Fetch.ai price faces tough decision, 23% rally or crash for FET holders?

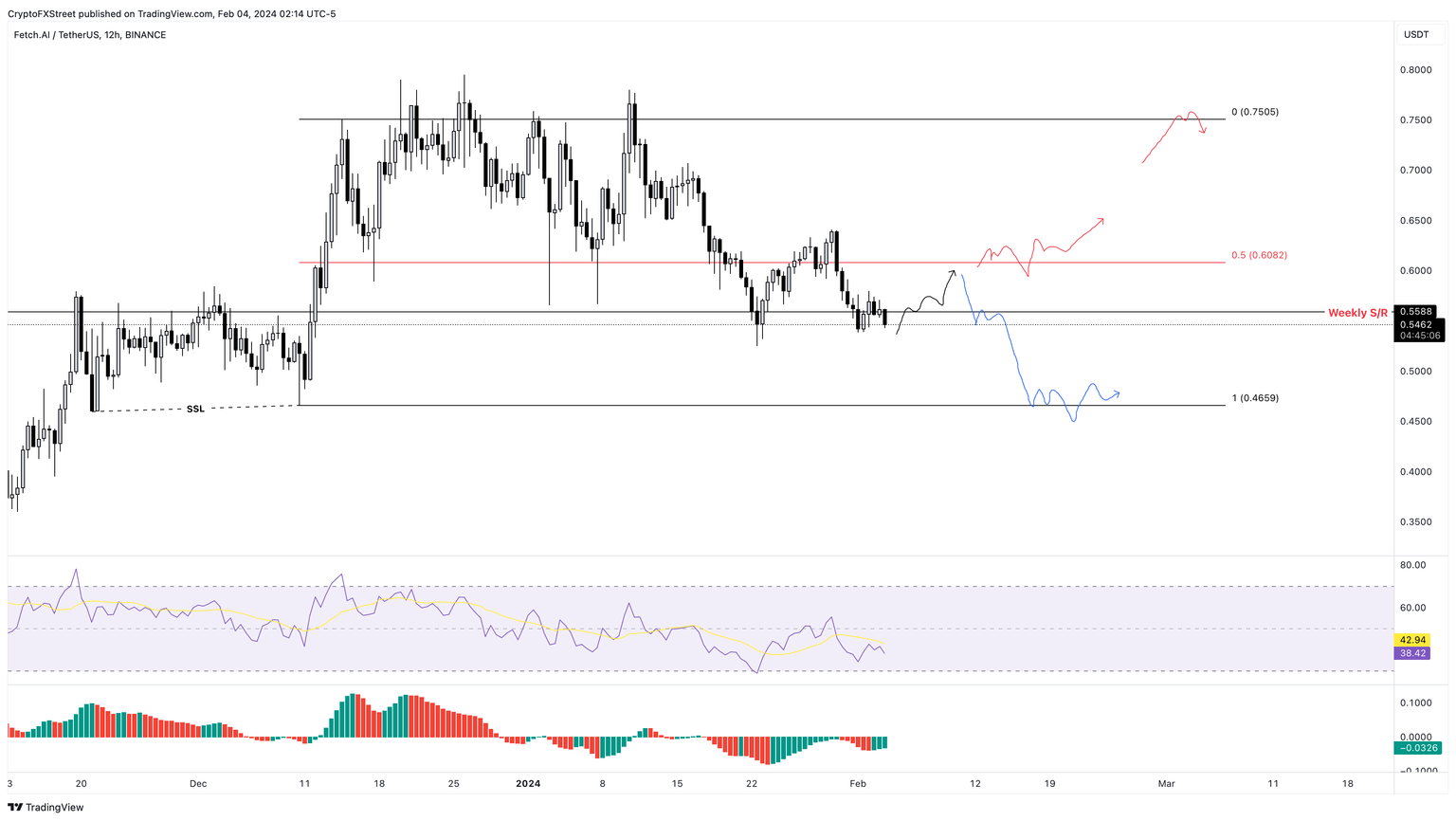

- Fetch.ai price has flipped below the $0.465 to $0.750 range’s midpoint at $0.608.

- This development could trigger a 23% crash to $0.465 if FET does not quickly recover above $0.608.

- A successful flip of the $0.608 barrier into a support floor could catalyze a sweep of the range high at $0.750.

Fetch.ai (FET) price is in a precarious position as it needs to decide its next move. FET recently breached a key support structure, favoring a bearish outlook, but things could change drastically for FET and other Artificial Intelligence (AI) crypto tokens due to the upcoming NVIDIA Corp’s earnings on February 21.

Also read: FET price rises 5% after Fetch.ai mainnet upgrade

Fetch.ai price needs to make a decision

Fetch.ai price rallied 61% between December 10 and 10, 2023, setting up a range extending from $0.465 to $0.750. While there were multiple attempts to overcome the range high, all were failed attempts. Lack of buying pressure and profit-taking triggered a 32% crash in FET’s market value between January 10 and 22, which flipped the aforementioned range’s midpoint at $0.608.

Since then, Fetch.ai price has been hovering around this level.

Investors can expect Fetch.ai price to revisit the midpoint at $0.608, where bulls and bears face a tough decision. Rejection at the midpoint or a continuation of the downtrend from the current position of $0.546 could see FET sweep of the range low at $0.465 should be expected.

This move would successfully sweep the sell-side liquidity below November and December 2023 swing lows.

FET/USDT 12-hour chart

On the contrary, if Fetch.ai price flips the range high at $0.608, it would signal a bullish comeback. In such a case, FET could trigger a 23% move to retest or sweep the range high at $0.750.

Also read: Fetch.AI price rally likely with retail investor accumulation of FET tokens

(This story was corrected on February 4 at 10:58 AM GMT to replace $0, likely 608 to $0.608)

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.