Fed hikes interest rate by 25 bps, fight against inflation continues despite banking crisis

- The Federal Reserve raises interest rates by 25 basis points, meeting the market’s expectations.

- Following the collapse of Silicon Valley Bank and Signature Bank, there was speculation of a pause rate hikes, which the Fed paid no heed to.

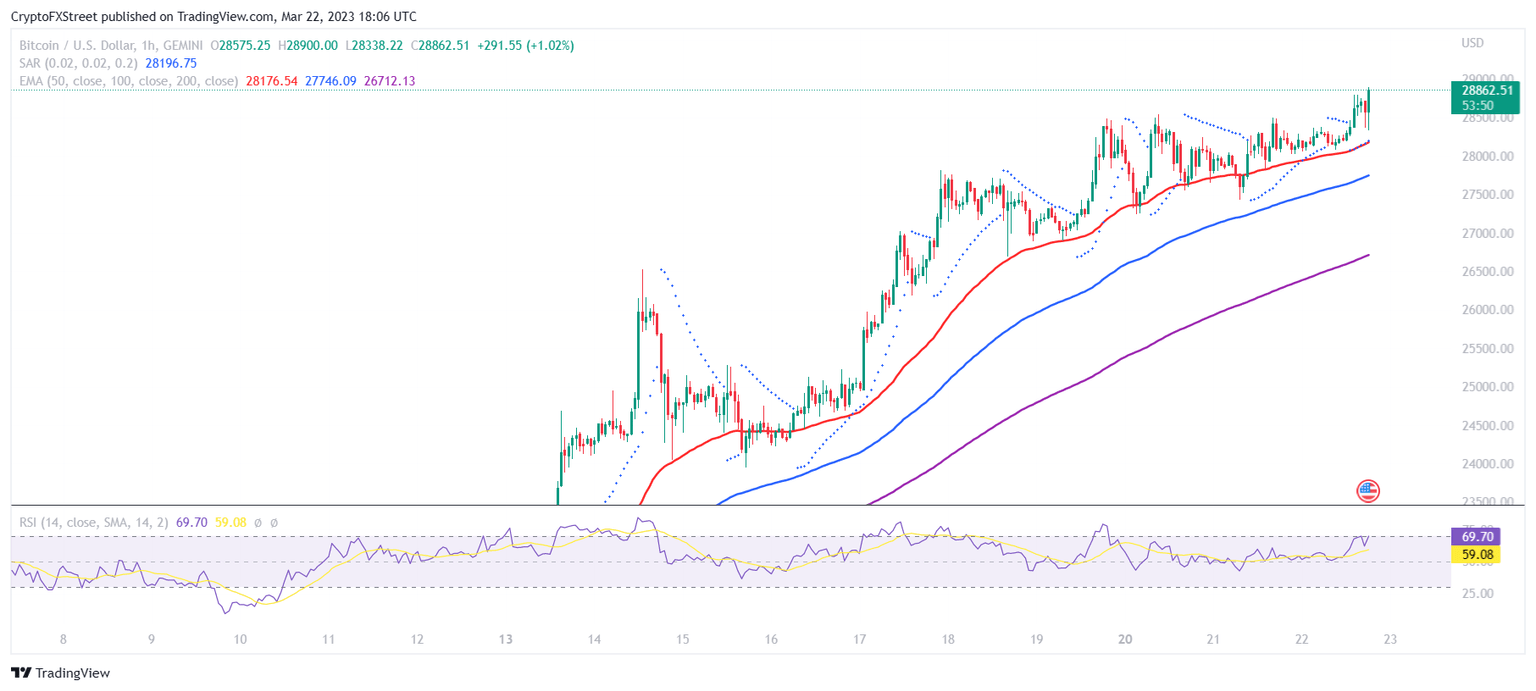

- The crypto market reacted positively immediately following the release as Bitcoin price rose to $28,862.

The Federal Reserve decided to hike the interest rate by 25 basis points (bps) to 4.75%-5% at the March meeting, in line with the market’s expectation. In its policy statement, the Fed dropped the reference to "ongoing increases" and said that some additional policy firming might be appropriate.

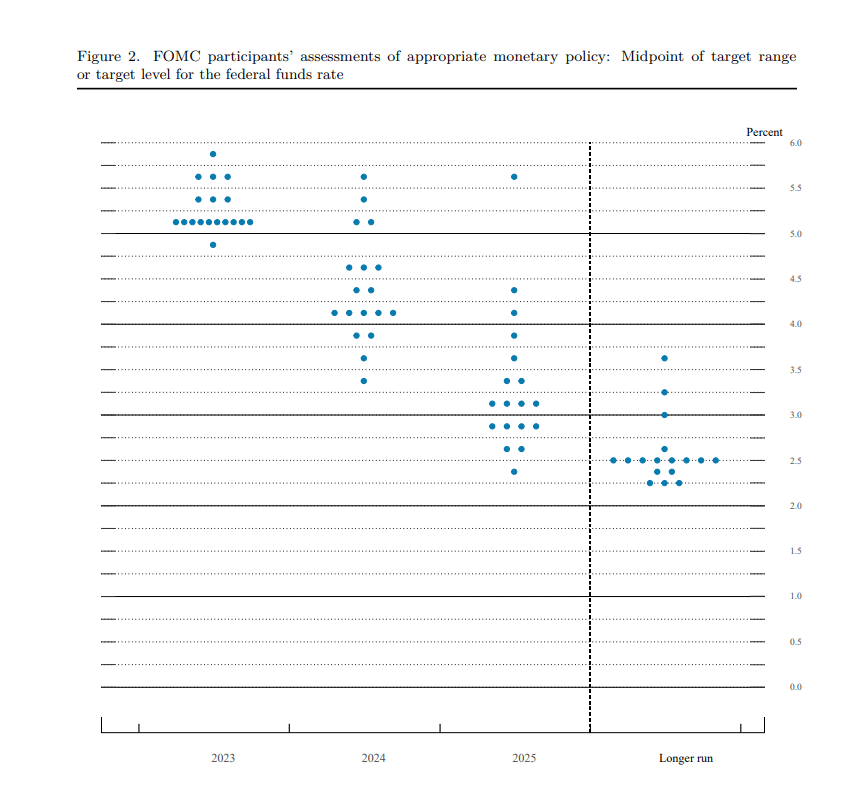

The Fed also published updated FOMC members’ projections on rates, the so-called dot plot, which showed the majority of the board expects rates to be between 5-5.25% in 2023.

FOMC dot plot

The hike in the interest rate was expected primarily due to the Fed wanting to continue its fight against inflation. Although the US February Consumer Price Index (CPI) came down to 6.0% on a 12-month basis, and the core CPI declined to 5.5%, the inflation rate is still above the target rate of 2%. In line with the same, the Fed on March 22 stated,

The Committee will closely monitor incoming information and assess the implications for monetary policy. The Committee anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.

The Federal Open Market Committee (FOMC) came down from their earlier decision which would’ve pushed the target rate to 5% - 5.25%. A 50 bps hike in the interest rate was also hinted at by the Federal Reserve Chair Jerome Powell last month during the semi-annual Congressional testimony, where he said,

The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated.

However, soon after, the United States faced the banking crisis, where three major banks came to an end. After the shuttering of Silvergate Bank, the Silicon Valley Bank and Signature Bank were also shut down by the regulators due to the high proportion of uninsured deposits and other risky investments. This spiked a possibility of a lesser rate hike, which the Fed lived up to.

The crypto market reacts positively

The crypto market showed erratic moves after the decision, with the Bitcoin price rising by 1% to trade at $28,862.

BTC/USD 1-hour chart

Ethereum price followed a similar path as the altcoin stood at $1,811, increasing by 0.5%. Other top altcoins noted no different movement as Cardano price rose by 1.3% to trade at $0.38. XRP observed a similar change as it went up by 1.63% to change hands at $0.44, and Binance Coin stood at $330.49, noting a 0.85% increase in the last hour.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.