Transactions on Fantom exceeded those of Ethereum for the first time ever on Monday, as investors seek newer avenues to farm yields and accrue value.

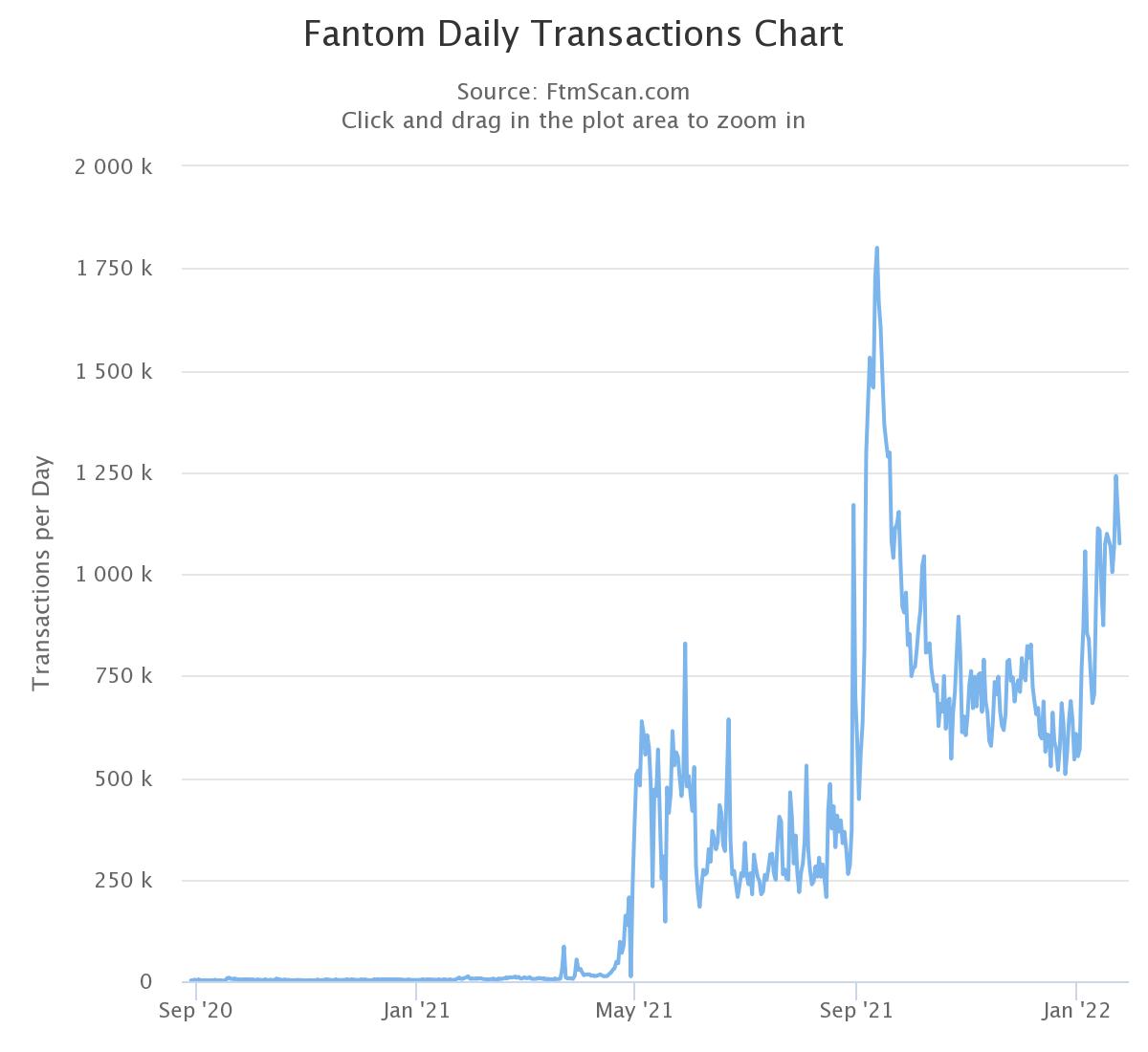

In the past 24 hours, over 1.2 million transactions were processed on the Fantom network, data from blockchain tracker Fantomscan showed. This was slightly higher than Ethereum’s 1.1 million transactions, as per data from Ethereum tracker Etherscan.

With fifty-five validators maintaining the network, Fantom processed upward of eight transactions per second (tps) on Monday compared to Ethereum’s current rates of under 2 tps, data showed. Ethereum transactions are now at August 2021 levels, far below the May 2021 peak of 1.7 million daily transactions.

Fantom has now recorded a total of over 170 million transactions since its launch in December 2019, a fraction of Ethereum’s 1.4 billion transactions since its inception in 2015.

However, Monday’s figures on Fantom were still lower than all-time high transaction counts of 1.8 million in September 2021, a month before FTM tokens reached a price peak of $3.46.

Tokens of Fantom have emerged as the top performers in recent months as investors bet on the tokens of layer 1 projects – protocols with their native blockchains, such as Fantom or Solana – as an alternate to Ethereum.

Fantom became the third-largest decentralized finance (DeFi) ecosystem by locked value over the weekend, as reported. It started 2022 at the eighth spot in rankings but has since climbed to the third spot amid increasing developer activity and user interest for products built over Fantom.

DeFi refers to financial services, such as trading, lending, and borrowing, that rely on smart contracts instead of third parties. Over $12.2 billion worth of value is locked on 129 Fantom-based DeFi applications as of Monday.

Why are transactions increasing?

Analysts say newer products and high yield rewards are fuelling growth on the Fantom network. “Many projects like Radial, veDAO, and 0xDAO came up with liquidity mining launches that vampire attacked other protocols to gain TVL. These projects share a lot of resemblance to defi summer projects in 2020,” wrote crypto research firm Delphi Digital in a note on Tuesday. Liquidity mining refers to users supplying liquidity to DeFi applications and receiving rewards for doing so.

“Mercenary capital came over to Fantom to farm these projects as they were providing incredible yields on single-sided staking,” the analysts cautioned, suggesting current activity could be short-lived as yields fall and investors exit to wherever more yields are on offer.

For now, FTM traders are rejoicing. Prices of the token were among top gainers in Asian hours on Tuesday, rising 8% to $2.30 in the past 24 hours. However, there was some profit-taking with prices falling seven cents at the time of writing.

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

Shiba Inu eyes positive returns in April as SHIB price inches towards $0.000015

Shiba Inu's on-chain metrics reveal robust adoption, as addresses with balances surge to 1.4 million. Shiba Inu's returns stand at a solid 14.4% so far in April, poised to snap a three-month bearish trend from earlier this year.

AI tokens TAO, FET, AI16Z surge despite NVIDIA excluding crypto-related projects from its Inception program

AI tokens, including Bittensor and Artificial Superintelligence Alliance, climbed this week, with ai16z still extending gains at the time of writing on Friday. The uptick in prices of AI tokens reflects a broader bullish sentiment across the cryptocurrency market.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

XRP price could renew 25% breakout bid on surging institutional and retail adoption

Ripple price consolidates, trading at $2.18 at the time of writing on Friday, following mid-week gains to $2.30. The rejection from this weekly high led to the price of XRP dropping to the previous day’s low at $2.11, followed by a minor reversal.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.