Filecoin price presents a buy signal before exploding 24% ahead of the FEVM launch

- Filecoin price is trying to hold above the $5.932 support level.

- FIL could break above the immediate resistance level at $6.168 and confront the 100-day EMA at $6.550 before heading further north.

- A daily candlestick close below the immediate support level at $5.932 would invalidate the bullish outlook.

Filecoin (FIL) price is trading with a bullish bias as it fights to hold above a key support level. The excitement comes as the countdown to the network’s EVM (FEVM) continues, which will bring smart contracts and user programmability to the Filecoin mainnet on Marche 14.

Did you hear? The #Filecoin EVM (FEVM) launch is closer than you think

— Filecoin (@Filecoin) February 22, 2023

After the completion of the calibrationnet upgrade earlier today, FEVM is on track to bring smart contracts & user programmability to Filecoin mainnet on March 14th, 2023!

https://t.co/CMjBDN5Idz pic.twitter.com/AdoblUk19R

Filecoin price ponders on its next move

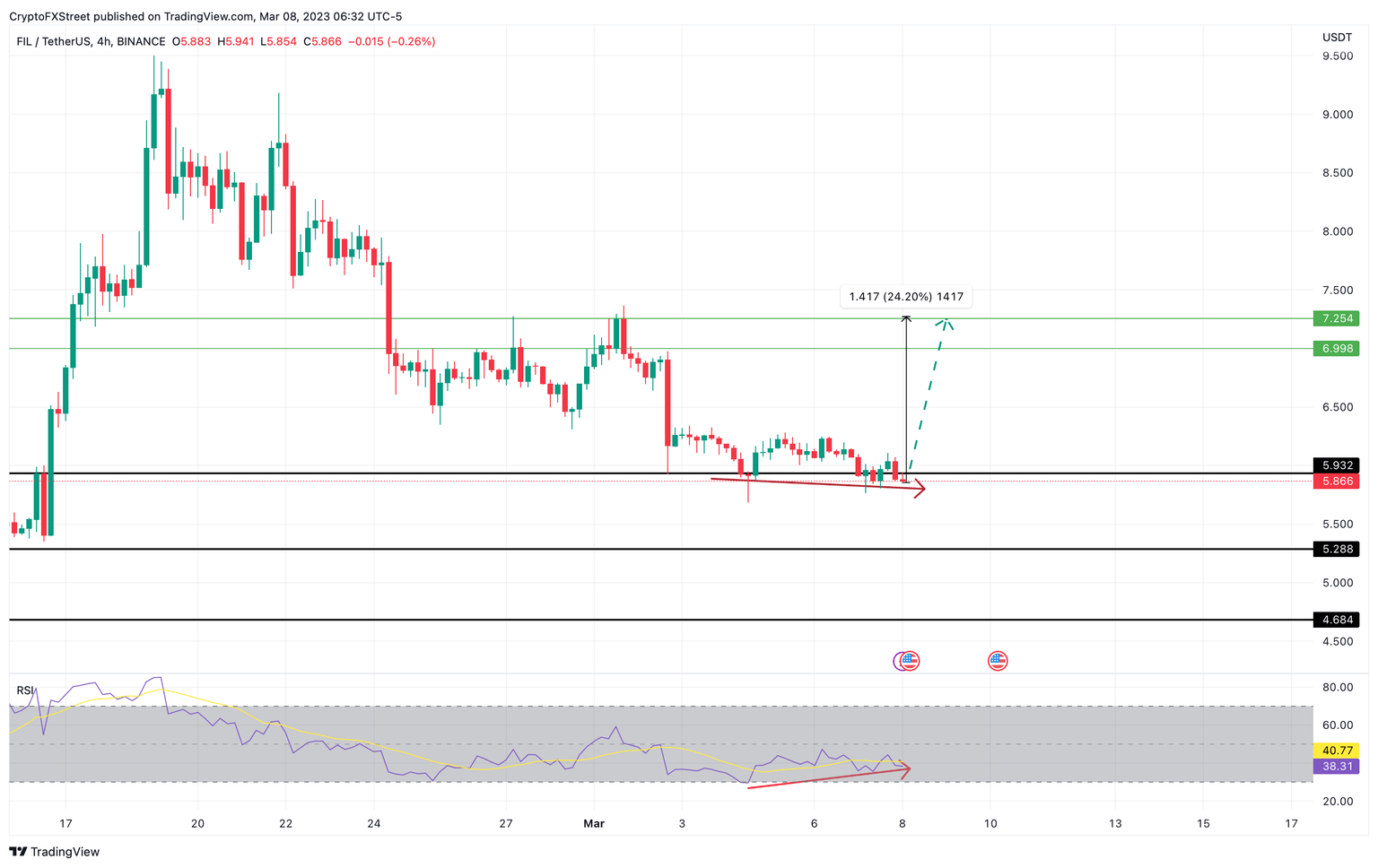

Filecoin price has shed 14% in the last five days after slipping below the 200-day Exponential Moving Average (EMA). Currently, FIL consolidates at $5.932, which is a support confluence made up of a horizontal level and the 50-day EMA, with the 200-day EMA acting as an immediate resistance level at $5.932.

An increase in buying pressure past this level will open the path for investors to recoup some of the losses made since February 19. Breaching this barrier will set the trajectory for Filecoin price to confront the next obstacle at the $6.550 resistance level presented by the 200-day EMA.

If buyer appetite remains intact past the aforementioned level, FIL could tag the $6.998 resistance level or in highly ambitious cases, reach the $7.254 resistance level. Such a move would constitute a 24% ascent in Filecoin price from its current position at $5.890.

Additionally, a bullish divergence was noted between Filecoin price, which recorded lower lows on the four-hour timeframe, and the RSI set up higher lows. This non-conformity often results in a breakout of the underlying asset's price to the upside. In this case, FIL could ideally kickstart a 24% upswing, as noted above.

FIL/USDT 4-hour chart

On the downside, profit-taking could interrupt the bullish outlook for Filecoin price. Amid the current FUD in the market, investors could resort to booking early profits.

Such a scenario could provoke a selling spree that would see Filecoin price lose the support confluence consisting of the 50-day EMA and the immediate support level at $5.932. Additionally, a daily candlestick close below the said level would add to the buyers’ woes and invalidate the bullish thesis.

The bearish outlook entails FIL dropping to the $5.288 level, or lower to the $4.684 support level. In extreme cases, the price could drop down to the $4.000 swing low.

Author

FXStreet Team

FXStreet