The head of the U.S. central bank told the Senate Banking Committee the Fed would continue its tactics to combat rising inflation.

Good morning. Here’s what’s happening:

Market moves: Bitcoin led a broad crypto recovery ahead of the U.S. CPI release.

Technician’s take: Buyers started to return to the market, although the upside seemed limited to the $45,000 level.

Prices

Bitcoin (BTC): $42,806 +2.4%

Ether (ETH): $3,240 +5.2%

Markets

S&P 500: $4,713 +0.9%

DJIA: $36,252 +0.5%

Nasdaq: $15,153 +1.4%

Gold: $1,821 +1.1%

Market moves

Bitcoin went up as high as $43,106 on Tuesday, leading a broad market recovery in crypto. The move came after the stock market in the U.S. halted its five-day rout ahead of the Consumer Price Index (CPI) data release on Wednesday.

At the time of publication, the most valued cryptocurrency was changing hands above $42,800, up over 2% in the past 24 hours, according to CoinDesk data.

(CoinDesk)

Bloomberg reported the stock market climbed on Tuesday after Jerome Powell, the chair of the Federal Reserve, reassured investors the Fed will combat the current high inflation, signaling the central bank may reduce its balance sheet this year.

As CoinDesk reported, bitcoin and the broad crypto market have behaved strongly like a risk asset recently.

A key event to watch on Wednesday is the release of December’s U.S. consumer price index (CPI). Economists anticipate a 0.5% month-to-month increase in CPI to 7.1%.

In the past two months, bitcoin’s price experienced high volatility after the CPI data release. While some crypto traders and investors view bitcoin as a hedge against inflation, others consider it as a risk asset like stocks, which react to tightened monetary policy resulting from high inflation.

Most other major cryptocurrencies also rose on Tuesday. Ether, the second-biggest cryptocurrency by market capitalization, was up over 5% to above $3,200, at the time of publication. Layer 1 token NEAR remained the biggest winner. It is up nearly 13% over the past week despite the crypto sell-off.

Technician’s take

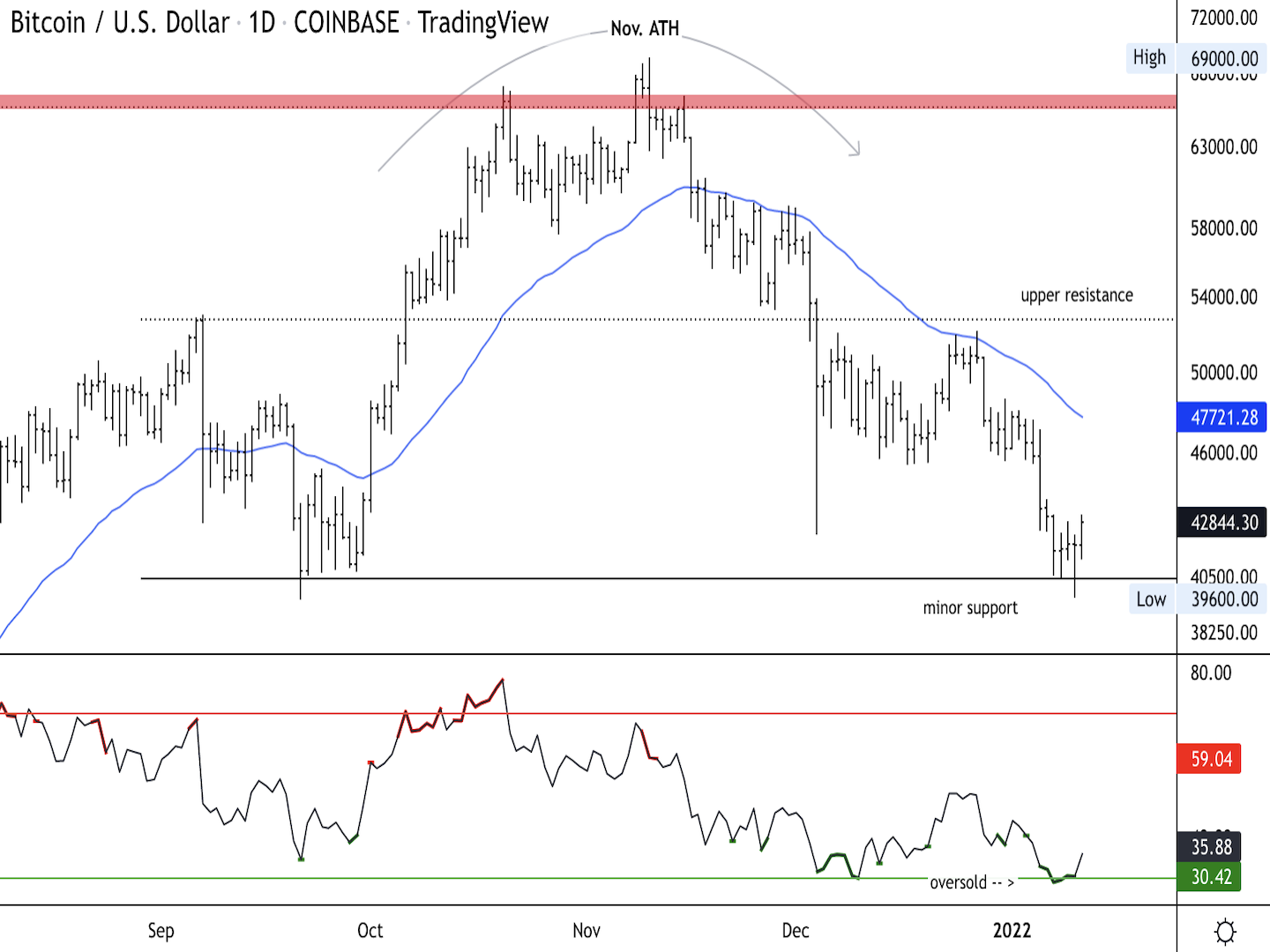

Bitcoin rises from oversold levels, faces resistance near $45K

Bitcoin daily price chart shows support/resistance, with RSI on bottom. (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) went trading above the $40,000 support level and was up about 3% over the past 24 hours from 9 p.m. UTC. Buyers are starting to return to the market, although the upside appeared to be limited to the $45,000 resistance level, which is also near the 200-day moving average.

On intraday charts, upside momentum is improving, which suggests buyers could remain active into the Asia trading day.

BTC is the most oversold since Dec. 10, according to the relative strength index (RSI) on the daily chart. Typically, oversold readings precede price recoveries, similar to what occurred in late September. This time, however, price reaction to the RSI and other indicators have been delayed.

Still, on the weekly chart, the RSI is not yet oversold, which decreases the chance of significant buying pressure.

Important events

Australia Housing Industry Association new home sales (MoM Dec.).

8 a.m. HGT/SGT (12 a.m. UTC): Australia and New Zealand commodity price (Dec.).

9 a.m. HGT/SGT (1 a.m. UTC): Bank of Japan Governor Haruhiko Kuroda press conference about monetary policies.

9:30 a.m. HGT/SGT (1:30 a.m. UTC) China consumer price index (Dec. MoM/YoY).

9:30 p.m. HGT/SGT (1:30 p.m. UTC) U.S. consumer price index (Dec. MoM/YoY).

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

Crypto fraud soars as high-risk addresses on Ethereum, TRON networks receive $278 billion

The cryptocurrency industry is growing across multiple facets, including tokenized real-world assets, futures and spot ETFs, stablecoins, Artificial Intelligence (AI), and its convergence with blockchain technology, as well as the dynamic decentralized finance (DeFi) sector.

Bitcoin eyes $100,000 amid Arizona Reserve plans, corporate demand, ETF inflows

Bitcoin price is stabilizing around $95,000 at the time of writing on Tuesday, and a breakout suggests a rally toward $100,000. The institutional and corporate demand supports a bullish thesis, as US spot ETFs recorded an inflow of $591.29 million on Monday, continuing the trend since April 17.

Meme coins to watch as Bitcoin price steadies

Bitcoin price hovers around $95,000, supported by continued spot BTC ETFs’ inflows. Trump Official is a key meme coin to watch ahead of a stakeholder dinner to be attended by President Donald Trump. Dogwifhat price is up 47% in April and looks set to post its first positive monthly returns this year.

Cardano Lace Wallet integrates Bitcoin, boosting cross-chain capabilities

Cardano co-founder Charles Hoskinson announced Monday that Bitcoin is integrated into the Lace Wallet, expanding Cardano’s ecosystem and cross-chain capabilities. This integration enables users to manage BTC alongside Cardano assets, providing support for multichain functionality.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.