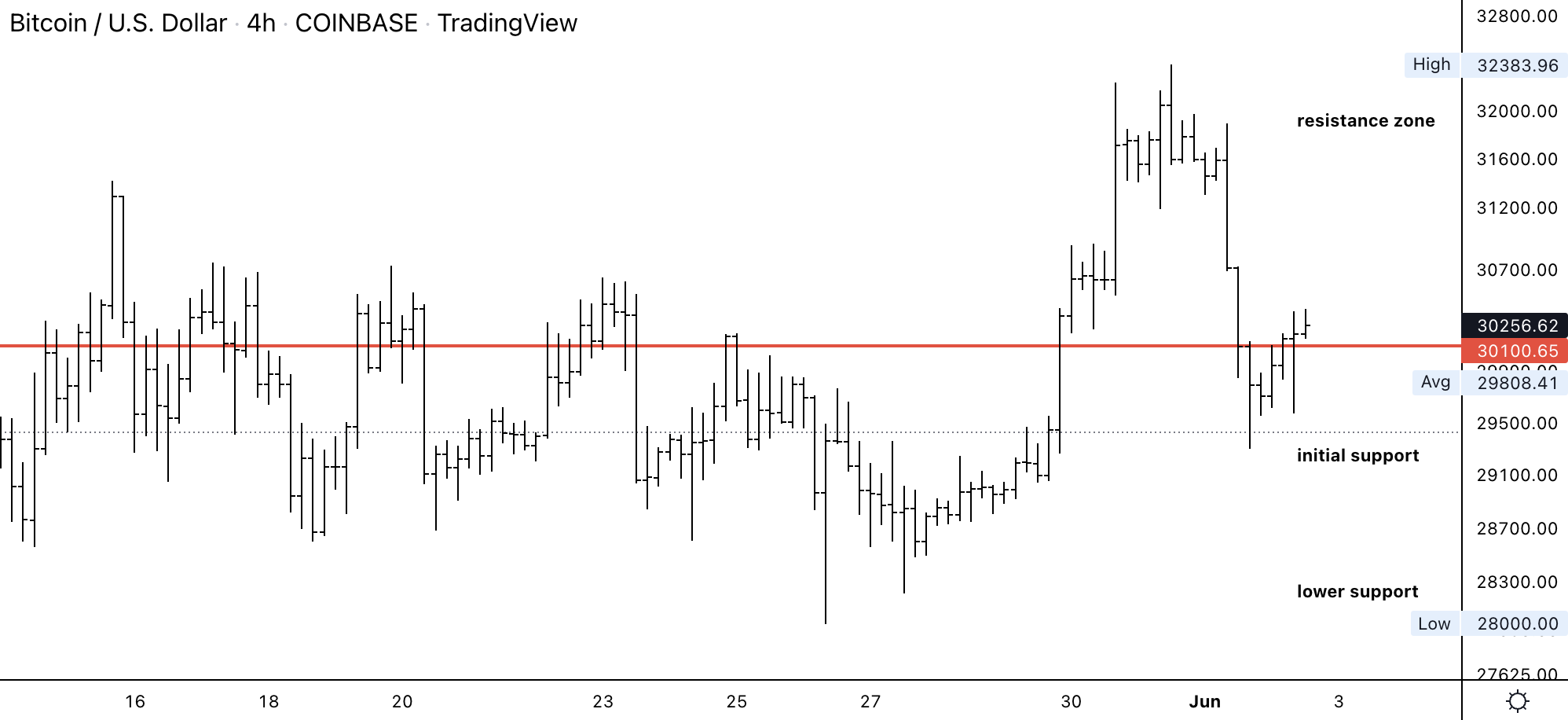

Bitcoin's four-hour price chart shows support/resistance (Damanick Dantes/CoinDesk, TradingView)

Bitcoin held initial support near $29,300, which was where an upswing in price originated over the past weekend. As of Thursday afternoon, the cryptocurrency remained in a tight intraday range, with a midpoint at $30,100. That's where the most trading volume occurred over the past two weeks. For now, BTC's price could continue to revert to that midpoint level until a decisive breakout or breakdown is confirmed.

Upside appears to be limited at between the $33,000-$35,000 resistance zone, especially as momentum signals remain negative on long-term charts.

Still, momentum remains positive on the daily chart, which could keep short-term buyers active. The 14-day relative strength index (RSI) will need to return above the 50 neutral mark to sustain a recovery bounce in price.

Important events

Blockchain Fest Singapore 2022

4 p.m. HKT/SGT(8 a.m. UTC) Eurostat S&P PMI (May)

8:30 p.m. HKT/SGT(12:30 p.m. UTC) U.S. unemployment rate (May)

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.