First Mover Asia: Binance’s USDC swap-out isn’t what you think it is; What's behind Bitcoin's late dive?

The exchange is hoping to generate one big pool for USD stablecoins to be used for trading and powered by Binance’s USD stablecoin; bitcoin drops below $19K.

Good morning. Here’s what’s happening:

Prices: Bitcoin's falls below $19K after a late Tuesday plunge.

Insights: Binance’s USDC swap-out isn’t what you think it is.

Prices

- Bitcoin (BTC): $18,857 −6.3%

- Ether (ETH): $1,538 −8.0%

- S&P 500 daily close: 3,908.19 −0.4%

- Gold: $1,707 per troy ounce +NaN%

- Ten-year Treasury yield daily close: 3.34% +0.1

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

Bitcoin Plunges Below $19K; Ether Falls as Well

By James Rubin

After cruising along just under $20,000 for much of the past four days, bitcoin took a late Tuesday plunge below $19,000.

The largest cryptocurrency by market capitalization was recently trading at about $19,850, down more than 6% over the previous 24 hours, as investors burrowed more deeply into risk-off mode. The decline followed the release of the Institute of Supply Management's (ISM) monthly services index showing an unexpected increase in activity among the 15 industries measured in the report. The August ISM underlined the likelihood of further steep interest rate hikes by the U.S. central bank to slow the resilient economy as it seeks to tame inflation.

"The September swoon is in play as a resilient economy paves the way for more Fed tightening," Oanda Senior Market Analyst Edward Moya wrote in an email.

Moya added: "The retail trader is starting to panic again as meme stocks and cryptos fall under pressure. Bitcoin is breaking below the key technical levels."

After surging early Tuesday and outperforming bitcoin, Ether also plummeted. The second largest crypto in market value was recently trading near $1,530, off roughly 8% as ETH excitement over the Merge, the change of protocol from proof-of-work to more energy efficient proof-of-stake lessened.

Other major cryptos were solidly red after promising beginnings on the first work day following the long U.S. Labor Day holiday weekend. ETC's price, which was trading had risen 28% early Tuesday over the previous 24 hours to trade at $41, was more recently down 14% and changing hands below $35. UNI was off almost 16%.

Equity markets also closed down, albeit less dramatically with the tech-focused Nasdaq, S&P 500 and Dow Jones Industrial Average (DJIA) all down by a few fractions of a percentage point. "Stocks are going to struggle because too much of the economy is doing well and that leaves Wall Street vulnerable to an extended period of rising interest rates," Moya wrote.

Moya noted bitcoin's continued correlation with tech stocks, and he called "the surge with Treasury yields, which rose to nearly 3.5% – their second highest level of 2022 – "a troubling sign."

"Many are starting to doubt that the peak in yields is in place and that could spell trouble for Bitcoin," he wrote. "Bitcoin selling pressure will next eye the summer lows just ahead of the $17,500 level."

Biggest Gainers

There are no gainers in CoinDesk 20 today.

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Chainlink | LINK | −10.9% | Computing |

| Polygon | MATIC | −10.9% | Smart Contract Platform |

| Avalanche | AVAX | −10.2% | Smart Contract Platform |

Insights

Binance’s USDC Swap-Out Isn’t What You Think it Is

By Sam Reynolds

On the surface, Binance removing stablecoins it doesn’t control, like USDC and True USD (TUSD), and converting the balances to BUSD looks bad – like antitrust bad, as there’s a platform swapping out the support of its competitor’s product for its own.

But that’s a surface-level analysis.

The reality is not quite that. Binance will still support other stablecoins. It will allow the deposit and withdrawal of USDC, TUSD and others (just not Tether). What the exchange is hoping to accomplish is having one big pool for USD stablecoins to be used for trading – powered by Binance’s USD stablecoin – similar to how FTX pools all stablecoins together under a generic “USD & stablecoins category.

Wallet (FTX screenshot)

“Removing most stablecoin pairs is a good thing. Liquidity doesn’t have to be split between multiple stablecoins, making market makers’ job easier and markets overall more liquid,” Evgeny Gaevoy, CEO of Wintermute, a market maker for digital assets, tweeted.

Gaevoy highlighted that this change actually makes transactions more seamless and frictionless. Binance’s margined products were all denominated in BUSD anyway so there was a conversion required.

“Now you can skip the conversion step both ways (for BUSD margined products). It’s a better customer journey all while keeping USDC useful (I’d even argue more useful),” he tweeted.

But why isn’t Tether included in this list of stablecoin products Binance will convert to BUSD?

Gaevoy thinks it's because U.S. regulators hate Tether, meaning that Silvergate and Signature, two large crypto-friendly banks in the U.S., won’t touch it.

All this is similar to how FTX treats Tether. USDT is viewed as an asset being 1:1 to the USD, but not a stablecoin.

Burak Tamac, senior researcher at CryptoQuant, has a slightly different view. This is all a play by Binance to absorb the liquidity of USDC in order to undermine Tether.

“According to our recent research on Stablecoin Efficacy, USDT and BUSD have been the top contender for market velocity,” he told CoinDesk, while pointing out that USDC’s one-year velocity is 0.08 compared to USDT’s 0.83 and BUSD’s 0.33.

“Since USDC does not seem competitive with BUSD, I believe Binance aims to absorb USDC’s liquidity to undermine USDT in the long run,” he continued. “BUSD’s issuer Paxos is under the New York Department of Financial Services regulatory umbrella. Regulatory clarity and a higher Peg-Robustness score will give BUSD a better ground to compete with USDT.”

Behind the Scenes

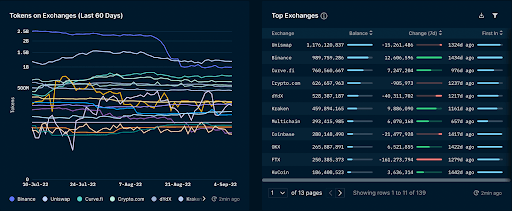

Nansen analyst Martin Lee wrote in a note to CoinDesk that Binance has “massively reduced its holdings from the middle of August, while most exchanges typically range sideways.”

Tokens on exchanges. (Nansen)

Data shows that Binance reduced its holdings of USDC from 2.2 billion USDC on August 14 to one billion USDC on August 22.

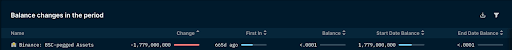

The most notable transaction is a transfer of 1.78B USDC from a Binance peg wallet to a Binance deposit wallet, Lee wrote. It's significant, he believes, because the Binance peg wallet contains tokens that are wrapped and pegged by Binance on a 1:1 ratio to the corresponding native token.

Balance changes (Nansen)

Binance’s Intent

The core question remains what Binance’s intention was in removing USDC and other stablecoins as a trading pair.

On the one hand, the fact that the exchange is removing, behind the scenes, USDC as one of its pegs would suggest that it might be a grander play to delete the stablecoin from history after it gets absorbed. After all, one of the functions of stablecoins aside from their use in trading pairs is to provide dollar stability that their name endows.

And if Binance is attempting to remove USDC’s functionality as one of the important pegs for other tokens, then it just might have more sinister plans for the stablecoin market to solidify BUSD’s lead.

But on-chain data doesn’t always paint the full picture, this could all just be a harmless reshuffling of assets.

Important events

Kyiv Tech Summit

1 p.m. HKT/SGT(5 a.m. UTC): Japan leading economic index (July preliminary)

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.