Fantom price rallies after FTM Foundation’s legal win against Multichain Foundation

- Fantom Foundation said that on January 30 the Singapore High Court ruled in favor of the blockchain platform.

- Fantom won its lawsuit against the Multichain Foundation, meaning that a court-mandated authority will help recover $65 million in assets.

- FTM price gained nearly 3% on the day, after hitting a new 2024 high of $0.75 on Monday.

Fantom (FTM) blockchain protocol announced a legal victory against Multichain Foundation, on the grounds of breach of contract and fraudulent misrepresentation. The High Court of Singapore granted a default judgment ruling in the Foundation’s favor.

In its official X account (formerly Twitter), Fantom informed users that while the Foundation has secured the means to recover its own losses, it aims to use the legal victory to pave a path for users to lodge their complaints against Multichain and attempt to recover their frozen stablecoins.

Also read: Fantom cuts staking requirement by 90% in a bid to increase security

Fantom Foundation aims to recoup $65 million

Fantom Foundation said that its management and legal team has succeeded in paving the way to recover the assets lost during July’s 2023 Multichain exploit.

After spending months attempting to engage with former directors and key personnel of the Multichain Foundation, FTM fought to recover its frozen stablecoins.

Following the legal victory, the Singapore Court is set to quantify the damages suffered by FTM and issue a demand for the Multichain Foundation to pay the sum.

If the Multichain Foundation fails to comply, the court will appoint a liquidator to claw back and recover assets for Fantom, including a total of $65 million in stablecoins.

The Foundation advised FTM users to lodge their own complaints against the firm to recover their funds.

Since the July 2023 Multichain exploit, Fantom Foundation’s management and legal team have been working tirelessly across multiple jurisdictions to chart a path forward that enables victims to partially recover assets lost. We have an important update in this regard.

— Fantom Foundation (@FantomFDN) March 4, 2024

After all… pic.twitter.com/pUxyalPdMD

FTM price rallies in response to court win

The development in Fantom’s lawsuit against Multichain was key to FTM holders as the Foundation attained a legal victory and cleared a path to recover frozen stablecoins from the Multichain exploit.

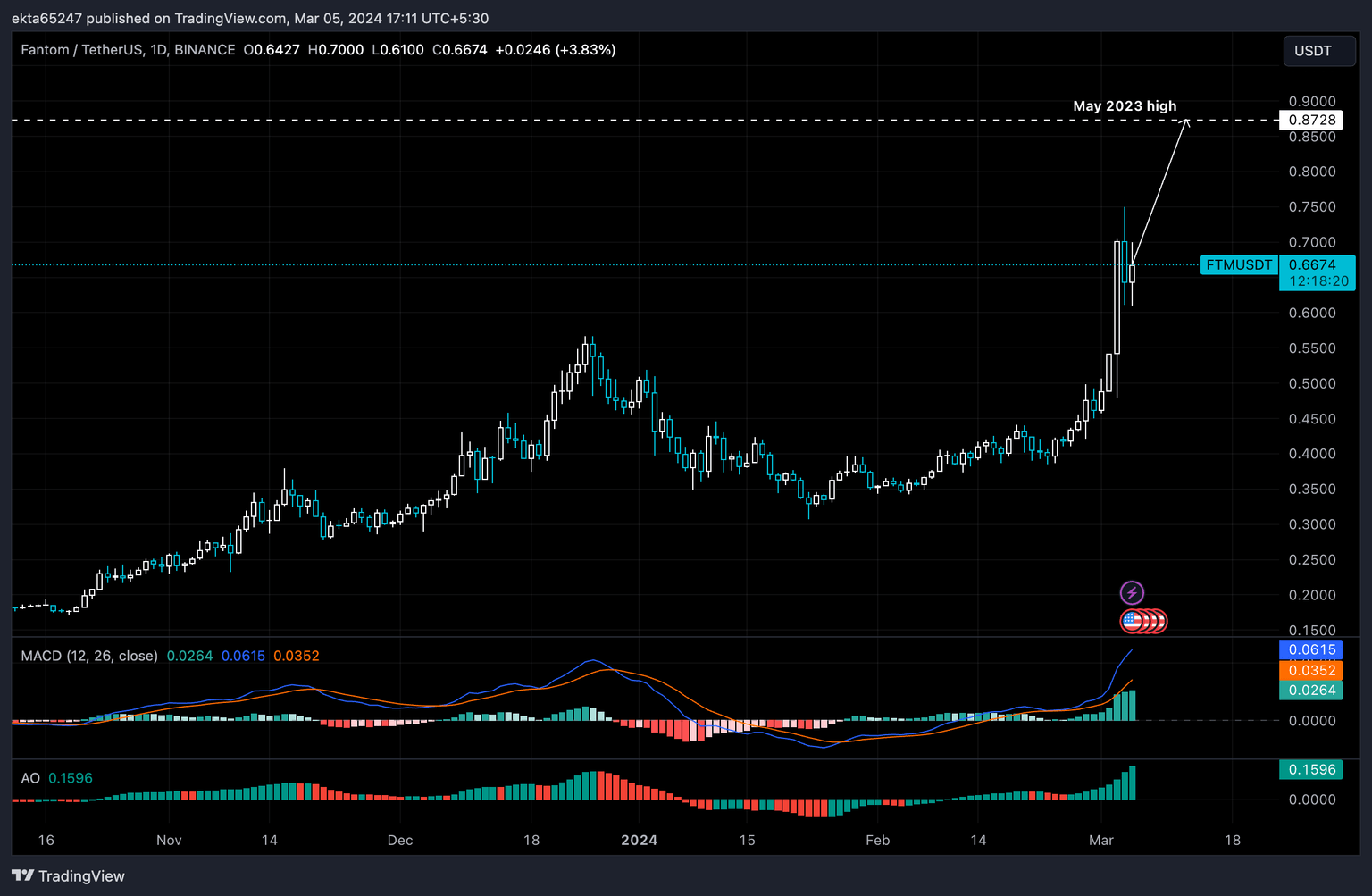

FTM price hit a new 2024 peak at $0.75 on Monday, before pulling back to $0.66. From a technical perspective, FTM price is on track to rally higher, with both the Moving Average Convergence/Divergence (MACD) indicator and the Awesome Oscillator (AO) supporting the asset’s gains and signaling that the uptrend is intact.

FTM/USDT 1-day chart

Still, a daily candlestick close below $0.60 could invalidate the bullish thesis for Fantom price. In case of price declines, FTM price could find support at $0.56 and $0.54, two levels that have acted as resistance for FTM throughout 2024.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.