Federal Reserve raises interest rates by 25 bps, Bitcoin price floats above $29,000

- The Federal Reserve ended up hiking interest rates by 0.25%, as expected, bringing the Fed Funds target rate to 5.25% - 5.50%.

- The central bank noted that it remains committed to returning inflation to its 2% objective.

- Bitcoin price observed no significant reaction as it continued to trade above $29,300.

The Federal Reserve lived up to its promise of raising interest rates despite hitting a pause at the last meeting. The Federal Open Market Committee (FOMC) today announced a 0.25% rise in the Fed Funds target rate to 5.25-5.50%. In its policy statement, the Fed reiterated that policymakers would continue to assess incoming data in terms of its implications for policy moving forward.

Bitcoin price reacts to Federal Reserve raising interest rates

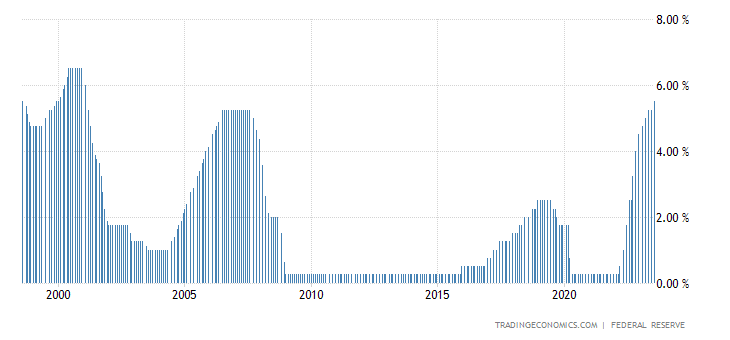

The rate hike brought interest rates in the US to a 22-year high, as the last time they stood at these levels was back in January 2001. In line with the hike, the United States central bank stated,

"In determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.

The Committee also stated that it would continue to reduce its holdings of Treasury securities and agency debt and agency mortgage-backed securities. The FOMC reiterated that it remains strongly committed to returning inflation to its 2 percent objective.

Federal Reserve interest rate

FXStreet analyst Yohay Elam, in anticipation of the FOMC's decision, said,

"I want to stress that a 25 bps hike is fully priced in, and will not have an impact on markets. Investors are laser-focused on hints about the next moves. The Fed does not publish new forecasts at this meeting, letting the statement talk first. Then, Fed Chair Powell will take the stage, answering questions and triggering the lion's share of volatility.

He responded to the interest rate hike stating,

Powell refuses to commit to automatic hikes, throwing markets a bone. The Fed decision is a net positive for risk assets such as cryptocurrencies.

This decision was met with a mixed response from the stock and crypto market. The S&P 500 Index moved down by 0.16% to 4561. At the same time, the US Dollar Index (DXY) also reacted negatively, declining by 0.13% to hit 101.16.

DXY 1-day chart

Bitcoin price could be seen trading at $29,362 at the time of writing as the biggest cryptocurrency in the world rose by 0.47%.

BTC/USDT 1-day chart

The altcoin market was met with a similar response as the likes of Ethereum, Cardano, XRP – and more – noted an increase of less than 1% in the past hour.

Read more - Expect this from Bitcoin price when the Fed ends up hiking interest rates by 25 bps

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.