February's $870 million crypto token unlocks: SUI, APT, SAND, APE, MANTA, AVAX, OP

- Seven altcoins will unlock over $870 million worth of crypto tokens in February.

- Large value unlocks have the potential to influence altcoin prices, token prices could crumble under selling pressure.

- Aptos, Sandbox, Sui and ApeCoin are set to unlock close to 3% and higher of the asset’s circulating supply.

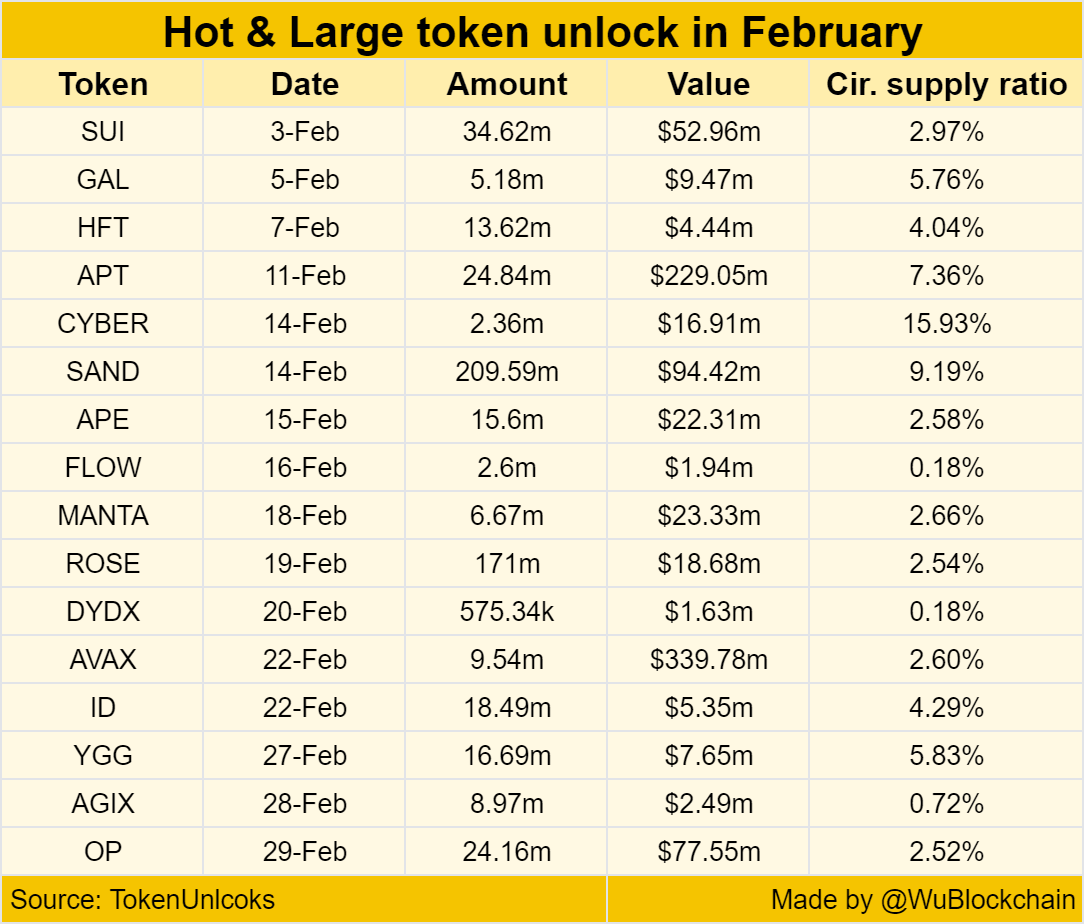

Data from TokenUnlocks reveal several large-volume unlocks are lined up in February. Typically, cryptocurrencies that unlock over 3% of their circulating supply suffer a correction in their price. Of token unlocks valued at $10 million and higher, Aptos (APT), Sandbox (SAND), SUI and ApeCoin (APE) are scheduled to unlock nearly 3% to 9.19% of their circulating supply.

Also read: Bitcoin halving countdown: Dive into two possible scenarios for the future of BTC price

Token unlocks to watch out for February

According to TokenUnlocks data, SUI, Aptos (APT), Sandbox (SAND), ApeCoin (APE), Manta Network (MANTA), Avalanche (AVAX) and Optimism (OP) plan to unlock a total of $870 million worth of tokens. This is a significant event for market participants as token unlocks tend to catalyze a correction in asset prices, in the case where the percentage of tokens being unlocked exceeds 3% of the circulating supply of the asset.

According to a table shared by Chinese crypto and blockchain journalist Colin Wu, these seven assets will unlock between 2.52% and 9.19% of their circulating supply in the month of February. This is a recipe for crypto price drops and an opportunity for sidelined buyers to “buy the dip.”

Token Unlocks. Source: Colin Wu’s tweet on X

The entire $870 million may not amount to selling pressure as MANTA, AVAX and OP are scheduled to unlock 2.66%, 2.60% and 2.52% of the circulating supply. These assets may not experience a correction in their prices. On the other hand, APT, SAND, SUI, APE are unlocking a larger percentage of their circulating supply. Once the unlocked tokens flood the markets, market participants can expect a correction in prices of these assets.

Avalanche’s $339.78 million unlock, what to expect

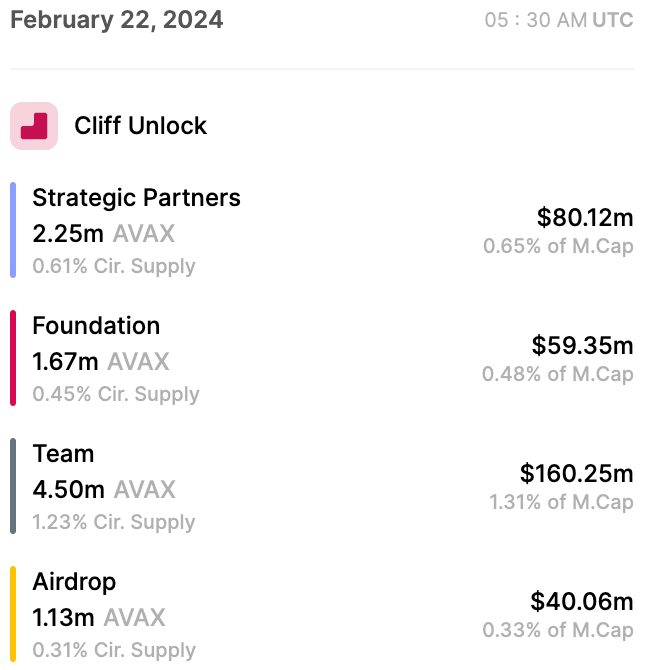

Avalanche’s strategic partners, foundation, team and eligible airdrop participants will receive AVAX tokens in the following manner.

AVAX unlock on February 22. Source: TokenUnlocks

$40.06 million worth of AVAX is likely to hit exchange wallets, as the 1.13 million tokens will be airdropped to eligible users. In addition to this, the team could shed their AVAX holdings, making a total of $200.26 million in selling pressure on Avalanche.

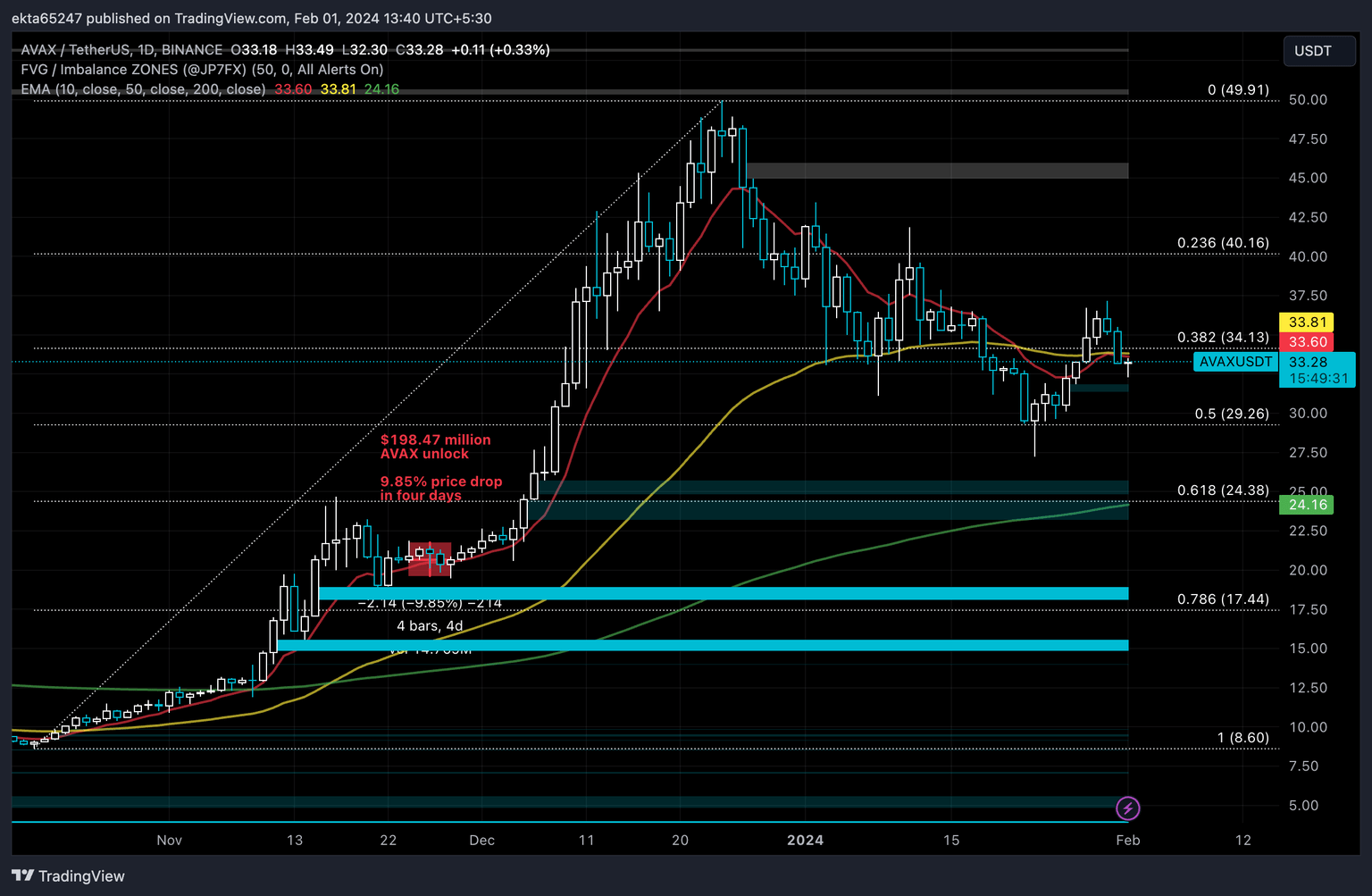

The previous token unlock of $198.47 million in AVAX pushed price 9.85% lower in four days. If the trend repeats itself, a similar decline of nearly 10% is expected following February 22.

AVAX/USDT 1-day chart

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.