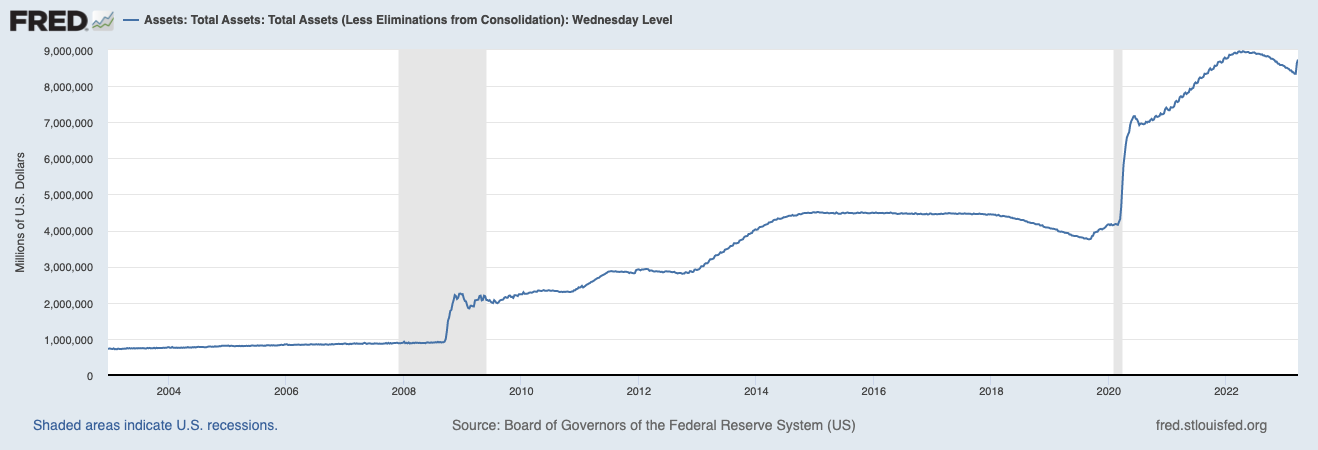

As of March 22, the Fed's balance sheet surged by nearly $94.5 billion — a $297 billion increase from the last week when the banking crisis started.

New QE hopes boost Bitcoin price

Overall, the U.S. central bank's liabilities increased by $393 billion in the last two weeks to $8.734 trillion. That is closer to the all-time high of $8.95 trillion a year ago when the Fed started its quantitative tightening program and reduced its assets by $600 billion.

Federal Reserve balance sheet as on March 24. Source: FRED

The Fed released the data on March 23, coinciding with Bitcoin (BTC $28,052) price rallying 5.5% toward $29,000. The rise occurred amid speculations that the Fed's expanding balance sheet results from quantitative easing (QE).

BTC/USD daily price chart. Source: TradingView

But the Fed did not use new dollar reserves to purchase long-term treasuries. Instead, the central bank dropped its U.S. Treasury holdings by $3.5 billion to $7.937 trillion, suggesting that quantitative tightening is still in place to curb inflation.

On the other hand, Fed's balance sheet grew because it dispatched short-term loans to the ailing banking sector.

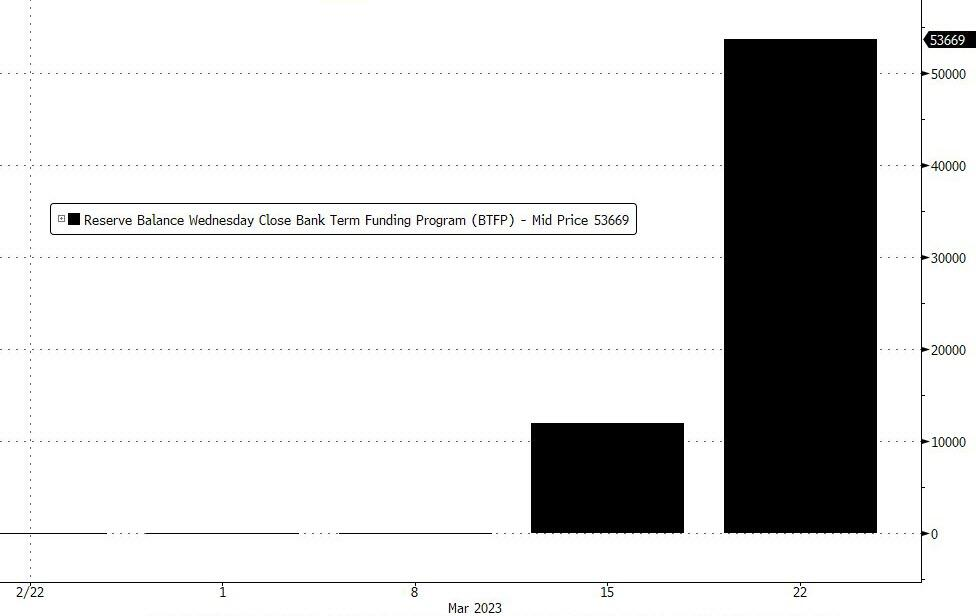

Notably, as of March 22, the Fed slashed the usage of its "discount window," which helps commercial banks manage short-term liquidity needs, by $42 billion. Instead, it allocated the same $42 billion to its brand new Bank Term Funding Program (BTFP).

Federal Reserve BTFP funding reserves. Source: FRED

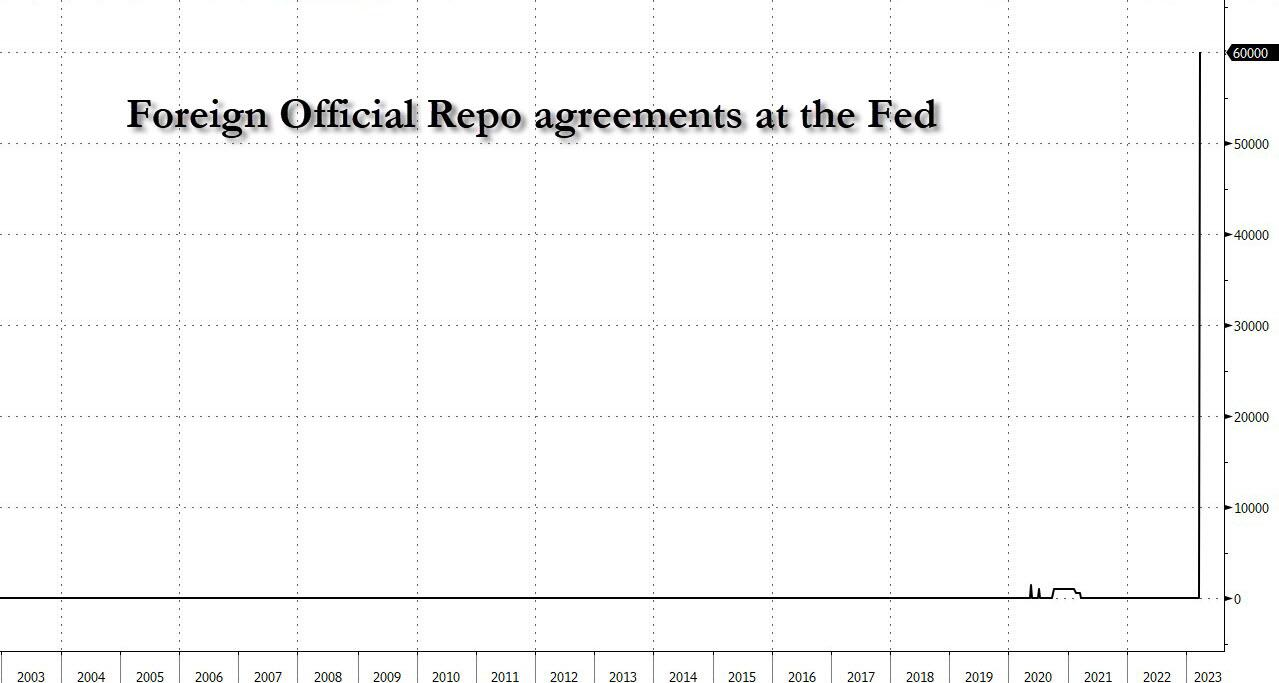

The other $60 billion went to the Fed's swaps facility that provides liquidity to offshore banks.

Foreign official repo agreements at the Fed. Source: FRED

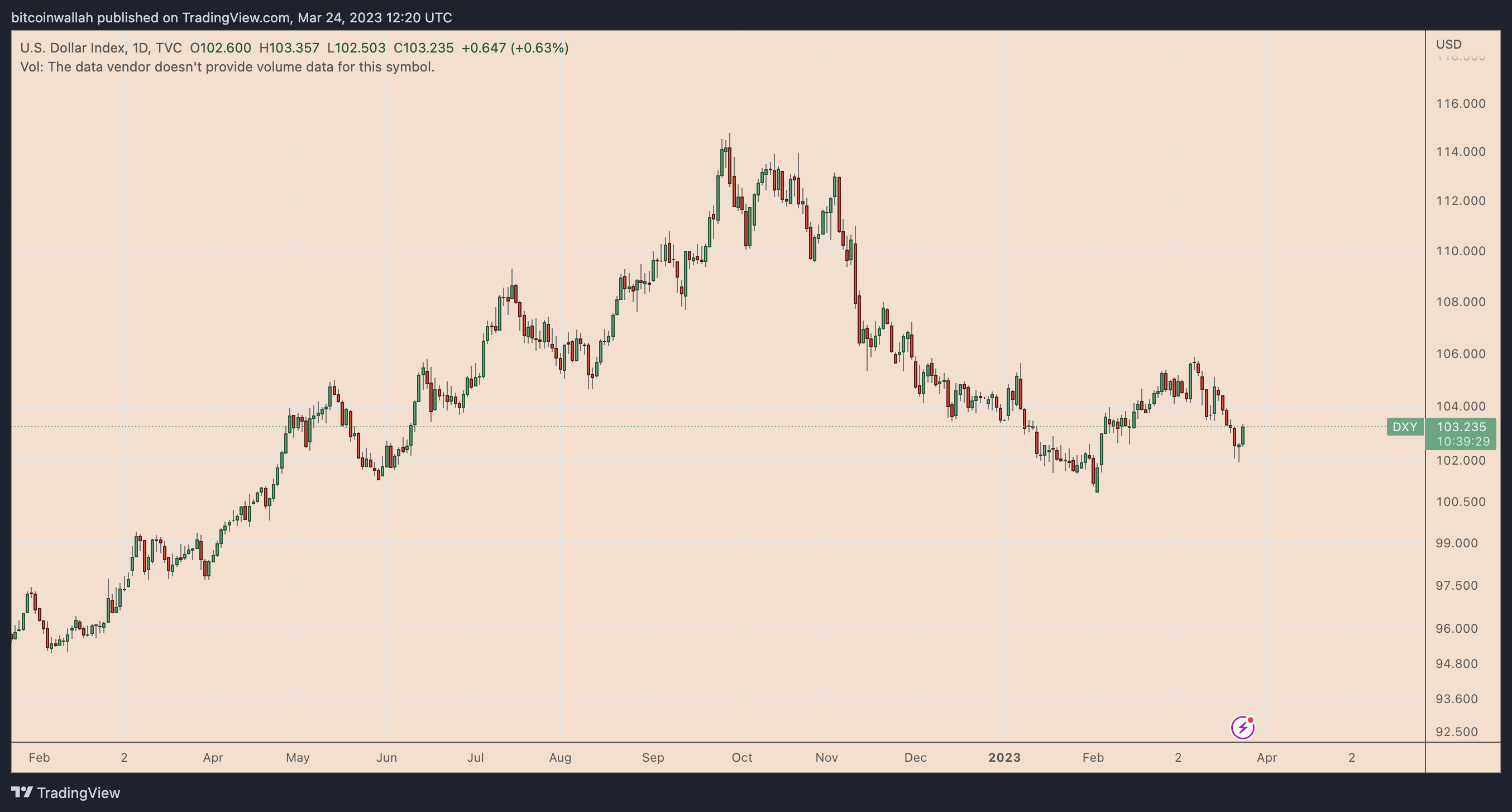

The Fed's tightening policy and lending facilities to regional and offshore banks risk drying up cash liquidity. This may boost the dollar's valuation versus other top foreign currencies, which, in turn, could push Bitcoin's price lower in the short term.

Interestingly, the U.S. dollar index has gained 1.5% since the Fed's balance sheet update.

DXY daily price chart. Source: TradingView

Has the banking crisis peaked?

The ongoing credit crisis may not have peaked despite Fed's $393 billion emergency lending to banks, however, if one considers Janet Yellen's blurred outlook on depositors' insurance.

On March 21, the U.S. Treasury Secretary confirmed protecting uninsured depositors over $250,000 "if smaller institutions suffer deposit runs" such as those witnessed in Silicon Valley Bank and Signature Bank.

But Yellen did a U-turn the next day in her statements to the Senate that she had not considered “blanket insurance or guarantees of deposits.” The bank stocks tanked in response to her statement, resulting in another U-turn.

KBW Nasdaq Bank Index weekly performance chart. Source: TradingView

Yellen then told the House on March 23 that the authorities "would be prepared to take additional actions if warranted."

In any case, the market will need to wait for the balance sheet data next week to determine whether or not the Fed's liabilities are declining.

But if these emergency lending facilities keep rising after more bank collapses, then QE will be inevitable, similar to what happened after the 2008 global financial crisis.

BTC price technicals hint at $40K

An expanding balance sheet — with or without QE — has proven bullish for Bitcoin in the past. This correlation will continue if the banking crisis deepens, according to Stack Hodler, the author of crypto-focused Stack Macro newsletter.

Fed balance sheet versus Bitcoin price performance. Source: TradingView

"BTFP, Swap Lines, TPI - It's All QE," the analyst noted, adding:

It all leads to balance sheet expansion and fiat currency dilution despite plenty of Central Bank fans that will tell you otherwise.

From a technical perspective, Bitcoin price is well-positioned for a run-up toward $40,000 by June, or 50% higher from today's price.

BTC/USD weekly price chart. Source: TradingView

As illustrated above, the upside target originates from Bitcoin's inverse-head-and-shoulders (IH&S) breakout setup on the weekly chart.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Grayscale files S-3 form for Digital Large Cap ETF comprising Bitcoin, Ethereum, XRP, Solana, and Cardano

Grayscale, a leading digital asset manager operating the GBTC ETF, has filed the S-3 form with the United States (US) Securities and Exchange Commission (SEC) in favor of a Digital Large Cap ETF.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH, and XRP brace for volatility amid Trump’s ‘Liberation Day’

Bitcoin price faces a slight rejection around its $85,000 resistance level on Wednesday after recovering 3.16% the previous day. Ripple follows BTC as it falls below its critical level, indicating weakness and a correction on the horizon.

Top crypto news: VanEck hints at BNB ETF, Circle files S-1 application for IPO

Asset manager VanEck registered a BNB Trust in Delaware on Tuesday, marking its intention to register for an ETF product with the Securities & Exchange Commission (SEC).

Solana Price Forecast for April 2025: SOL traders risk $120 reversal as FTX begins $800M repayments on May 30

Solana price consolidated below $130 on Tuesday, facing mounting headwinds in April as investors grow wary of looming FTX sell-offs.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.