Fed’s Powell calls for proper crypto regulations as Bitcoin price shoots beyond $20,000

- Bitcoin price is sprouting above $20,000 following a symmetrical triangle breakout.

- Fed Chair Jerome Powell reckons that a lot of thought must be put into regulating crypto activities.

- Crypto assets call for the same risk and regulation to level the playing field and avert downsides of regulatory evasion.

- Bitcoin price could tag $20,900 if investors shun early profit booking for a long-term bullish outlook.

Bitcoin price is exploring highs above $20,000 on Tuesday after holding support at $18,800 for nearly four days. Green sprouts are noticeable across the market, led by Uniswap price’s 16.70% move to $6.60. Ethereum price is trading close to $1,400 while XRP has only managed a 1.30% swing to $0.47.

The cryptocurrency market’s bullish stint coincides with Federal Reserve Chair Jerome Powell’s speech “on opportunities and challenges of the tokenization of finance,” at the Louvre Museum in Paris, France.

Cryptocurrency is a new tech that needs proper regulation – Jerome Powell

Central banks globally have been tested by fire this year amid the impact of the COVID-19 pandemic, dynamic geopolitics and the Ukraine-Russia war. While addressing attendees at the Paris conference, Powell said that the normalization of monetary policy had laid bare key structural issues within the decentralized finance (DeFi) system.

The US Fed chair added that governments across the board need to carefully and thoughtfully approach the regulation of the DeFi system. In other words, proper regulations should be implemented to address the new technology.

"Should be same risk, same regulation for crypto assets,"Jerome Powell.

Regulation is one way to level the playing field and avoid the dangers of regulatory evasion. Powell reckoned that a lot of work needs to be done on both traditional and digital assets – especially regarding stablecoins. The issuers of stablecoins have shown interest in reaching the broader public. However, this raises the question of whether there is enough regulatory oversight for broader use.

Bitcoin price starts rewarding patient investors

Cryptocurrency investors have this year been forced to grow a thick skin to endure frequent pullbacks and little to no progress to the upside. The largest cryptocurrency recently bled to $18,200 before rebounding to $19,500.

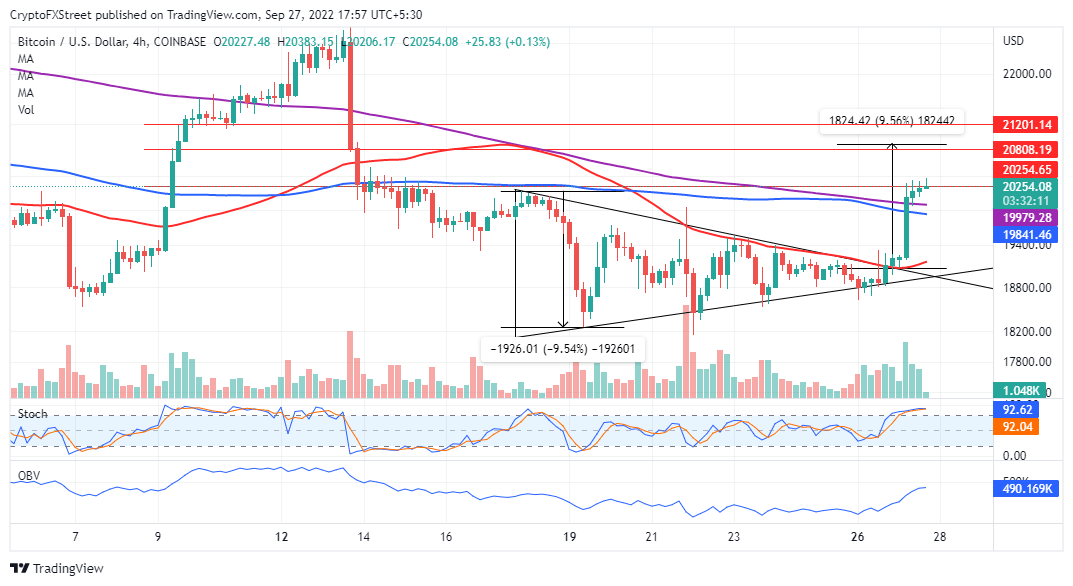

However, profit taking, investor skepticism, and external forces attributed to inflation and geopolitical shifts pushed BTC price to $18,800. On the bright side, Bitcoin price finally made good of a potential symmetrical triangle breakout, climbing the ladder to $20,350.

BTC/USD four-hour chart

It could be a big boost if higher support, preferably at the 200-day SMA (Simple Moving Average – purple), held its ground. The OBV (On Balance Volume) affirms that bulls have the upper hand and could easily propel Bitcoin price to complete the 9.54% triangle breakout to $20,900.

On the other hand, the risk of pulling back is still apparent amid overbought conditions, as shown by the Stochastic oscillator. Short-term traders should consider taking profits at $20,900 to avoid a possible trend correction to $19,500 and $18,800, respectively.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren