Filecoin Price Forecast: FIL gradually nurtures uptrend toward $60

- Filecoin’s multi-week uptrend steadies as $60 beckons.

- The SuperTrend indicator has continued to reinforce the bullish outlook.

- The seller congestion at $57 may delay or sabotage the expected upswing to $60.

Filecoin uptrend is still intact despite lethargic price actions across the board. A new record high has been achieved at $57. In the meantime, FIL is teetering at $54 amid the push for gains above $60.

Filecoin technical picture remains bullish

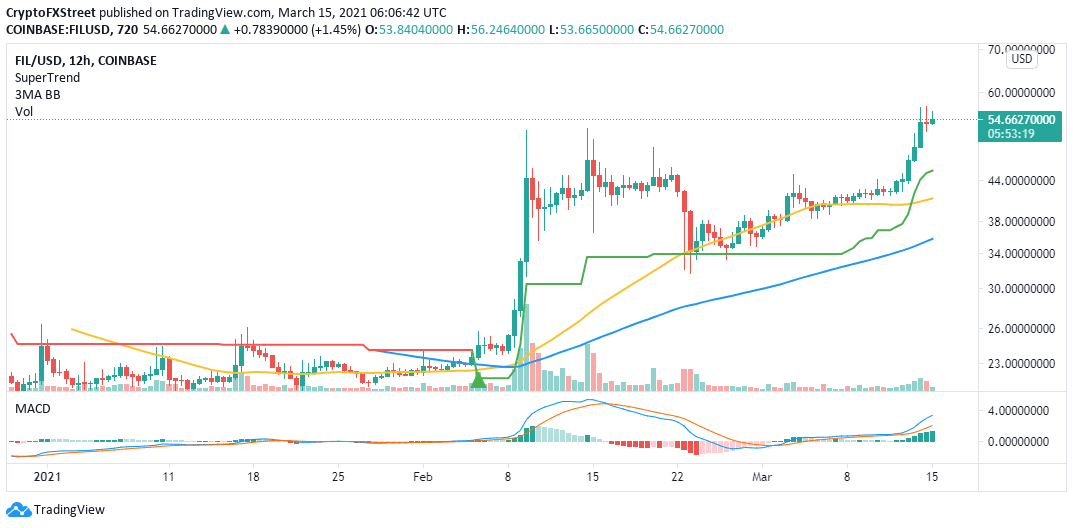

The 12-hour SuperTrend indicator flashed a signal to long Filecoin at the beginning of February. The bullish impulse still holds, suggesting that the least resistance path is north. The all-time high at $57 temporarily cut short the upswing eyeing $60.

The Moving Average Convergence Divergence (MACD) cements the bullish outlook by moving higher within the positive region. Moreover, the recent MACD cross above the signal line is a huge bullish signal. Note that action past $60 may trigger massive buying orders due to the fear of missing out (FOMO).

FIL/USD 12-hour chart

Looking at the other side of the picture

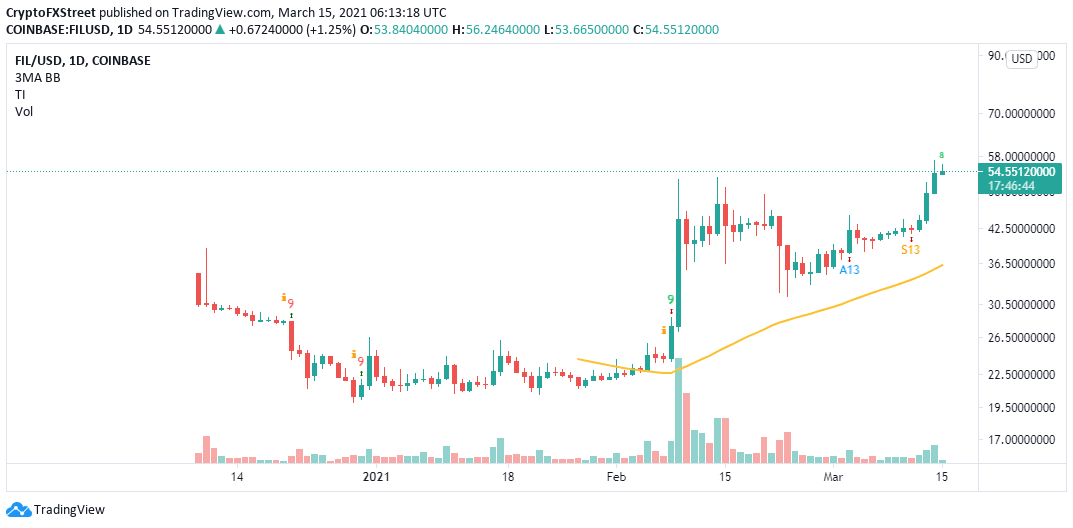

The TD Sequential indicator is likely to present a sell signal on the daily chart. The call to sell will manifest in a green nine candlestick. If validated, Filecoin will correct appreciably, perhaps in one to four daily candlesticks.

FIL/USD daily chart

Support above $50 will ensure that losses do not become extremely damaging to the uptrend. However, if massive sell orders are triggered, the bearish leg may extend to $40.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren