- Filecoin price breakout from a double bottom pattern yields 177% gain.

- Daily Relative Strength Index (RSI) confirming price highs, but overbought.

- Volume has supported the rally the entire time.

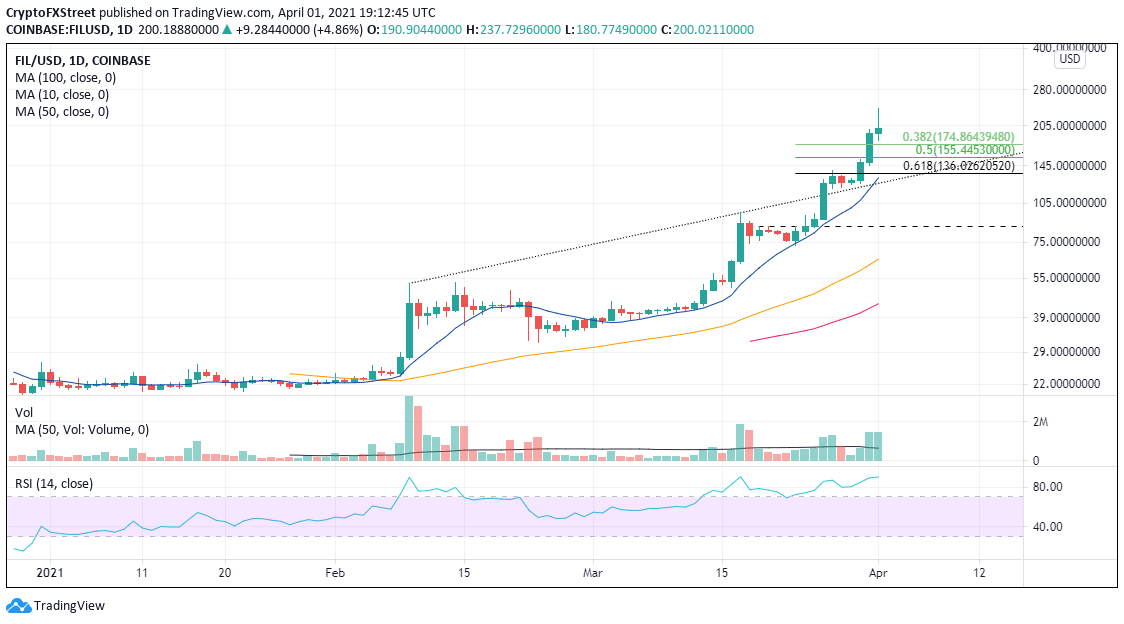

Filecoin price has rallied 650% from the February 24 low at $31.57, and it is one of the biggest rallies in the cryptocurrency complex over that time frame. However, momentum could be waning as today’s candlestick is currently showing a bearish reversal in the form of a shooting star. If it holds, it should prompt traders to capture recent gains or resist taking new trades.

Filecoin price is ready for a consolidation

A shooting star is a single candlestick reversal pattern, defined by a small real body and a long upper shadow, and is commonly found in a lengthy uptrend that is beginning to stumble. It highlights how buyers are struggling to bid prices higher but are eventually overcome by heavy selling that knocks prices down near the candlestick low.

With bullish momentum waning, a few support levels need to be considered by traders. Based on the Fibonacci retracements level, the first support is the 0.382 retracement at $174.86, followed by the 0.50 retracement at $155.44. A critical area of support emerges between $125.50-136.00, which includes the 0.618 retracement at $136.02, the 10-week simple moving average (SMA) at $131.36, and the topside trend line at $125.55.

FIL/USD Daily Chart

Buyers may resurface today, but in light of the massive gain of almost 180% over the last ten days, bullish traders should at the very least anticipate a consolidation, maybe in the form of a pennant or flag pattern.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Top 3 gainers Supra, Cosmos Hub, EOS: Supra leads recovery after Trump’s tariffs announcement

Supra’s 25% surge on Friday calls attention to lesser-known cryptocurrencies as Bitcoin, Ethereum and XRP struggle. Cosmos Hub remains range-bound while bulls focus on a potential inverse head-and-shoulders pattern breakout.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin price remains under selling pressure around $82,000 on Friday after failing to close above key resistance earlier this week. Donald Trump’s tariff announcement on Wednesday swept $200 billion from total crypto market capitalization and triggered a wave of liquidations.

Can Maker break $1,450 hurdle as whales launch buying spree?

Maker is back above $1,300 on Friday after extending its lower leg to $1,231 the previous day. MKR’s rebound has erased the drawdown that followed United States President Donald Trump’s ‘Liberaton Day’ tariffs on Wednesday, which targeted 100 countries.

Gold shines in Q1 while Bitcoin stumbles

Gold gains nearly 20%, reaching a peak of $3,167, while Bitcoin nosedives nearly 12%, reaching a low of $76,606, in Q1 2025. In Q1, the World Gold ETF's net inflows totalled 155 tonnes, while the Bitcoin spot ETF showed a net inflow of near $1 billion.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.