Filecoin Price Prediction: FIL primed for 15% advance

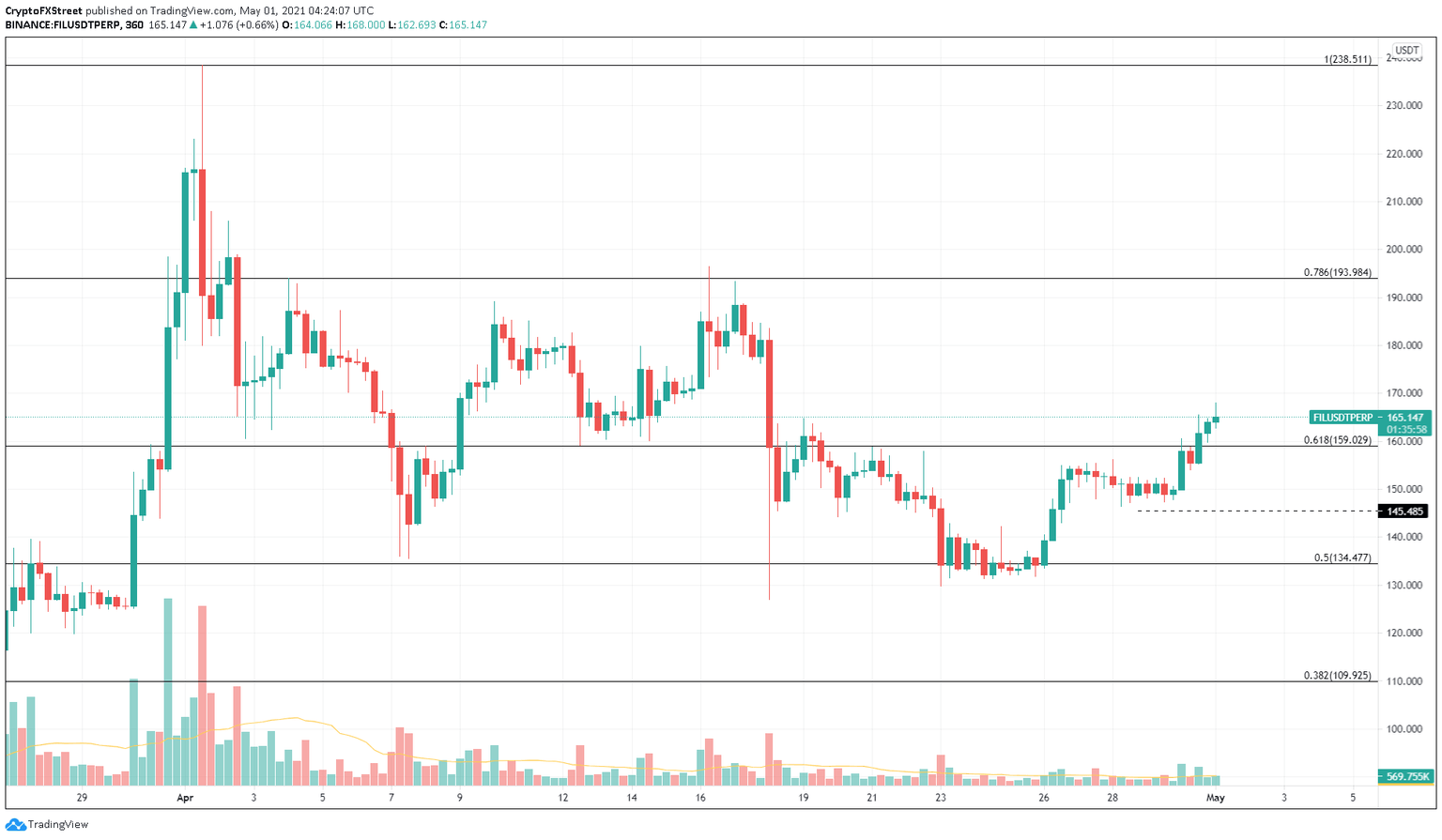

- Filecoin price has sliced through the 61.8% Fibonacci retracement level at $159.02.

- This move confirms a strong presence of buyers that could propel FIL by 15% to $193.98.

- A breakdown of the $145.48 support barrier will signal the start of a new downtrend.

Filecoin price displays a sense of calm before the sudden burst of bullish momentum sends to flying.

Filecoin price confirms start of new uptrend

Filecoin price shows that the bullish momentum has overtaken the selling pressure, which has resulted in a 23% upswing. This move has shattered the 61.8% Fibonacci retracement level at $159.02, indicating that more gains are on the horizon.

If the buyers keep piling up the bid orders, Filecoin price will roughly ascend 17% to test the 78.6% Fibonacci retracement level at $193.98.

Investors need to keep a close eye on $188.43, where the upswing might slow down or halt abruptly.

If the holders do not book profits here but instead add to their positions, Filecoin price might surge an additional 12% to $218.03.

FIL/USDT 6-hour chart

While a retest of the 61.8% Fibonacci level is plausible, a breakdown of it will question the bullish momentum. Under these circumstances, market participants need to be wary of a reversal.

A decisive 6-hour candlestick close below $145.48 will invalidate the bullish thesis and trigger a 4% downswing to the support at $139.89.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.