First Mover Asia: Bitcoin below $40k before regaining ground; altcoins fall

The declines followed U.S. stock exchange losses as investors anticipate continued hawkishness by the U.S. Federal Reserve.

Good morning. Here’s what’s happening:

Market moves: Bitcoin fell below $40,000 briefly as U.S. stocks continued to drop thanks to a newly hawkish Federal Reserve.

Prices

Bitcoin (BTC): $41,797 -0.2%

Ether (ETH): $3,077 -2.6%

Markets

S&P 500: $4,670 -0.1%

DJIA: $36,068 -0.4%

Nasdaq: $14,942 +0.05%

Gold: $1,801 +0.3%

Market moves

Bitcoin fell again on Monday during U.S. trading hours after a small recovery over the weekend. The bearish price move came after U.S. stock market losses deepened as investors brace for actions from a more hawkish Federal Reserve.

The most valued cryptocurrency fell below $40,000 briefly in early hours before it moved back above $41,000. At press time, bitcoin was changing hands at over $41,500, down about 1% in the past 24 hours, according to CoinDesk data.

Last week, prices of the oldest cryptocurrency fell for six straight days after Fed minutes revealed policymakers had discussed aggressive interest rate hikes alongside a faster pace to normalize its balance sheet.

“The tightening of financial conditions is expected to negatively impact risk assets such as equities and crypto as they become less attractive than safe-haven bonds,” crypto trading data firm Kaiko wrote in its weekly newsletter on Monday.

According to Kaiko, the impact of the Fed’s December meeting has sent the correlation between bitcoin and traditional assets to the highest in more than a year.

(Kaiko)

“The Federal Reserve’s December meeting had a strong impact on global financial markets, with traders reacting swiftly to the prospect of monetary tightening,” Kaiko wrote. “During the volatility, bitcoin behaved strongly like a risk asset.”

Following bitcoin, most of the major cryptocurrencies were also in the red on Monday. Ether, the second-biggest cryptocurrency by market capitalization, plummeted below $3,000 at one point before it returned above $3,000.

Technician’s take

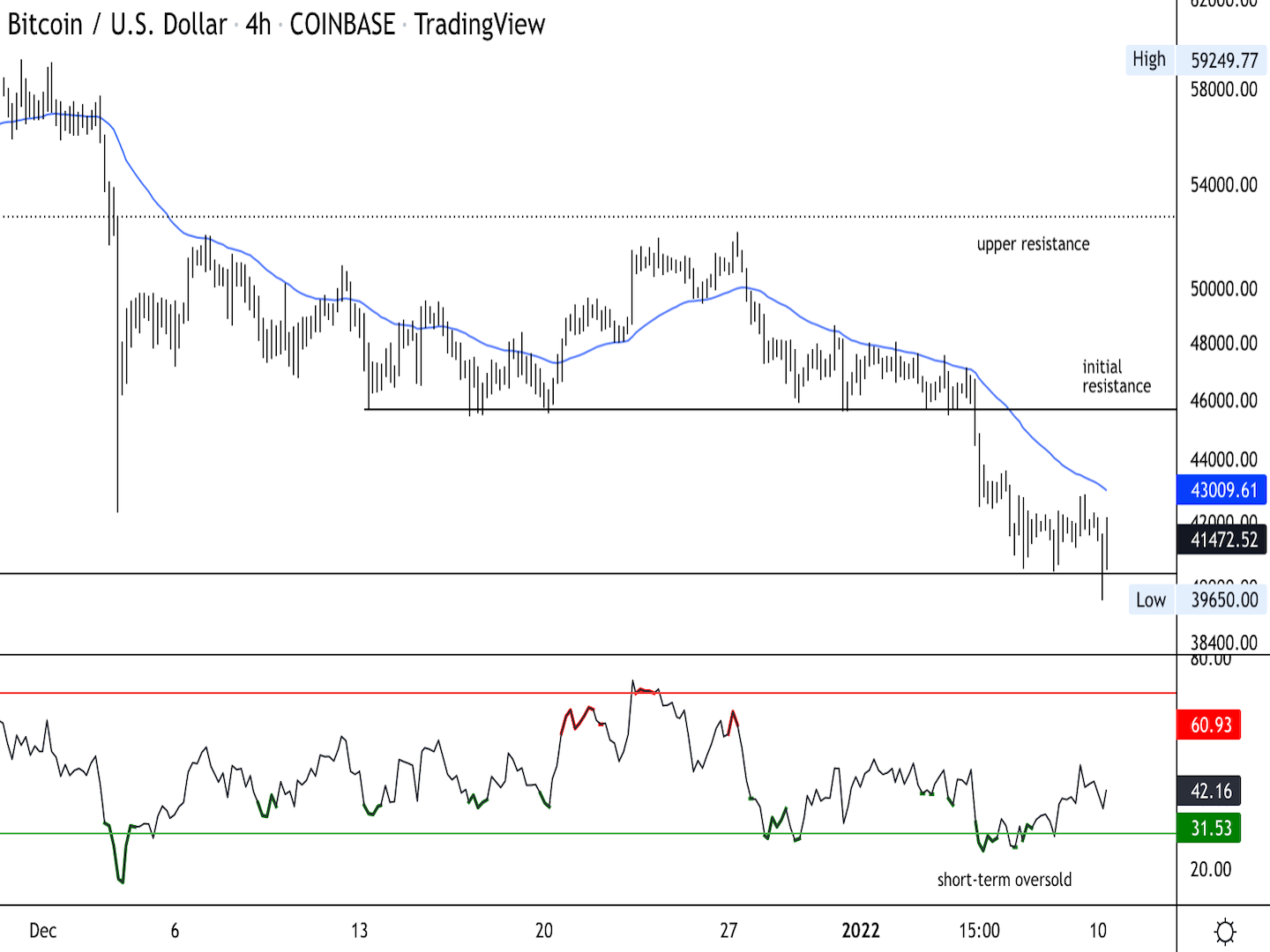

Bitcoin stabilized above $40k support; resistance near $45K

Bitcoin four-hour price chart shows support/resistance with RSI on bottom (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) selling pressure is starting to wane after last week’s price dip. The cryptocurrency is holding short-term support at around $40,000, although upside appears to be limited near $43,000-$45,000.

BTC was down about 2% over the past 24 hours, although the price action has been fairly muted over the past few days.

The relative strength index (RSI) on the four-hour chart is rising from oversold levels, which typically precedes a brief price bounce. On the daily chart, the RSI is the most oversold since Dec. 10.

Upside momentum has weakened given BTC’s two-month long downtrend. This means sellers could remain active around resistance levels.

Important events

8:30 a.m. HKT/SGT (12:30 a.m. UTC): Australia imports and exports (Nov. MoM).

8:30 a.m. HKT/SGT (12:30 a.m. UTC): Australia retail sales (Nov. MoM).

8:30 a.m. HKT/SGT (12:30 a.m. UTC): Australia trade balance (Nov. MoM).

1 p.m. HKT/SGT (5 a.m. UTC): Japan leading economic index (Nov. MoM).

11 p.m. HKT/SGT (3 p.m. UTC): U.S. Federal Reserve Chair Jerome Powell testifies before Congress.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.