Filecoin price skyrockets 50% but FIL faces massive profit-taking

- Filecoin price had a 52% breakout thanks to a new product launch support FIL by Grayscale.

- A key indicator has presented several strong sell signals for Filecoin.

- The digital asset is poised for a significant correction in the short-term.

Filecoin had an explosive 52% breakout after Grayscale announced the launch of five new products that included FIL to enable institutional investors to buy the digital asset. However, many indicators show the asset faces robust selling-pressure.

Filecoin price primed for a pullback

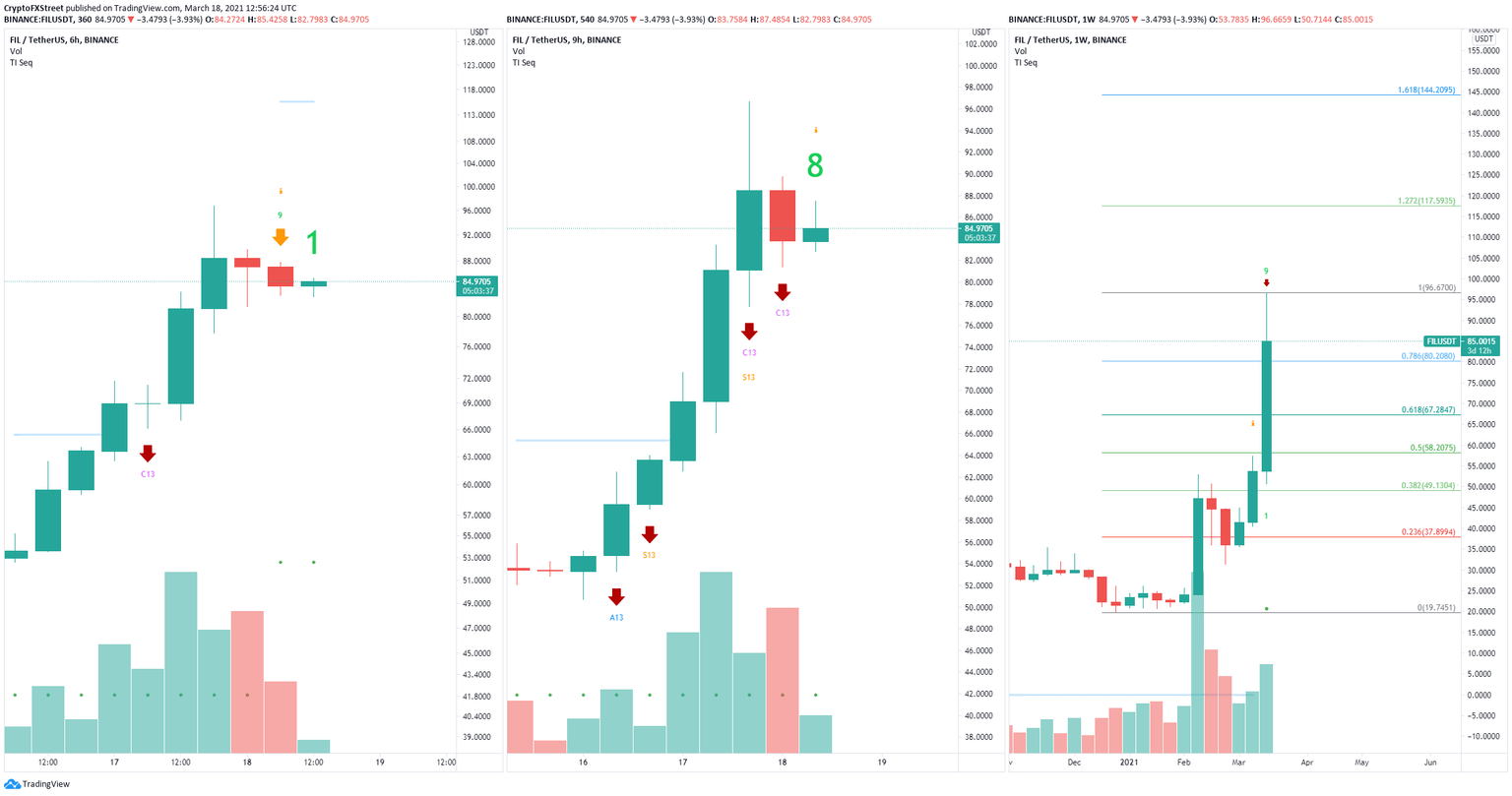

Filecoin is facing a ton of pressure in the short-term as the TD Sequential indicator has presented a sell signal on the 6-hour chart and will mostly do the same on the 9-hour chart.

FIL Sell Signals

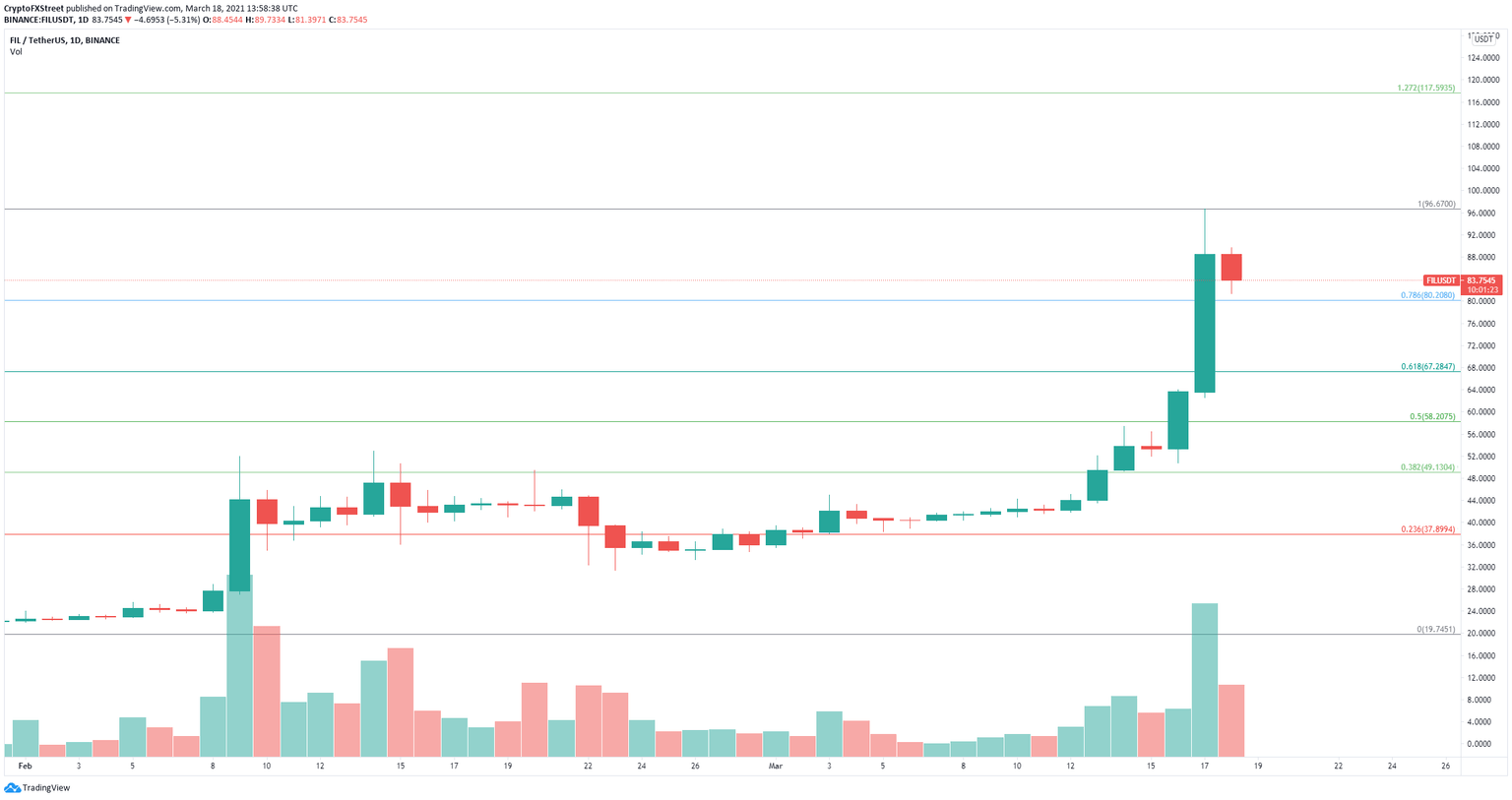

On top of that, the indicator has also just presented a sell signal on the weekly chart, which has more weight. After a massive 50% breakout, Filecoin price is primed for a pullback down to at least $80 at the 78.6% Fibonacci level. Losing this point would drive Filecoin down to $67.28% at the 61.8% Fib level.

To invalidate all sell signals, Filecoin price needs to see a new high above $96.66. A breakout above this key point will confirm another bullish break that can potentially drive Fielcoin towards $117.59 at the 127.2% Fibonacci level.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.